yes another quick way to become millionaire is getting into pre ipo companies. Like prepare hard to crack interviews in roblox, uipath, next door which are touted to become public. Get 300k-400k worth of RSU’s, see it tripled. BA keeps churning these companies which I don’t see happening in Austin. Also if I get a bad mgr, it’s easy to switch in BA compared to Austin where there are only handful of companies and difficult to move (it’s like being in an abusive relationship for a long time!)

Redwood City has mediocre schools.

San Carlos house would be 2 to 2.2 million.

Those make sense to me.

But you aren’t considering taxes - what is take home pay really matters.

$300k in BA = $17000 / month take home pay

75% = $225k in Austin = $14600 / month take home pay

$2400 per month drop in take home pay. I don’t follow rents elsewhere, so maybe that is a wash.

But if you want to buy a house, 3 bed 2000 sq ft house on the peninsula with good schools is 2 million +

In Austin, looks like it is about a 1/3 of that.

Assume 20% down payment, mortgage cost for BA is $7500 per month.

$2600 a month in Austin.

That leaves you with $9500 in BA.

$12000 in Austin.

Almost $2500 difference in what’s left.

Sure there are a bunch of approximations here. We all know BA real estate varies a lot with how far you are willing to commute. But the difference is significant.

how did you arrive $300k to $8500/ month?

Mistake looking at semi-monthly. Updated.

For a 300k income, married, CA state tax is about 25k it seems? With kids that would be lower. Housing costs aside that’s the gain by moving to a no-tax state like Texas. But with a 20% drop in TC you will make 60k less if you moved. You’d still be short 35k.

True. But after 30 years, in BA you will have a 2M house free and clear, in Austin it’d be 1/3 of that, not including appreciation in either case.

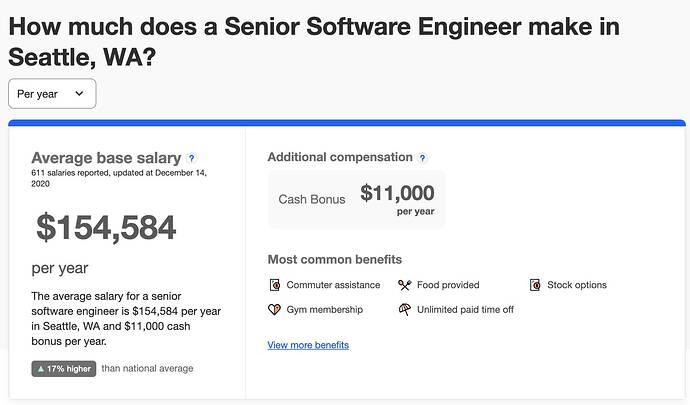

Sr software engineer in Seattle is $169k base from our market data HR provides. Just wrapped up the 2021 budget that’s being presented to the board tomorrow.

It’s crazy since people who’ve been with the company 3+ years are 15-20% underpaid. The market has moved that much faster than annual 4% pay increases.

Want me to insult you or not? Firstly is not 1/3 and only 10% drop in salary, I can assume those are true to make you happy. Let you figure out yourself why your statement is dead wrong. Hint: Downpayment and stream of $2500 per month.

It’s 25% drop in TC.

Another way to look at your $2500 additional stream is that you are missing out on the chance to borrow and locked in historically low rate. Mortgage is the most tax efficient form of debt. It’s also very safe. Not many would lever 4x and take out a 1.5M margin loan to bet on stocks for example. With mortgage it’s commonly done.

What about downpayment? 20% $2M = $400k. 20% $600k = $120k.

A rental + S&P index fund (not TSLA which is what @Zeapelido bought  ) ?

) ?

Please compare Apple with Apple

Ok. It’s complicate.

All I am saying is that it’s by no means a no brainer slam dunk.

brentwood, 5% down (27.5k) 2.625% 550K 2k sq ft SFH no HOA

Obviously complicated. Guess who can accumulate downpayment for a rental faster and hence build up a stream of rentals and passive income faster. Just using your idea of exploiting mortgage loans (no TSLA  )

)

Speaking of TSLA, would Wu be crazy enough to take out a HELOC and put everything into TSLA, if he hadn’t worked for Elon Musk and seen him in action before?

Wu may not have made 15M in one year if he lives in Austin instead of the Bay Area.

Obviously no.

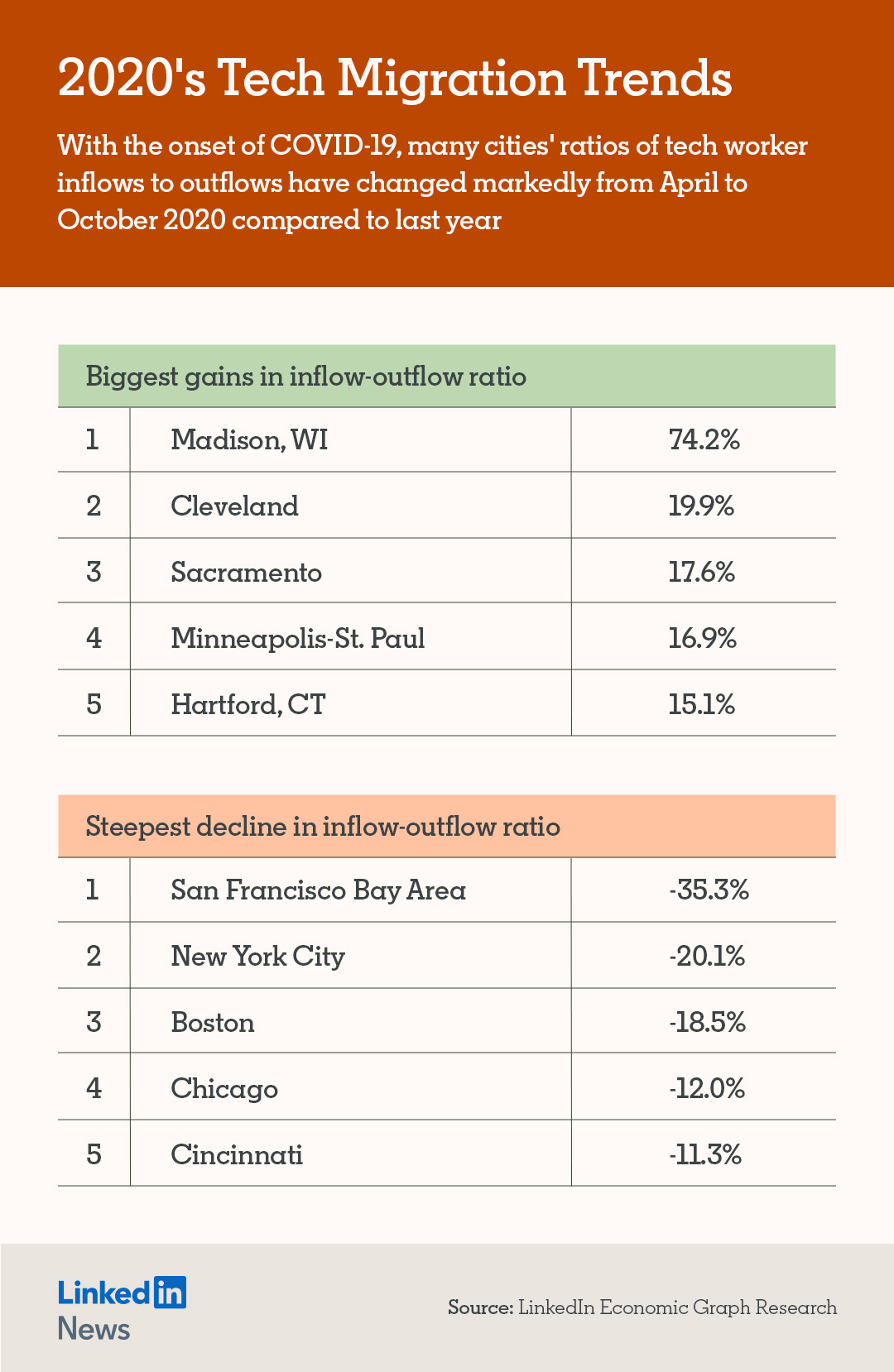

Investing is about the future. What I am telling you the future trend is… nvm… you can’t sense trend.

Has @wuqijun stay in Shenzhen he could be a founder and become a billionaire like Pony.

And lower federal taxes. That’s all accounted for in the calcs. (Didn’t include kid deductions though).

You are right obviously that lost cash flow isn’t thrown down the drain, it’s put into equity.

It’s more simply that for many people that loss of buffer cuts down their cash flow too much and they have to start really controlling spending elsewhere to not be in the red monthly.

Yes in my case (at least right now), renting and putting cash flow into equities was clearly financially better, but that’s an unlikely assumption to make consistently