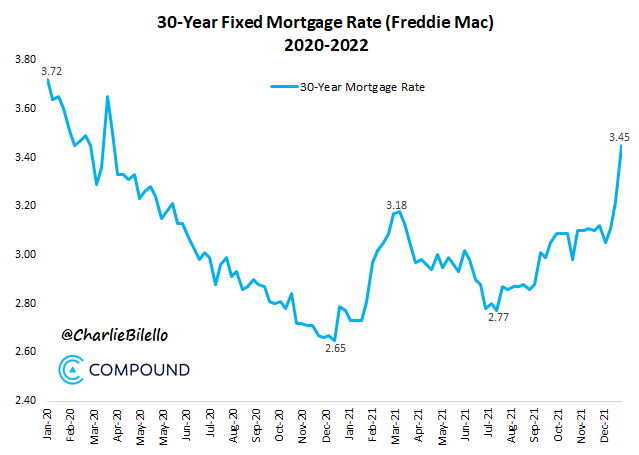

The 30-year fixed-rate mortgage averaged 3.45% for the week ending Jan. 13, up nearly a quarter of a percent from the previous week, Freddie Mac FMCC, -0.54% reported Thursday. It’s the highest average rate for the 30-year loan since March 2020 when the coronavirus pandemic first began to send shockwaves through financial markets amid the first wave of lockdowns.

Comparatively, a year ago, the 30-year fixed-rate mortgage averaged 2.23%, near record-low levels.

Guess the refi window is closing. Glad that I refinanced into a 2.625% 30 year fixed jumbo loan last year. We may not see these record low rates for a few years to come, at least until the next recession —> money printing cycle.

Might be good news for some buyers - there will be less competition

Bad or good news?

Rate up means lower or higher house price?

If higher mortgage rate leads to lower house price, is bad for all buyers or only those who borrow a lot? Or is good since lower house price more than compensates higher mortgage rate?

A 4.x% average High Balance Conforming rate will likely mean two things:

- Portfolio Bank lending will stay in the 3’s and absorb most of the lending biz.

- 7-1 and 10-1 ARM loan products will replace the current 30 fixed volume.

Home prices and interest rates have some correlation, but not as much as employment/income and house prices. In 1991-1994 we had a lowering rate environment, but job and income growth reversed - the real cause of the housing price crash of those times. Between 2007-2009 we had relatively low rates, but now you had to qualify for the loans because all of the “NINJA” loan options had evaporated. It wasn’t a rate issue then (per-se) but a qualifying problem that ran out of lending solutions to feed home purchase volume dynamics. The FIRE industry collapsed and many short term high paying jobs were wiped out. Remember back then EVERYONE was either in the loan biz or speculating on rental property in Vegas or Phoenix, eventually getting blown out as economic reality set in. Kinda feels that way today… only it’s Stonks, BTC, and housing.

Thanks for reading.

So, what is the current jumbo mortgage rate for loan amount of 1.5-2M, LTV of 70-80% - 30 year fixed vs ARM?

Can’t give specifics because there isn’t enough data. Some of the missing items include:

- Purpose? (purchase/refinance)

- Occupancy (owner/investment)

- FICO (mortgage sourced, not “creditkarma” or “my bank says my score is”)

- County.

- Number of properties financed.

- Any secondary financing?

- What kind of ARM?

- Do you have assets to move to get a lower rate?

- How many points would you pay to lower your rate?

- Will you impound for taxes and insurance?

- Are you prepared to lock today? (if “no” then rate quotes are meaningless since rates, like stocks, change by the moment)

and so on.

Most websites will give a general picture of where rates are. At BofA per their site (Mortgage Rates - Today's Rates from Bank of America) their spread between a fixed rate jumbo (over $1m) and a 10/1 ARM is about .375 in rate and .375 in points charged. At Wells Fargo (Customized Home Mortgage Rate Tool | Wells Fargo) it’s about .25 in rate and .25 in fee.

Every company has unique rate/and fee differences.

Thanks for reading.

Refinance, owner occupied, 1 property, Santa Clara county, 30 yr fixed vs 7/1 vs 10/1 ARM, no secondary financing, no impound account, 800+ FICO

Will reply in a PM. There can be a need for “non public information” to get exact figures and a forum is best for general information, not specific to one person’s data.

You can always get a comparison @ Zillow (Compare Today's Current Mortgage Rates | Zillow) and Costco Refinance. Zillow quotes tend to be lower than Costco, and you should at least get the lowest rate from Zillow when you shop outside.

Thank you, this is helpful

Didnt you refi at the lows already?

Yes, I re-fi’d last year at 2.625%, 30 year fixed. But does not hurt to ask…

Interesting.

Why not just get a heloc instead of refi…

Lower rate at reducing balance. May be I am wrong, can’t qualify for Heloc?

Anyway, I won’t do that at higher interest rate. Last year, I cash out re-fi at lower rate. Cash to buy investment properties in Austin

We refi’ed a while ago - twice - and then WF wrote us out of the blue last year and said we could get a lower rate, likely without having to redo anything - that it was “an amendment.” SUPER HAPPY we got it in when we did. I think we’re done with the refinancing now, but we’re saving almost $1700/month over our original mortgage payment!

As rates go up, inventory may go further down in the Bay Area. A lot of homeowners here have probably locked in sub-3%, 30 year fixed mortgages last year. They will now be even more disincentivized to sell, unless there is some compelling life event.