That Chris guy likes TDOC. Not Beth.

Ad Tech is long lasting? So is AAPL platform style - no Ad Tech.

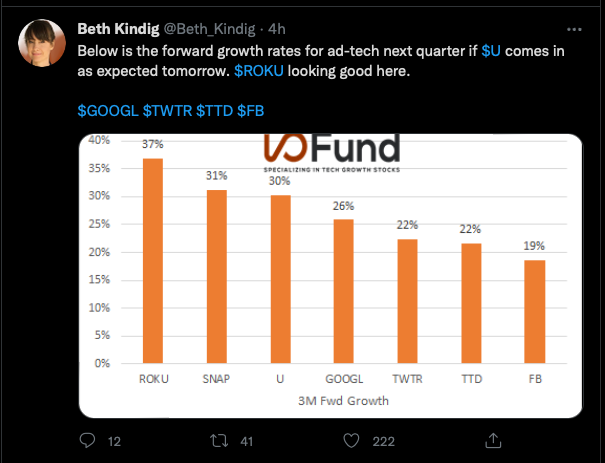

Beth has 4 positions in Ad Tech and connected to TV ads? FB GOOG ROKU TTD?

Don’t know what connected TV names Cathie has. Her portfolio is so huge.

.

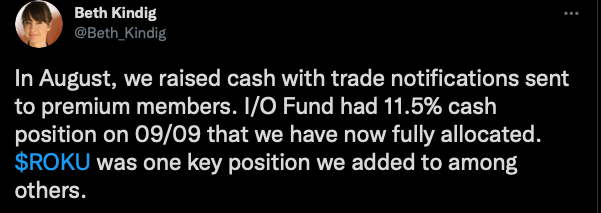

we have been accumulating high conviction names that are showing excellent relative strength.

Like ZM? The hot microtrend is fin tech. UPST AFRM SOFI MQ LC BILL

11%? Why bother.

Didn’t know that U is an ad tech. To her, all stocks are ad tech?

yes there’s a fear ad revenue would be bad like snap for tomorrow’s ER

.

For safety, I sold 50% of holding.

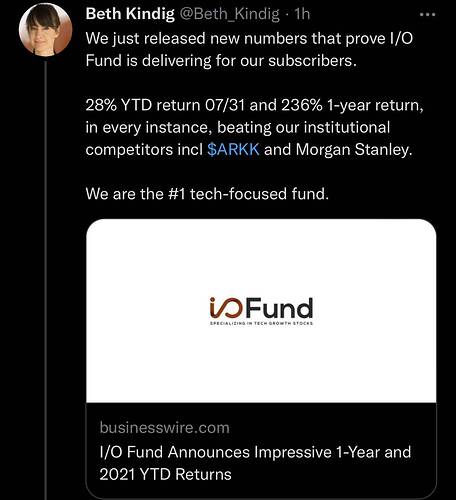

Since Beth brags so much about the performance of I/O Fund, let’s compare with TQQQ ![]() the super duper etf that we know.

the super duper etf that we know.

I/O Fund

TQQQ easily blows away return of the I/O Fund and ARKK.

Don’t be jealous…

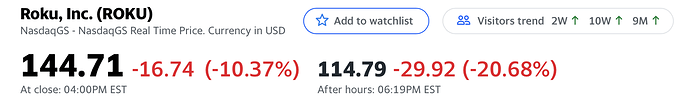

WTF !!!

Beth said ROKU bottomed in Jun 16, 2021. $336.67

Today,

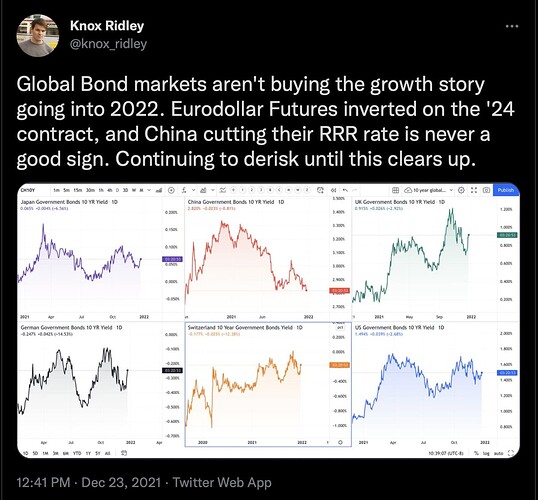

Her fund should be ok since Knox said de-risk in Dec… EW expert! which Cathie didn’t have.

Beth thinks Voyager Digital trumps Coinbase.

Today,

Guess we can ignore Beth in additional to Cathie. Both sound like geniuses when market is in a strong bull trend. Hence we can call BS the article below:

Since the above article was published, NVDA vs AAPL

Another one bites the dust because of bankruptcy of Voyager, the fallacy of using FA without really understanding the business operation and monetization methods.