I like this statement:

The most important lesson learned by this writer: expect the unexpected and don’t trust anyone, trust your own due diligence.

The most dependable person is yourself. The most trustworthy person is also yourself.

First lesson?

I am not fond of the stock market, but they say you keep your money invested in verified, with an ample record of achievements as Apple, and others no matter what the crashes or upswings come and go. I don’t know if truth, but they say stock market average 8% in a historical timing 20 years or so. Pathetic if you know what I mean. You haven’t paid taxes.

Second lesson:

Never, ever vote, and fall for promises from a president that is destroying your portfolio. He or she should keep his mouth shut about anything related to the stock market where his or her words make it crash while his inside trader friends make a killing.

Don’t you have wished to have a stock market going on slowly, but surely, where your stocks were appreciating slow instead of seeing them going crazy, then you losing your yearly earnings due to stupid tariff wars, attacks against manufacturers or corporations because a president is butt hurt, thus causing $ billions in losses, which by the way become your losses?

The stock market is speculative, and relies on BS, or words of mouth, or a hearsay heard during a meeting.

I rest my case.

https://finance.yahoo.com/news/dow-plunges-below-26-000-162935365.html

Investing in just one or two stocks you think are safe is about the dumbest thing you can do.

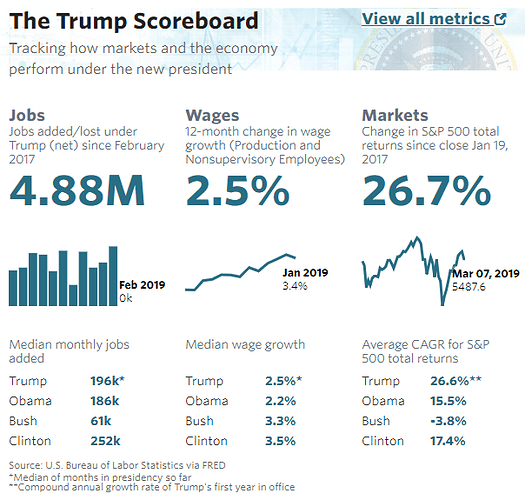

And under Trump the market is now over 7000 points higher that the best levels his predecessor ever achieved - even with the “tariff wars.” And the advance has been broad-based; not just a handful of growth stocks trading at eye-watering multiples and leading capital-weighted indices higher.

I hope you don’t have supporters………oh wait! You got one! And I hope he ain’t the one that loves “options” but said they were bad when insurance companies use them ![]()

![]()

![]()

![]()

Early Stock Market Results (first two years after election)

S&P 500

Obama: +54%

Trump: +18%

Dow Jones Industrial Average

Obama: +47%

Trump: +26%

Nasdaq

Obama: +82%

Trump: +30%

You could also compare real wage growth and unemployment rates, since those are the two things that impact average workers. Obama had negative real wage growth and much higher unemployment his first two years. The wealthy benefited from stock gains, but everyone else was worse off. Stock gains only benefit the wealthiest 10%.

The irony is that Obama was seen as for the average American, and the perception is that Trump only cares about wealthy elites.

Then there’s the difference in fed interest rate and balance sheet policy during the two time periods. One had a fed actively trying to stimulate the economy in a very aggressive way and still struggled to get it growing. The other has a fed that’s trying to slow the economy and increased the growth rate despite it.

Bogus numbers.

The market jumped almost 2000 points between Trump’s election and when he took office; such was the relief we didn’t get Hillary. It crashed by almost the same amount between Obama’s election and when HE took office.

I don’t know who is the idiot here, but the market crashed prior to Obama first day in the white house… because of him? ![]()

![]()

![]()

![]()

![]()

Thursday’s moves come after the major indexes posted their third straight day of losses, with investors eager to know details from trade negotiations between the U.S. and China.

Data out on Wednesday showed that the U.S. trade deficit remains a problem. President Donald Trump has imposed a series of tariffs on countries like China, in an attempt to bring down his country’s trade deficit. However, Wednesday’s data showed that trade deficit in the U.S. hit a 10-year high in December. <---------![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

The most undependable person can also be yourself. The most untrustworthy person can also be your own self.

When that happens to you, you can give 95% of your networth to @harriet, let her help you decide how to spend and how to invest. She seems to be trustworthy and also dependable. You’ll be in good hands ![]()

If you are not comfortable with that, give 95% to your brother

Liberals trust the government, conservatives trust corporations. I don’t trust either.

Maybe it’s libertarians that trust themselves.

I’m talking about you. Of course personally I’d have no problem with either of the cases. So let me help you out. You can give 95% of your net worth to me.

You can build up your trustworthy score by giving 9% of your networth to 11 different people, I am not interested though.

That means you are not even trustworthy by your own definition

While you guys are debating, escrow 95% of your net worth with me.

Now that I think about it, he seems to be a small fish. So even 95% of his net worth might not amount to much…

Always rub it in ![]()