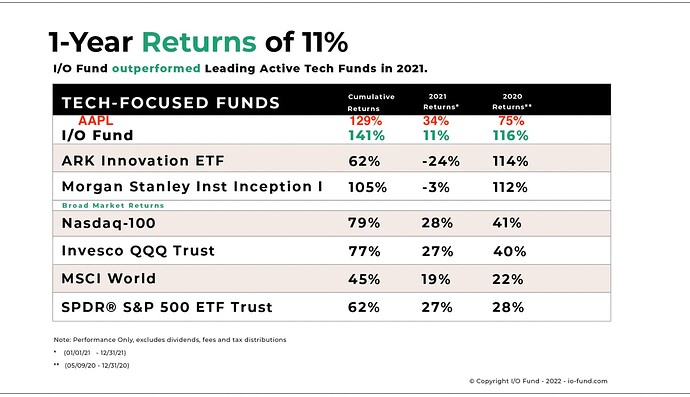

I/O fund trounces ARKK. I/O fund uses EWT in addition to fundamentals.

Knox explanation is clear. Surprise he gave so much details and clearly explain what kind of price action would tell him what to do. I can see why I/O fund outperforms ARK funds. Cathie is too dogmatic. Beth recognizes need both TA and FA, ofc her network.

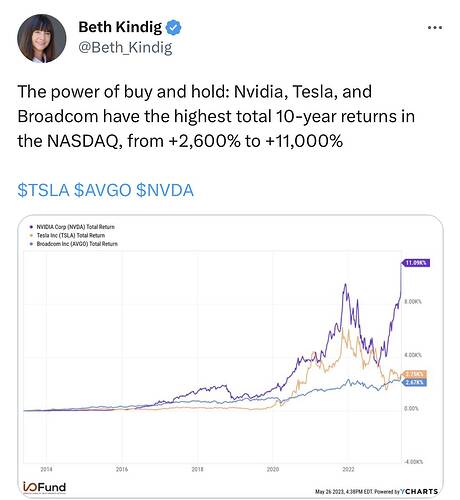

Broadcom all time high. That SG guy is good at milking the company.

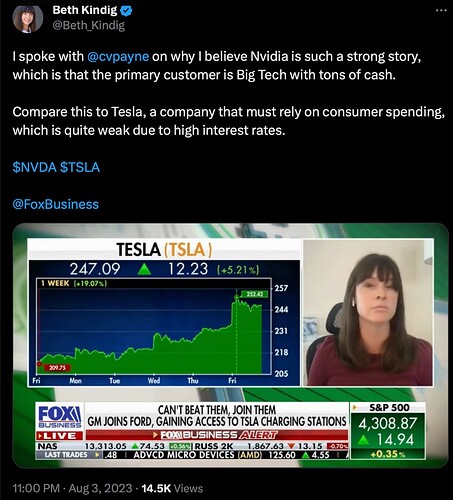

Kumar rubbing it in. She earns $ from subscribers of I/O fund. Ofc, she would be promoting her best performer. All other subscription services e.g. Motley Fools, did the same. She can’t use TSLA as it is claimed by Cathy Woods. Anyhoo, NVDA trumps TSLA. TSLA has been heavily diluted by excessive SBC especially to EM… suckers are supporting EM to be the 2nd richest guy. If he truly doesn’t care about money and just want to save the world, he won’t be asking for so much SBC.

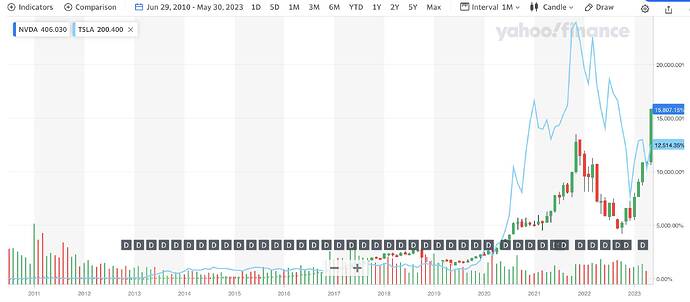

Investors are better off investing in NVDA on IPO day of TSLA… Jun 29, 2010.

Running 10-year duration…

Running 2-year duration…

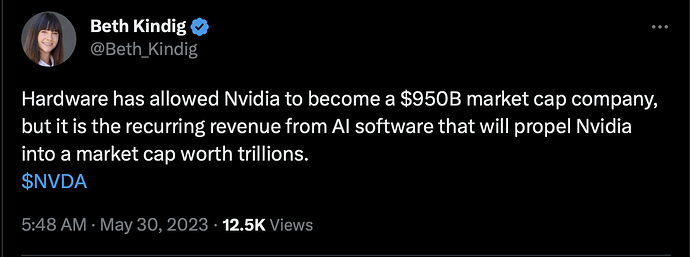

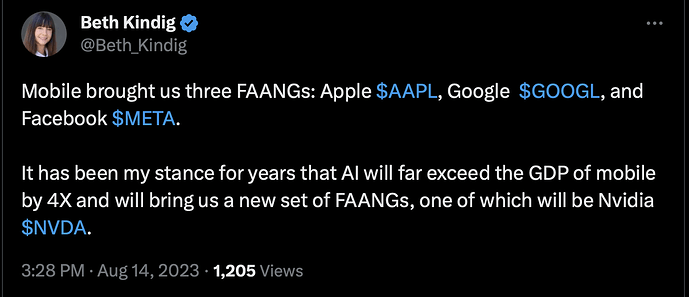

If one stock that would take the largest market cap crown from AAPL, likely to be NVDA.

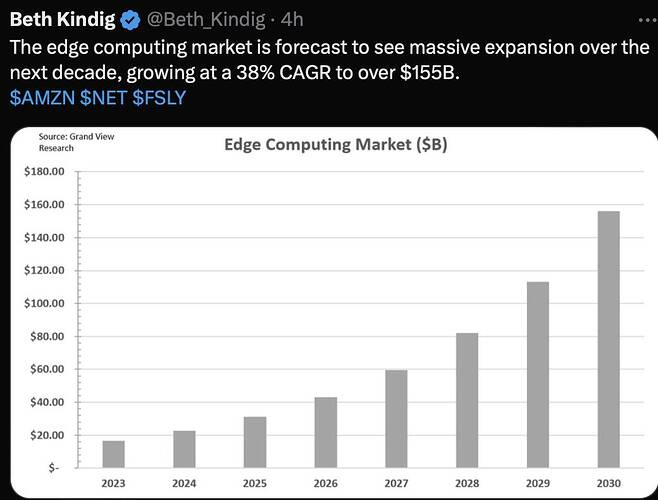

Actually only one: NET.

Now Beth thinks NVDA is better than TSLA.

NVDA is 15% of her portfolio whereas…

TSLA is 5% of her portfolio.

Hey, you make me feel that your other calls are screwed. Other than NVDA, you have no other stocks to brag about?

Struggling to make money. Like Cathie, her portfolio was decimated in 2022. Embarrassed to say, my growth stock portfolio is also destroyed ![]() Well, so long is not wipeout, fight another day. Is not the first time, almost as bad as Dotcom bust in 2000, I don’t learn

Well, so long is not wipeout, fight another day. Is not the first time, almost as bad as Dotcom bust in 2000, I don’t learn ![]() Oh, also in 2009, no growth stock portfolio but AAPL + S&P tumble to scarily low value.

Oh, also in 2009, no growth stock portfolio but AAPL + S&P tumble to scarily low value.