Mine is in cash. 2.2% better than bonds and liquid. Most in RE. Illiquid but less volatile than stocks

Investors are still really scared, and that could drive stocks a lot higher

- A behavioral-based “worry gauge” has been at the highest quintile for the past few years.

- “Unlike any in at least the last 50 years, the contemporary bull market has coexisted with a tall and persistent Wall of Worry,” strategist Jim Paulsen says. “The Worry Gauge suggests most investors already expect, and are prepared for, a difficult future.”

- Looking at stocks’ forward performance since 1970, when the worry gauge was in the top quintile, the S&P 500 pulled off an 18.48% annualized return within three months, or 4.33% nonannualized, Paulsen says.

Nasdaq again closed above 8000 today. And yet you don’t hear anyone taking about it. At all.

WB always has a lot of cash. Maybe 1/3 cash. Always ready for a downturn. There is plenty of cash on the sidelines… Bullish

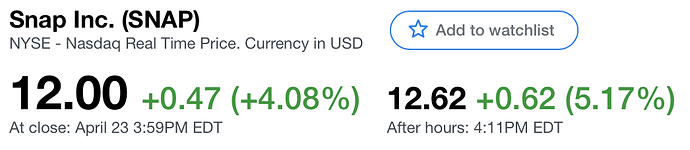

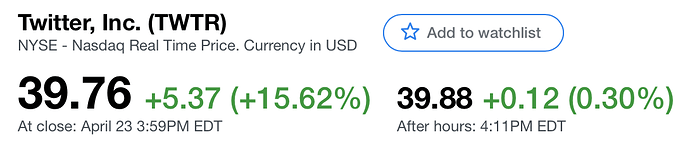

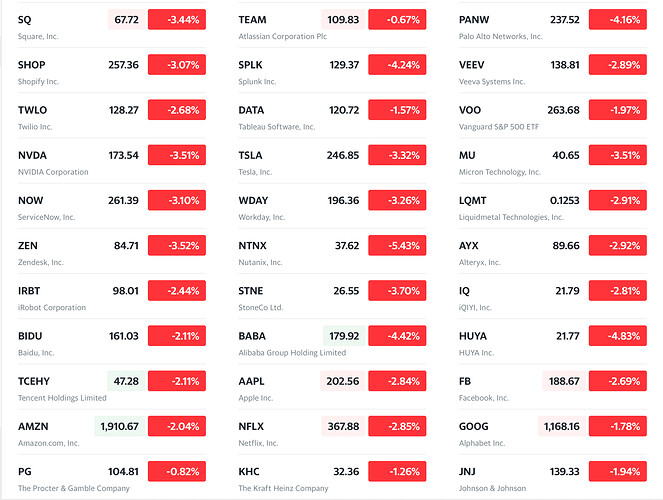

Melt-up in progress, especially in cloud stocks.

How much margin do you use now? You should have gone 10x in December. You may get a 250% return by now.l

Since Dec 24 last year. And Jim Cramer’s cloud kings and princes perform far better than your cloud princesses.

Fools insurance premium.

Are you sure?

Yes. Comparison has to be without leverage for obvious reason.

Continue to grind higher. GDP growth is surprisingly high in Q1.

That’s with the government shutdown holding it down some. Will we see 4% in Q2?

Black Monday?

Trump says tariffs on $200 billion of Chinese goods will increase to 25%, blames slow progress in trade talks

BTFD Monday

The tariff stuff has been BTFD so far.

BTFD or wait

During panic, buy BTC? I sold some amzn and bought gbtc as replacement