yes but is it a correction or a steep decline? There is definitely going to be a correction to the mean, but the real question is - steep or small?

The thing is, if you keep predicting “market crash” every year, you will eventually be right. A broken clock will be right twice a day.

Grantham has been predicting doom once every two years or so for the last 10 years. What did he have to say in 2016?

Grantham is concerned about the future. He calculates that the stock market will climb roughly 10% followed by a decline over the long term of about 60%, with the market peaking shortly after the U.S. presidential election and before the end of 2017.

Whoops. Did not happen. S&P at end of 2017 was 2743. Today it’s at 4352. 60% decline from end of 2017 would be 1097, or 75% below current level.

What about Druckenmiller?

He figures stimulus measures have run their course and the bull market has finally exhausted itself. As a result, the market could decline a whopping 60% from current levels. As Druckenmiller says, “we have borrowed more from the future than any time in history, and markets value the future. While policymakers have no end game, markets do.”

What’s with these 60% numbers these guys kept throwing out? Does it sound more serious than half?

.

![]()

Better than the one who say “A broken clock will be right twice a day”.

Other than magnitude, we want to know the speed and duration of the decline.

“Have a prediction but only act on that once price action confirms it”

If you won’t act on the prediction, it doesn’t matter it is wrong or right.

If you want to act on the prediction, act only if price action confirms it.

“Rich Dad Poor Dad” wrote a book predicting that the BIGGEST market crash is coming.

One small problem: the book came out in 2013.

Perhaps I should also go predict “century top”’or similar doomsday scenarios. I will look like a genius when it finally happens, at some unspecified future time. Eventually I will be right.

.

Do it then if that is what you want. I prefer to look stupid and be rich.

Btw, Robert T. Kiyosaki didn’t make money from his predictions, he made money from people like you buying his books ![]()

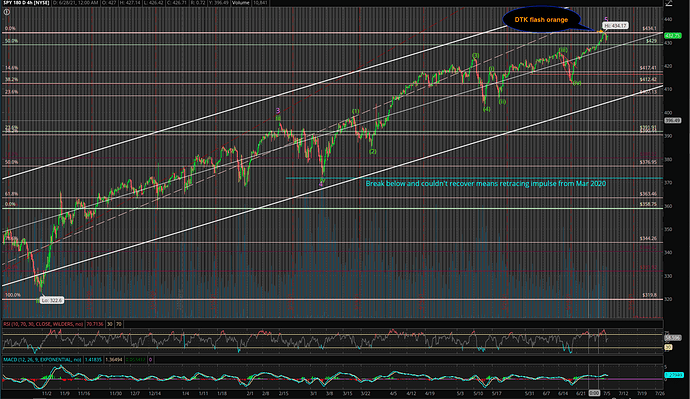

Decline started… how low and what is the duration of the decline? Just predicting the top doesn’t make much money (I hear a genius broken clock can make billionaire dollar with only top predictions ![]() ) if can’t predict the bottom because you don’t know when to close a short that was made at the top. So a broken clock is worthless.

) if can’t predict the bottom because you don’t know when to close a short that was made at the top. So a broken clock is worthless.

If decline below 20-day SMA (currently at 4250), the decline will accelerate. Otherwise, it could revert to uptrend. What to do if you have shorted at the top? If I have not shorted, should I short now or wait till SPX break below 20-day SMA to short? I don’t know the answer since I am stupid, I guess the genius broken clock know ![]()

True !

IMO, This looks like one day affair…no more…Market has to peak more (to crash nicely). They need to create more FOMO before final…You can be confident that market does not normally turn up or down until FAANMG results are out as they are big puller of market.

Master Wu safely said July 26th as Megacap results are out at that time.

Even today, they are up while index is down.

BTW: If market corrects only today, the top blow off can happen by this month-end. If market correct 3 days, the blow the top will be shifted for 21 to 30 days…

This is just shit calculation of mean reversion/blow off top. Market behavior changes as data is changing, and it is pretty difficult to predict precise time lime, height, depth as everything with multi-trillion market is very dynamic (not static).

.

Exactly. @manch insists on precise price and date many moons away. Can’t be done. Can only predict based on current data available and if price action doesn’t confirm, move on… forget about previous predictions.

There is a site that use ML algo… https://twitter.com/ArastooFazeli … he seems very confident of a severe correction (he doesn’t make EPIC doomsday like Panda) in Jul.

ArastooFazeli was ML programmer turned into stocks, but his ML is not that great as most of the time he uses EWT or TA to guide up or down, not focusing SPX alone.

ArastooFazeli is like us swimming with the tide, go positive when market positive, go negative when market negative. I have tested more than 25 ML, take enormous machine CPU & Memory, they are not so good for stocks.

ArastooFazeli is profit motive, he will provide first hand info for his paid subscriber, but Panda Wu is just sharing whatever he knows.

Panda shares his experience, knowledge teaching etc. I have good regard for his update, value his experience. The biggest issue with Panda is making laborious calculation by hand and drawing conclusion. Scalability issue as market is dynamic. He is a good man but unfortunately poor manual practice.

IMO, His call for super peak (Like Mar 2020) is correct, but I can also find it as perfect as Panda. I just check Panda for double confirm my DTK (Similar) findings, that is all as I do not find any reliable person out there other than Panda.

BTW: I may not know depth of fall and duration of fall, but I will know the top (95% of top) and bottom (95% of bottom) time either one day before or 15 minutes before each turn. Everything is dynamic nature (no static) for market.

Simple rotation is going on…It is rare for market (S&P) make positive side continuously for 7 days which happened last week. Today, we feel, it is one day dip. Manch himself called market went up 7 continuous days. The clue is 8th day is negative !

Market has to go up and up before sudden crash (Unless data changes soon few days).

If one started investing around the new millennium it’s easy to take a bull or bear stance. My earliest investments go back to DOW 800 and S&P 100.

In the 1970’s and 1980’s there were two camps as far as where the future lay. One was represented by apocalyptic films like the “Planet of the Apes” franchise. Charlton Heston starring at the head of the statue of liberty sticking out of ocean sands. Or Mad Max the Road Warrior. The other side saw the technological advances of the 20th century continuing. We went from "oh, wow, diseases are caused by things called germs"in the 1880’s to aircraft to exploding atom bombs to a man on the moon less than 100 years later. Following that trajectory we should be spread out about solar system by now with Martian colonies and mining settlements on Saturn’s moon like in “Outland” with Sean Connery. Neither vision came to be.

Nobody - and I mean NOBODY - thought that in 2021, barring the East/West full scale thermonuclear war some feared - people would still go blind, die of cancer and reach for the duct tape when something was busted. Or not have flying cars. Or laud cars with stuffed with batteries and social media that allows you to share what you had for lunch with the world as innovative and “the next phase.”

There is no reason for the parabolic expansion of markets since the early 1980’s other than money printing. No technological breakthroughs to drive it on the scale of the 20th century. No economic growth - in fact a flatlineing economic growth by 20th century standards. I can see either argument -continued multiples expansion as cash is rendered increasingly useless as a store of value - or a brutal mean reversion as the chickens come home to roost. The later seems likelier.

.

![]()

Can we position ourselves to benefit from either scenarios ![]() ?

?

The best I think I can do is spread my bets to avoid being crushed by either scenario.

.

For example?

Some cash, though not much (15% of assets), most of the rest diversified over the S&P and international equities. 5% gold and silver. No bonds. Financial planning based on dividend yield discounted for downturns, not on current valuations or expectations for future capital gains. Asumption is dividends, long term, will keep pace with inflation or slighty exceed it.

.

Conservative portfolio. I hold less than 2.5% of cash. You don’t have RE rental?

Nope. Don’t want to deal with renter drama. My 2nd property stays empty 90% of the time.

I have a slightly different count from Panda. If DTK flash red 2mrw, then (century ![]() ) top could be in. Otherwise, is just a wave 4 and can expect a new ATH after pull back is over. Price action

) top could be in. Otherwise, is just a wave 4 and can expect a new ATH after pull back is over. Price action ![]() will tell us.

will tell us.

Panda Declared DTK set in today, I am just waiting until EOD to confirm…