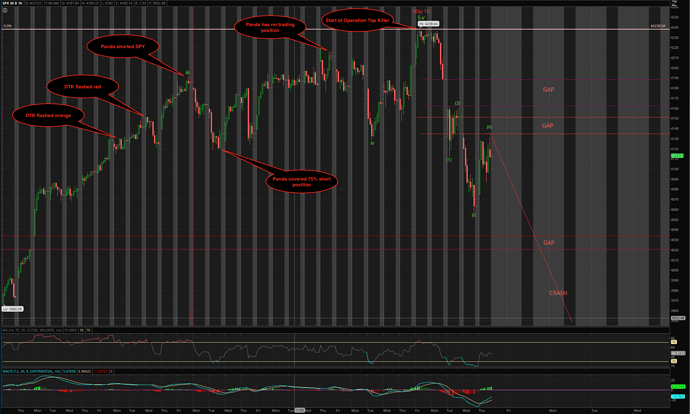

I’m not so sure if I buy the Panda’s massive crash scenario, at least, not so soon. Fundamentally, there’s some scare about inflation but that’s sort of played out so I think market is looking for slower growth in latter part of the year and some realization about fed’s slowing of liquidity. I’m generally looking for more downside but I think QQQ will hold above 300 and will lead the rally back. I did buy PUTs on today’s rally though.

.

UVXY is more profitable or you bought it because of no expiry date?

Are the components of the SMH in accumulation? The current narrative isn’t a drop in demand, but a drop in supply. Any drop in revenue should be temporary. This is a serious question even if it sounds silly.

.

Referring to 1750 by Mar 2022 or the wave (iii) of (3)? The latter is my interpretation of what he said. He no longer said much… hint only… trying hard to decipher.

Whatever, is STFR time… definitely no BTFD… stay cash or STFR.

That said, I bot 200 TQQQ yesterday ![]() Sold for a puny profit since is only 200 shares… no balls to long 4500 any more… just betting for a short re-bound

Sold for a puny profit since is only 200 shares… no balls to long 4500 any more… just betting for a short re-bound ![]() which had happened… probably back to down again.

which had happened… probably back to down again.

That’s what the pundits said… my experience is they are usually wrong. Wrong to assign market decline is due to “temporary” inflation from this supply shortage.

Just expiry but came out

Very near to the gap down… which I thought is where wave (ii) will complete at…

I relabeled yesterday’s tracking Panda’s major moves chart to one degree lower… updated with today’s price action… even though it hits where I thought (ii) is… still chicken ![]() … only long 5 SPY put(May 21 $410)… don’t have 20+ years of active day trading experience… if it did crash… 20x over 3 days

… only long 5 SPY put(May 21 $410)… don’t have 20+ years of active day trading experience… if it did crash… 20x over 3 days ![]()

tomorrow prediction- put or call prints?

Current short position

LT:

Long 10 SPY put(Mar31 $285)

Long 10 SPY put(Mar31 $360)

MT:

Long 10 SPY put(Sep30 $400)

ST/ Day Trading/ Gamble:

Long 5 SPY put(May 21 $410)

IMHO, it is, at the minimum, retracing the impulse from SPX 3723.34. That is will decline to below 3900 sometime in the future. So my long Sep and Mar 2022 puts should be profitable.

We’ll see how it goes from here…

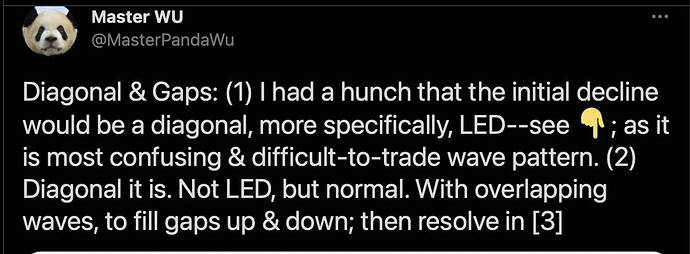

Can’t decipher what Panda is talking about. Sound like a Chinese puzzle.

SPX in blue (2) or red 2 or somewhere between red 1 & 2?

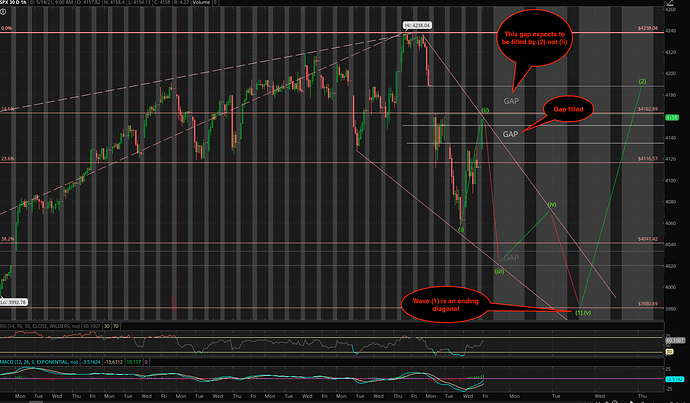

Below is a chart posted by one blogger’s interpretation of what Panda meant. I think black 2 should be higher in price ~420 filling the gap down. Red (2) likely completed during PM 2mrw, so open down ![]()

Black 3 should be the crash, hence price should be quite low, less than 370.

Here Panda is captured on video fist fighting a bull. What’s the market implication of that?

.

A leading diagonal that will slaughter stale bulls and clumsy bears.

Reference the post on ending diagonal, the nearest gap down is filled, expect to reverse soon,… unless I misunderstanding Panda, he meant also fill the higher gap down?

Look like Panda meant (ii) would fill all the gap up… thought he meant (2).

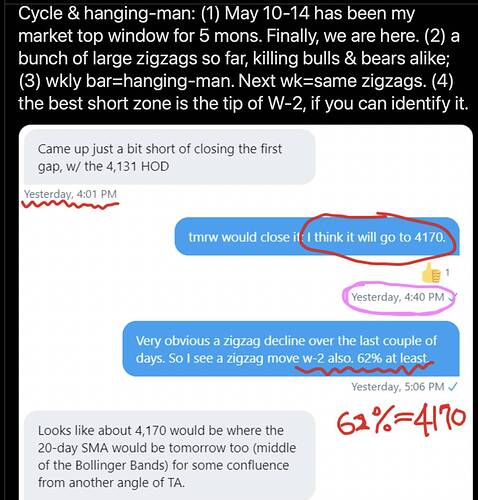

Any1 want to bet this is the W-2 that Panda meant… ALL IN SHORT!

Below is posted one day ago.

so monday bloodbath?

.

You’re game? I am indecisive ![]() as usual

as usual

The gap down is almost filled… this is supposedly to be the time to short ALL IN…

I don’t know! Only thing I know is my puts are red!

My LT and MT SPY puts are red too

YOLO:

Long 2 SPY put(May17 $415)

Long 5 SPY put(May21 $410)

Long 10 SPY put(Jun18 $405)… 168 is good number

I bought 20 QQQ put spread Jun 18 312/307

your fav panda posted

.

Panda is a naughty bear… always messing around with your head… What he said I already know… my problem is I hesitate all the time… anyhoo, if next week no bloodbath and no new ATH, can throw few thousands again… return is 10x to 100x, so can try 10 times ![]() If new ATH, back to drawing board.

If new ATH, back to drawing board.

Btw, first gap is closed, 2nd gap is almost close… so Monday close it or close 1-2 weeks later. Unless a new ATH is established, bearish count is unchanged… remember wave two can retrace 99% of wave one i.e. can get very close to wave one ATH.