I am saying this without any education on economics, nor an iota of knowledge on RE investing.

I bet 100% of you guys agree the best moment to have bought as many properties as you could so cheap is gone 100%.

Perhaps you remember my topic about what the deportation of hundreds of thousands of undocumented people would do to “your economy”? Well, those “illegals” have been a part of the pressure in the market to keep the value of homes rising until these days. I am going to avoid going into politics at this moment.

Just think, think twice what the absence of 10,000 people in only one city would create. Some of you renting units to them may argue good because then you will have “better tenants” when the credit issue or good jobs comes to be debated. No doubt, you are right. But, that person you take as a new tenant has to abandon another unit. And that owner has to either lower the rent, or lose some $ between the exit of the old and the entry of the new tenant.

Now, abandoning my position, change an illegal for a high techie leaving this area or the US because there’s no more jobs for him, or the immigration rules aren’t allowing him to stay here anymore disregarding the many opportunities there are out there. Or, as we saw last time, those “wives” of H1B visa leaving the US because they are not allowed to work anymore. I haven’t followed that story at all.

Also, long ago I created a topic about why “you should be blaming the lack of housing on your employer”. I said so because as of today, Apple is building campuses all over the US, thus allowing the gentrification not only here, but to happen elsewhere. It may be them shooting everybody’s feet after they have grabbed enormous pieces of land depriving the public from owning them and building housing units.

You need to drive around San Jose to understand my point of view. Right in Cupertino-Sunnyvale border, block after block, huge pieces of land are owned by Apple. Never mind Google, Ebay, Facebook, and many more high tech companies.

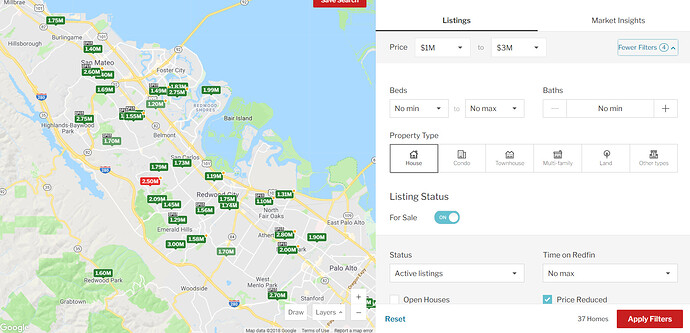

So, is it a good time to buy properties? It all depends if the job market keeps adding more and more workers to the pool of people wanting to buy, or rent a housing unit. Once they are gone by a result of any recession or because their projects didn’t pan out, yada, yada, yada, God have mercy on this area’s soul.

If that happens, will you see another opportunity as in 2009-2011? If you think so, and you haven’t lost your underwear before that “whatever bad happens”, grab your wallet, the wash and rinse story will repeat again and again.

Now, did you know that Twhitler……