Stock makes new highs and bond price also moves high. This is not sustainable. Is the money supply coming from overseas? Maybe US asset and debt are both attractive to foreigners with a Trump presidency

Look at 10-year treasury rates in Europe. They are garbage. Italy has a lower yield than the US. Does anyone believe Italian debt is more secure than US debt?

If 30 year mortgage (and 10 year T) continue to fall and short term rates are continue to raise, we have issue with economy.

When short term 3 month note rates exceed 10 year T notes rates, we are likely to enter downturn. History showed this has happened every down turn.

“At stake, proponents say, is credit access for as many as 35 million consumers whom FICO doesn’t evaluate, especially blacks and Hispanics with scant borrowing histories.”

It always amazes me when people turn credit score which is a mathematical formula to predict credit worthiness into something about racial discrimination. Calling FICO outdated is ridiculous. It was a more accurate predictor of default during the great recession than anything else including down payment size. It did exactly what it was supposed to do and predicted default risk.

“VantageScore disputes that. It estimates that about 7.6 million of the 35 million people whom FICO doesn’t review would have a score high enough to get a mortgage. Of those 7.6 million, the company estimates more than 72,000 would try to buy a home each year.”

72,000 extra buyers a year? That’s not material.

Rising mortgage rate is bad for buyers and may slow down the appreciation

This has been debated since at least 2011. Rising rates = inflation = bullish for RE prices. It’s WAY better than an inverted yield curve which equals recession.

Bring it on

Deflation is depressing

I recently learned about high correlation between inverted yield curve and recession.

However, what is the impact of rising rate and on yield curve?

Right now, yield curve is pretty flat.

If rate rises, wouldn’t it possibly make yield curve inverse by pushing up short term rate? (Sorry if I miss very basic econ knowledge here. ![]() )

)

In the Seventies inflation was great if you owned real estate. Of course real estate has gone up even since the Great Recession and in a deflationary environment. Think what rents will do in a wage inflation environment.

Already seeing it in Tahoe. Wages up another 50 cents to $11 headed to. $15

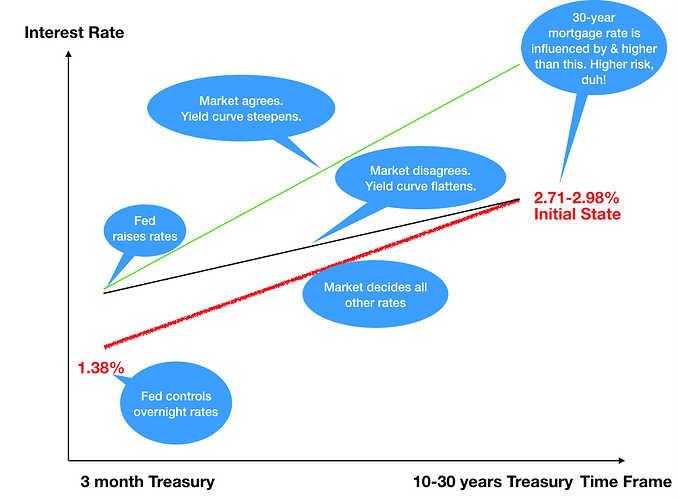

It depends on if the market agrees with the fed. The fed controls the over night rate. The rest of the rates are relative to it based on what the market thinks. The fed is raising rates because they are worried about inflation. If the market agrees, then the yield curve will steepen with an interest rate increase. If the market disagrees, the yield curve will flatten. Right now, the market disagrees. That’s why I think there’s a lot of danger in the fed continuing to increase rates in the absence of inflation.

Banks were expected to benefit once the rate increase cycle started. Everyone expected the yield curve to steepen which increases bank profits, since they borrow short-term to lend long-term. Banks haven’t benefited as much, because the yield curve stayed flat.

Honestly, I feel the fed is boxed into a corner. They need to gradually increase rates, or there won’t be room to cut them in the next recession. The fed is very divided on if quantitative easing was effective, so most of them think cutting rates is the solution to a recession. It’s hard to cut rates when you’re already near zero. The issue is inflation is so low they are risking inverting the yield curve if they keep increasing rates. I bet if you asked each of them they’d wish for inflation to get over 2% and maybe even 4%. That’d steepen the yield curve and give them more room to increase rates.

So, your are saying fixed rate mortgage rate is correlated to 30-year-yield-rate, thus rising mortgage rate means steeper yield curve instead of inverse/flat curve. Right?

One more question.

With rising stock and housing price, why is inflation rate so low?

I thought that cash value was decreasing because of stock/housing price rise.

Correct. The yield curve is getting steeper this week.

Inflation is based on a calculation of the cost of a basket of typical items. It’s published by the bureau of labor statistics. The cost of housing is included, but the stock market has zero impact on it. These are the major groups and some examples of what they measure:

FOOD AND BEVERAGES (breakfast cereal, milk, coffee, chicken, wine, full service meals, snacks)

HOUSING (rent of primary residence, owners’ equivalent rent, fuel oil, bedroom furniture)

APPAREL (men’s shirts and sweaters, women’s dresses, jewelry)

TRANSPORTATION (new vehicles, airline fares, gasoline, motor vehicle insurance)

MEDICAL CARE (prescription drugs and medical supplies, physicians’ services, eyeglasses and eye care, hospital services)

RECREATION (televisions, toys, pets and pet products, sports equipment, admissions);

EDUCATION AND COMMUNICATION (college tuition, postage, telephone services, computer software and accessories);

OTHER GOODS AND SERVICES (tobacco and smoking products, haircuts and other personal services, funeral expenses).

Stocks are more sensitive than RE. Dow down 400 points in as 10 year hits 2.7%

I honestly don’t get the logic behind long-term rates going up a little and stocks going down this much. It seems there’s just a lot of profit taking going on.

Yield curve has been steepening recently. I think the tax reform is one big reason why the 10 year is going up. That and the 1.5T infrastructure push means US government will borrow more thus pushing up rate. With unemployment so low already and you put in extra stimulus at this moment are we going over the natural sustainable growth rate? If we do inflation will go up like a kite and the Fed will hit on the brakes hard.

Treasury yield is compared to stock yield. Stock market yield is the inverse of PE ratio. If stock yield is not much higher than riskless treasury many people will just buy treasuries instead.

Yardeni fwd P/E = 20 - 10-yr TB = 17.29 (13.47 for AAPL, how come AAPL is declining?)

Yardeni ttm P/E =1/10-yr TB = 36.9 (18.13 for AAPL, how come AAPL is declining?)