Trust Jim Cramer. Better than charting and algorithm ![]()

My guess is your algorithm is flashing green? Impending buying opportunity?

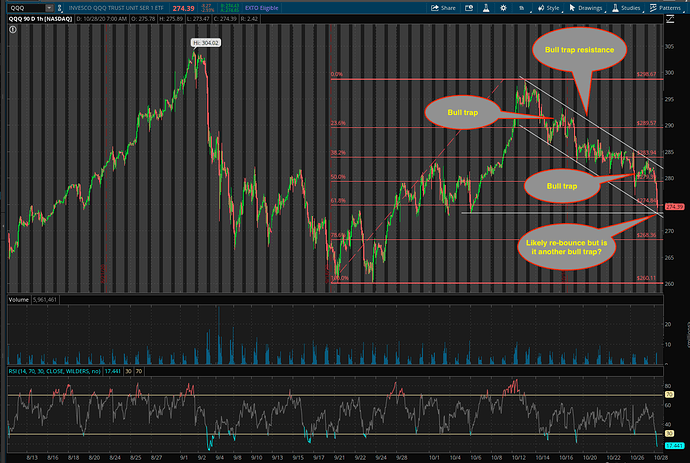

There will be a re-bounce for sure but is it resumption of the rally or merely DCB or worse a bull trap?

Look at my chart posted few posts earlier, it hits a strong support.

Debating between NFLX, NVDA, and FSLY. Probably should play it safe with a big cap.

Trusting Jim Cramer is kind of hitting my head in concrete wall ! He does not have the magic algorithm what I have.

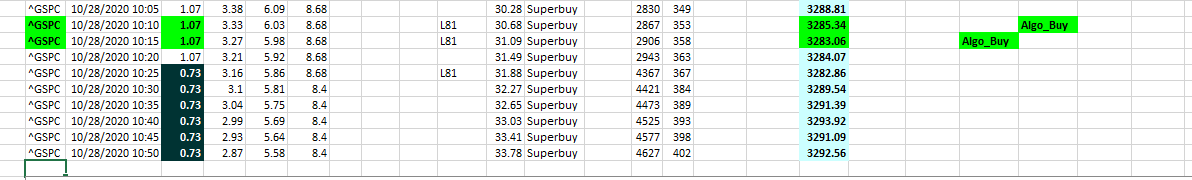

My algorithm says that we are at near low around 8%-20% possibly above the bottom and can turn any day from now. This means, market may go down further until elections and jump heavily after elections.

This can happen when Trump is declared winner…watch out ! ![]()

![]()

![]()

My astrologer told me that market is falling because latest poll by Biden show Trump is winning in the swing states i.e. He would likely get a 2nd term ![]() because of EC system.

because of EC system.

Not like that,

Now, market is going down as freedom press predicted Biden win !

After elections, market will go up, when freedom press admits mistake, after Trump winning.

Let us review after elections.

From late Sep to early Oct, market was rallying when the poll and media indicate Biden would likely win. Check past articles on the web. Now it seems Trump might win. If Trump lose, massive riots and turbulent handover. If Trump win, global stock market crash because guaranteed heightened global instability created by him.

Article dated Oct 13. 15 days earlier than your algorithm ![]()

Jim Cramer can not beat mean reversion !

Jim crammer can only say earlier than actual. He has told that when S&P was 3511 (close). Had someone bought S&P on that day, now it is 3301 ! People whoever listens to him equal to hitting concrete wall !

For stocks, you need very precise timing which my crystal ball can say 90%-95% accuracy level…See here, market is very likely turn around between now and elections day. This is written by my own hands more than 3-4 years working ( will sync with you after completing 10th year ), far better than Jim Cramer’s Astrology.

BTW:This is not stock advice or any hint

Anything you do on stocks, you are on your own

[picture removed]

How does Trump create global instability?

Ed Yardeni, president and chief investment strategist of Yardeni Research, said on Monday that the early sell-off may well represent “garden variety volatility” rather than a new crisis. Manufacturing indexes last week, Yardeni pointed out, still suggest a “v-shape” recovery and wider strength in the broader U.S. economy. It’s still possible that stocks make a healthy recovery in time for Election Day.

“It’s not a correction yet. This is just more of the same,” Yardeni said. “The market could be up big tomorrow. Or it could be back to worrying about covid.”

Thought your algorithm is only good for S&P ![]()

Mine is not good for S&P , neither nasdaq, listen to Jim Cramer ! hi hi hi !!

Market turns now to upside…most likely bottom over today…

Market turns now to upside…most likely bottom over today…

Not sure what your algo is indicating. Good for a few days or a few weeks or a few months? From simple straight line analysis, indices hit the lower channel of the downtrend channel and the horizontal support, and now re-bouncing. Simple straight line analysis can’t tell whether it is a DCB, bull trap or a resumption of rally. What can your algorithm tell?

There will be a re-bounce for sure but is it resumption of the rally or merely DCB or worse a bull trap?

Look at my chart posted few posts earlier, it hits a strong support.

Just repeat above posted 3 hrs ago.

Not sure what your algo is indicating. Good for a few days or a few weeks or a few months? What can your algorithm tell?

I have multiple algorithms that will tell both long term and short term. Any way, it is does not matter to others. It presents data in excel, but I can infer the details. The inference part is too hard, readable by me (as author) and my partner (imparted all knowledge - he will not leak the secret)

For me, it is better to stick to my algo than Jim Cramer.

I ended up getting into AMD at 76.50. Let’s see how this goes.

Nasdaq is not even at midpoint of ATH and September low yet. I need MOAR crashing!

I need MOAR crashing!

Be careful what you look for, market does not go straight down, it is in wave. You are lucky this time to keep cash like WB !

@hanera, you need to learn from manch how to keep 100% cash position ! ![]()

I am 100% invested actually. Looking for opportunities to deploy margin money.

I am 100% invested actually… Looking for opportunities to deploy margin money.

OMG, if this is right, investing using margin, esp during recessionary period, is dangerous!

Market may react very widely and unexpectedly…leading big corporate to bankruptcy over night !

Just review 2008-2009 downturn, market went down in 5 cycles to 50% from peak.

Individual companies may drop up to 80%.

Margin money is good for short term only

( IMO )

@hanera what do you feel?

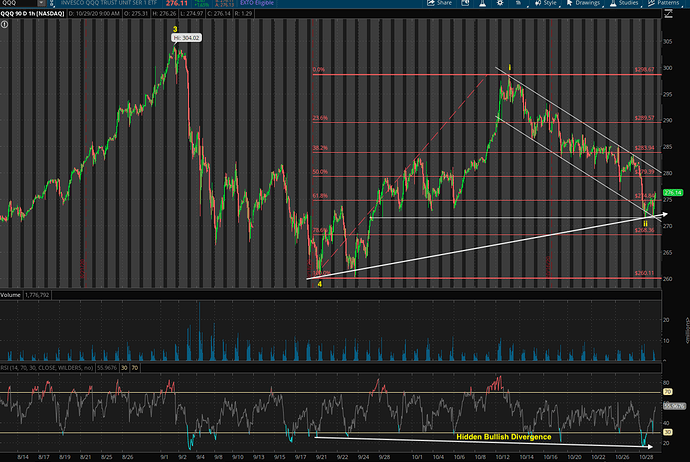

Hope so for my health sake ![]() There is a hidden bullish divergence

There is a hidden bullish divergence ![]() and $271.38 was not broken below and wave behavior appears to be impulsive.

and $271.38 was not broken below and wave behavior appears to be impulsive.