Sorry to say the world will pass you by.

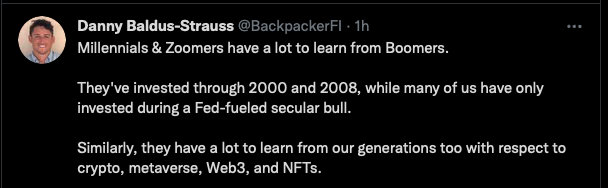

Don’t kid yourself it will pass us all by. I invested in SV real estate for 45 years. Never chased the latest stocks like Pets.com.

Made a fortune. Retired to Tahoe. Been buying RE in Eldorado county for 8 years. Made another fortune. Buy what you know. Why keep chasing the latest hype. I have one fool friend who thinks AMC stock is going to $1m a share. I want to hold on to something solid till I die.

.

Exactly what I am doing. We know different things.

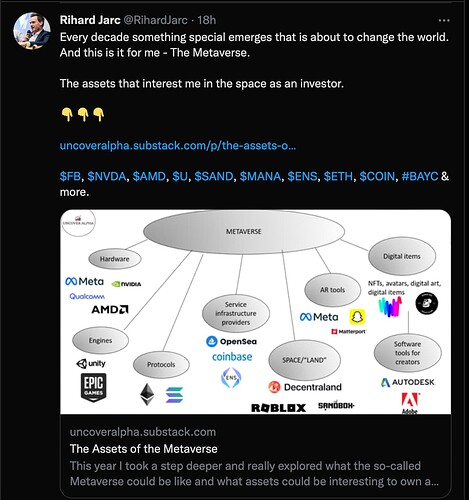

Hype? EV/AV are real, so is metaverse.

I am one of those boomers who are learning from you ![]() Most of them are fossilized in time.

Most of them are fossilized in time.

So many wave two retracements, hate them. You don’t know for sure when it would be completed and the range of wave two is very wide, from 23.6% to 99%, yes 99%, all the way back to the start

We might be see-ing the strong vs the weak…

Strong: metaverse stocks ![]() U RBLX MTTR NET NVDA

U RBLX MTTR NET NVDA

U: Retested the breakout ~$175… now what? Hit the minimum retracement 23.6% of wave ii, so BTFD? Or be scared because the broad market feels weak? Easy to say, buy when there is fear, and sell when there is greed… now is the time to decide… yet hesitate…

COIN: Still trading higher than my last FOMO purchase of $310 ![]() No action.

No action.

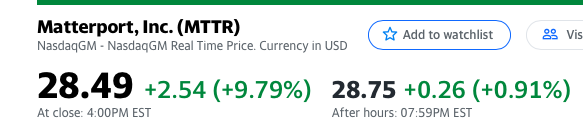

MTTR: Holding core position only. No action.

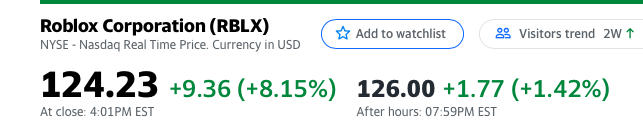

RBLX: Reduce further?

Why trim the winner?

.

Trying to be cute. Hoping to get cheaper price ![]() May be just forget it.

May be just forget it.

Frankly, no reason for I should trim any more. Already in 60% cash. Just itching to do something. I have to RESIST. HOLD. I think I should go to watch TV serial. Looking at the screen make me want to do something.

I am very tempted to buy some of the luxury apparel stocks  KER? I am very convinced NFTs are going to be huge.

KER? I am very convinced NFTs are going to be huge.

RBLX and MTTR rock!

My sentiments too. But which one might be a 1000 bagger? Market cap of AAPL in 1997-8 is about $1-3B. Market caps of U and RBLX are so large!

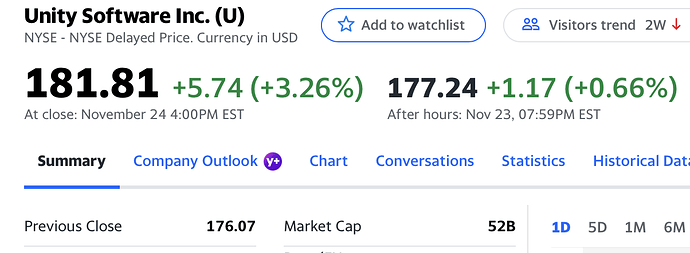

Market cap of U is $52B

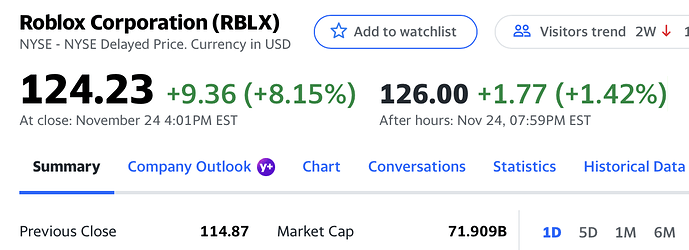

Market cap of RBLX is $72B

Chine company $WIMI

Build brand recognition with young is good, when they grow up, they would be potential customers.

I did some computation on Puru portfolio. His return is over 50% CAGR. But…

The return of Puru’s stock picks (without hedging) is about the same as S&P index… 15-20% CAGR, the recent 10-year return of S&P index. His hedging is what gives the other 30+%. That is, if you are not following his hedging approach or is not able to execute good hedging, copying his portfolio won’t produce return that is superior to S&P.

MTTR is on fire ![]() New ATH. IMHO, if there is a market correction, is a good time to BTFD metaverse stocks. Just thinking aloud, not a financial advice.

New ATH. IMHO, if there is a market correction, is a good time to BTFD metaverse stocks. Just thinking aloud, not a financial advice.

MTTR is a loser stock??? Say some1.