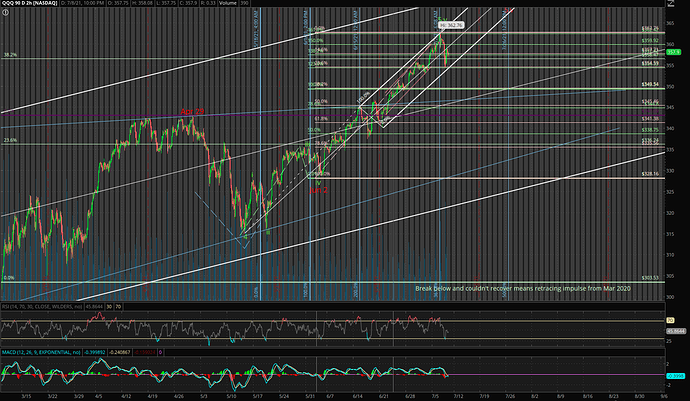

EW count for QQQ. If 362.76 is not 5.v then Panda is right, should be around Jul 26.

Blue lines are my maiden attempt at Fibonacci time spiral… so far so good.

Take note that uptrend pitchfork isn’t breached.

IMHO, this is not fortune telling, other than Panda telling Solar Eclipse etc.

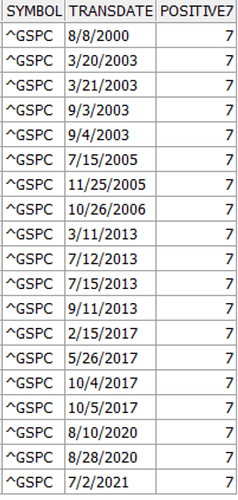

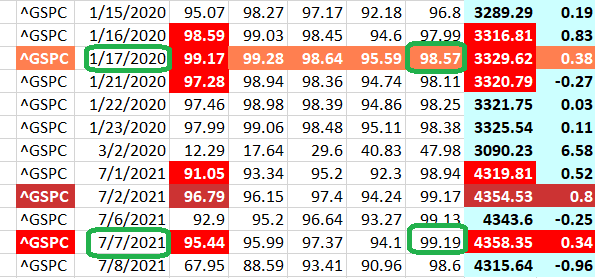

See here the analytical/logic way. When you said “S&P is straight up 7 days in a row”, I just queried my database from 1999 to till date how many times S&P reached that level. Noticed only few times. That triggered my mind 8th day will be negative ! Frankly, 8th, 9th day can be positive, but the statistical chances are high for negative. I also checked 8th day positive since 1999, none was there.

This is pure logical and understandable way.

Here you go.

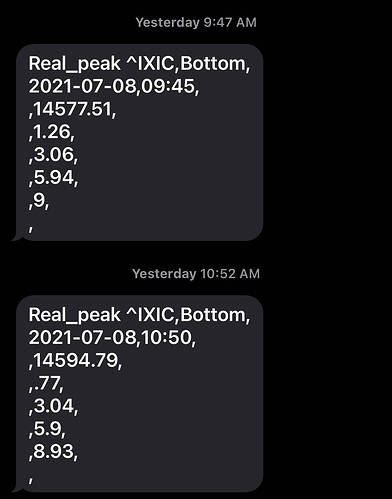

I created my database/data analysis system over the last 5 years. This has given be alerts on AAPL, MSFT, ^GSPC and ^IXIC top level set.

I do not like to openly post my secret algorithmic results, but that gave my own System Ranking AAPL 99.63 MSFT 98.63, ^GSPC 95.54 and ^IXIC 97.19 (Max can happen 100). Similar ranking had happened Jan 17, 2020 (exactly when stocks dived 30%) and before then it was Sep/Oct 2018 where it had 19.96% drop.

Notice the Green oval round which is the key for peak sets now. This secret algorithmic is known to me alone as it was completed code, compiled and it is cryptic format running at my home server.

Now, Recession already started now. When the green high-lighted turns to below 10 rank, recession ends. I will buy TQQQ at that time.

There is no fortune in my system, but it is just pure mathematical, statistical calculations with multi-millions of lines of code/programming.

This the So called “Crystal Ball” people in this forum was asking me (“Where is your crystal ball?”) few years before ! I named my database as “Crystal”

I told too much to this forum and public, would not like to add more.

If time, money, skill set is available, we can do miracle.

![]()

![]()

![]()

Did you incorporate a startup with this algorithm yet? Can be the next 10s of billions $s fin tech.

.

We’ll be the early investors.

Yes, I am aware of it, but program is still rudimentary stage. Above all, it can make few millions. In order to go for billions, I need to have bigger setup for which I am not ready yet. Remember Jim Simon medallion fund is just 10B growing at 79% YOY. Mine is too small compared to those giants !

The real estate lawsuit has given me set back (or clarity). Vulchurs are there to swindle the money! It taught me a lesson that I need to have some multi-millions to withstand any lawsuits.

Good. I went half all-in yesterday with SQQQ. Covered pre-market today and bought AAPL calls looking for 150, 155 and 160. Let’s see what happens! My stop loss is earnings from SQQQ.

DTK is worthless now? It works till it doesn’t work.

So go back to basics, RSIs and price action confirmations.

did he ever admit he was wrong? I see him adding new stories everyday!

.

All such bloggers will never admit wrong. Always 100% spot-on.

This is like astrology – predict everything with escape clauses, selectively pick the ones that are close enough and call it perfect.

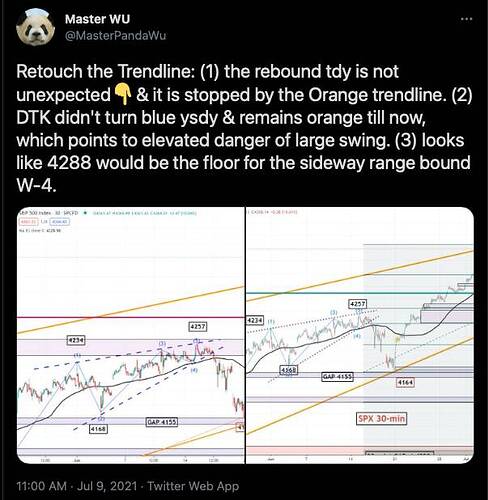

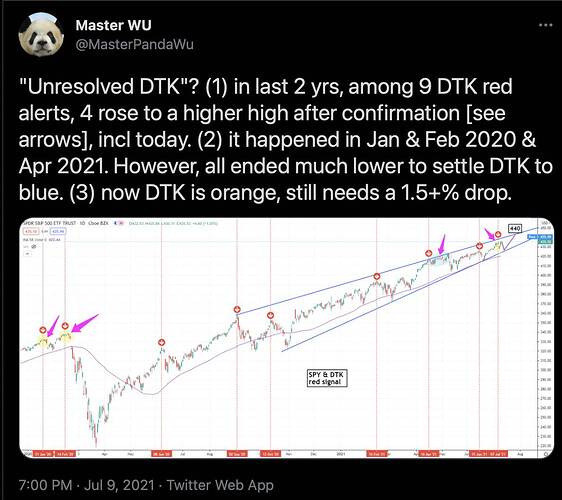

Wednesday: Panda RED ALERT!!!

Friday:

Reference chart below…

One of those “up before decline” or DTK is broken?

Panda boldly declares Monday is a DOWN day…

Frankly, Bloomberg always write nice story after the fact. They are good presenters and their motive is to bring more people to their business!

Market never goes straight but always zigzag.

See my internal alert ( texting from my system ) telling market turns by yesterday!

Note the time and date, I sold 90%-95% of puts, SQQQ, SPXU which gave me appx $20000 profit in a single day!

Message is IXIC reached bottom tipped 9:47 then one hour later. That was the peak drop after which market started recovering!

Today, myself and partner regret not buying upro ( as were not confident on market turning, but took profit )

Even after 5 years, we are skeptical about our own system as market can dynamically change anyway.

Ultimately, we went to Safest route cashing our gain, leaving future gains.

Anyway, if you do not like this update, ignore it.

Interesting for sure. Do you keep track of the accuracy of the prediction (and probably feed it back to improve it)?

It is stored for three days for me to review and then automatically deleted. Not seen single scenario repeating and market behavior dynamically changes. I make changes or enhancements periodically.

With all this, manual review mandatory and reliability is not 100%. Market is so hard to predict. Any mistake costs heavily and horrible.

The two charts below are saying one decline one more top, then start of a bear market (to be confirmed by VIX above 20 or FGI to high greed?)

!

Some1 need to know…

A zen story

“Brother, I set her down on the other side of the river, why are you still carrying her?”