Don’t care about S&P. Be a Master Han and do the work on Nasdaq.

QQQ picture differs from SPX.

For SPX, purple line support SPX. However, QQQ broke below the purple line, was support last week.

For SPX, the last wave (wave c) has 7 sub-waves, so incomplete. However, last wave (wave iv.c) for QQQ has 5 ![]() waves. So I believe QQQ has completed correction while SPX has not.

waves. So I believe QQQ has completed correction while SPX has not.

Btw, purple lines are lines drawn using channeling technique of EWT, he called them trend lines, he has a narrow definition of EWT.

Wish I am right, please ![]()

For visual learning style folks,

Do you see the blowoff top in Nasdaq like what Master Wu predicted for S&P?

No margin, strictly I maintain within my limits.

Yes, When morning QQQ went to 3.3% my system said it is buy, later it is left open by the recovery end of day, that is the killer !

Either, market has to push down tomorrow further and further. If not and if it is positive, then Monday or Tuesday, it can bottom.

End of the day recovery from 3.3% to 2.11 has left lot open for more correction, unfortunately.

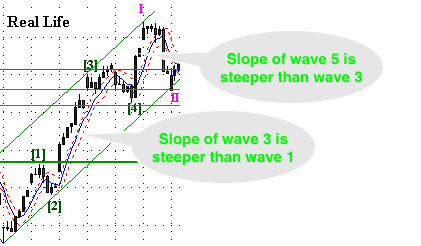

I am only a Pandawan. I guess he is using the generic behavior of EWT. See chart below… So in idealized impulse, fifth wave is always blowoff.

And then the cut-in-half crash is resetting the count to one?

Haha… not sure what you’re asking… should be yes to your question if I didn’t misunderstand you. Anyhoo, you might want to look at QQQ picture with new annotations, note that fifth wave is the steepest… ![]() Using what we are interested in should be more apt…

Using what we are interested in should be more apt…

Guess you would deduce the corollary that if you see three waves and the third one is not the steepest… most likely is a zigzag abc and not 123 of an impulse,… if there is some overlap, could be 1-2-i-ii pattern. And if the third wave is steeper than first wave… wait a minute… QQQ picture: I notice wave iv.( c) is steeper than wave iv.(a) … now I am worried…

@Jil Do you realize deep analysis requires looking at many things? Master only focus on SPX… too hard to do deep analysis for more than 1 ticker… especially for day trading… mission impossible…

Since S&P and QQQ have the same megacaps, how likely is it that S&P will continue down while QQQ goes up?

.

If S&P does down on Monday and Tuesday as predicted by Master Wu, QQQ should go down too if the cause of drop is by mega cap BUT… unlikely for QQQ to break new low even though S&P is likely to break new low.

My question is, based on what did the Master say S&P will be cut in half later this year?

You are right…mission impossible…esp human calculations…etc. Best is to limit with GSPC and IXIC. I do not even include SPY or QQQ as they change in values with dividend effect.

For you, stay focus on GSPC and IXIC alone. You (or forum members) need to protect their wealth when there is a correction (like this) or deep recession (like last Mar 2020). Rest of the time, just hold, never bother about minor one or two days normal 1%-2% dips. It is waste of time.

Whenever you want to buy a stock, say TDOC or TWST, just do one time analysis and see whether you are buying at low price. Human can easily scale to 5 to 10 tickers, not beyond that.

For your level, avoid day trading, keep 20%-30 cash always, buy when there is a dip like this one.

Even though my system has many stocks, I mainly focus GSPC, IXIC, SPY, QQQ and TQQQ (the last 3 are new additions).

My own rules for me is this => Avoid day trade and avoid margin. I still do both when unavoidable situation, but margin I clear within 2 days or on the same day.

Wow! You are asking me some tricks of the trade!

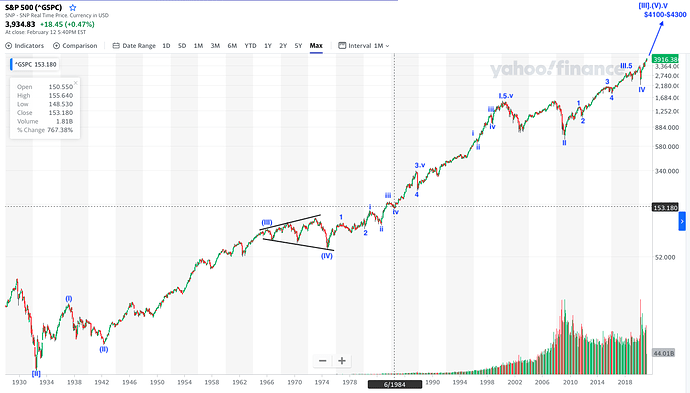

I need to whip out my super duper multi-decade EW picture of GSPC, see chart attached.

At 4100-4400, is completion of wave [III].(V).V ![]() A Grand SuperCycle four, not your I don’t care Intermediate degree and below corrective wave. We are talking about Wave [IV]

A Grand SuperCycle four, not your I don’t care Intermediate degree and below corrective wave. We are talking about Wave [IV] ![]()

Wave [IV] targets are, assuming wave [III] is 4300,…

23.6% 3285 (price zone of wave IV)

38.2% 2657 (price zone of wave IV)

50.0% 2150 (price zone of wave 4)

Take note that retracement usually completes at lower degree wave four ![]()

61.8% would be 1642 close enough to Master Wu target. So he counts 4300 as completion of wave [II]… well I am just a Pandawan…

As to when it would happen… hasn’t learn how to estimate time yet ![]()

Degrees of EW

Grand SuperCycle degree Multi-century or generational (20-30 years) waves [I]

SuperCycle degree Multi-decade waves (I)

Cycle degree Multi-year waves I

Primary degree Multi-Month waves 1

Intermediary degree Multi-week waves i

Minor degree Multi-day waves (1)

Minuetee degree Multi-hour waves (i)

Retracement of wave…

Two, 23.6% to 99%, typically 50-61.8%

Four, 14.6% to 50%, typically 23.6%-38.2%

Good advice  After reading Master Wu blog and your advice, I realize I have wasted a lot of time running around like a headless chicken… need to regroup and has a clear strategy. My biggest issue is after so many years of bad habits, the hardest thing to do is unlearn these habits… recall the violin master and his students story? I am the one who have learned something and is actually harder to teach.

After reading Master Wu blog and your advice, I realize I have wasted a lot of time running around like a headless chicken… need to regroup and has a clear strategy. My biggest issue is after so many years of bad habits, the hardest thing to do is unlearn these habits… recall the violin master and his students story? I am the one who have learned something and is actually harder to teach.

My margin was 20% but after buying the dip for 1 week it became 48%! What’s your advise?

I hate margin, year 2019-2020, I tried margin and it does not work out good for me. It is always better stay well within your cash limits. Some people hate this kind of suggestion, but I always stay within my limit.

I know the pain of margin as well as day trading. I have done excess margin and excess day trading…and finally streamlining to “No Margin…No Day trading”.

I put about 10% of my liquid assets into TQQQ (5% today and 5% in the past week). These are long term savings and I don’t need them for the foreseeable future. Is TQQQ ok to hold long term?

Below is the TQQQ long/short timing summary from @Jil

It does not decay.

If QQQ goes up 1%, TQQQ goes up 3%

If QQQ goes down 1%, TQQQ goes down 3%.

The issue is here: You need to time it properly.

You have $100 on TQQQ, and

Hypothetically QQQ goes down 30%, TQQQ corrects 90% , i.e. your value goes down $100 to $10.

Now, next day, QQQ goes up 30%, TQQQ goes up 90%

By the end of 2nd day, TQQQ value is $19 while QQQ value is $91

TQQQ = 100 (1 - 90/100)(1 + 90/100) = $19 where as QQQ = 100 (1 - 30/100)(1 + 30/100) = $91

You need to buy TQQQ at market bottom and can hold TQQQ as long as market goes up.

got it. So not a great idea to hold it if market is correcting violently. Good idea to hold it if market is in a general upward trend.

I’m going through social media and everyone saying QQQ should hold 298-300. That seems way too predictable…

Uh oh.

![]()