REITs are excellent source of Income, There are different kinds of REITs, Mall REIT, Data Center REIT, Health Care REIT, Residential REITs, Hotel REITs…etc.

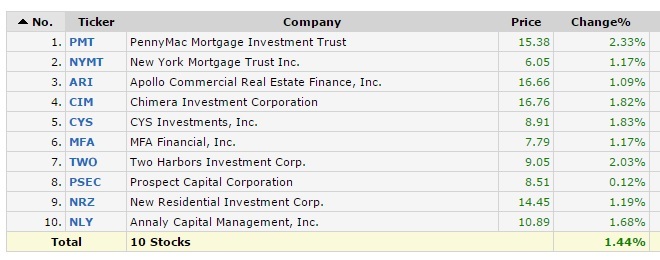

Some of them are good growth and some of them are good dividend income, especially above 10%. Here are the 10 REITs I follow/monitor.

Note: This is for information purpose, but not for investment purpose.

Investing in real estate involves big amount, but equal returns are possible, in small investment, with REITs

Own only one healthcare REIT, OHI. Just one of the stock in a defensive portfolio that collect dividends for spending money only. Mostly utilities stocks:

Telecom: T, VZ

Waste: RSG, WM

Water: AWK, AWR

Electric: PCG, ED

Few good threads on REIT

https://www.reit.com/ Has good REIT Magazine

Opinion: These 15 REITs beat low interest rates with dividend yields of up to 9.7%

Evaluate REIT using FFO/AFFO and Price/FFO and Price/AFFO

========Copied from thread (strong REIT to invest in)=======

STWD is a mortgage REIT. It is well managed but I would view it as primarily a well-managed source of income, not at all as something that’s going to be a home run by any means.

VNQ is an ETF, not an individual name.

I think many of the high quality REITs (VNO, BXP as two examples) are overvalued. Realty Income (O) is a fine option, but more appealing in the mid-50’s where it was the other day. Do I like Boston Properties? Yes, but not at $126. Maybe more at $95-105. Vornado (VNO)? No at $95, maybe at $80-82.

Equity Lifestyle (ELS) would be something I’d be very interested in, but not at $73. More like upper $50’s/maybe low $60’s. Equity Residential (EQR) is getting closer to where it would be appealing (upper $50’s/maybe low $60’s.

I don’t want to own mall REITs at all. At times I’ve pondered Tanger Outlets (SKT) but I just really am not positive on malls at all and I’m really, really not positive on the mid/lower-end/strip mall operators.

The data center REITs that I like so much (CONE, COR, EQIX, DLR, QTS) are - in my opinion - fully valued or somewhat overvalued. Do I think they are still very appealing long-term growth/income plays? Yes. Would I be buying a little more here? No. Did I trim a little bit? Yes. Sell any of them completely? No.

Cell Tower REITs (AMT, CCI) are not as appealing a play as the data center REITs, but they’re okay, with CCI being US-centric and AMT being global.

Industrial REITs are appealing with the continue rise of e-commerce being a benefit for warehouse space. Prologis (PLD), Stag (STAG) and others are a play on this.

Healthcare (VTR, HCN and others) REITs are appealing long-term.

Farmland REITs (FPI, LAND) have not gotten much of a response. American Farmland (AFCO) IPO’d last year and it’s already seeking strategic alternatives because it continually has traded under book.

There’s some more unique REITs - Lamar Advertising (LAMR) for one. Entertainment Properties (EPR), which offers a monthly dividend. EPR is heavily movie theaters, and I’m not particularly bullish on movie going long-term. If you are, by all means.

Hotel REITs I don’t care for because they just get completely fucking obliterated at the slightest hint of a slowdown. Pebblebrook (PEB) is the one I like in this sector, but I just am not going to get into these because when things are good they do pretty decently, when things slightly slow down they get annihilated. Many of them cut their dividend in 2008. This is not a perfect comparison, but I just feel with hotel REITs that it’s two steps forward, two steps back.

Thank you for doing the legwork.

Uh, we have a winna!!! Jil is now designated the REIT Queen!!!

Geez, did you write all that in one breathe…

Sounds like good stuff. I will be sure to check it all out…

Thanks Jil!

For every investment, I spent time to research it.

If I am not doing that, I stand to fail as I may miss some important issue.

Even If I do, I may fail sometimes, but later I learn a lesson.

But chances of getting a good hit is high when I do some research.

Still, REIT is too big a subject

Most of those aren’t REITs in a traditional sense. They don’t own properties. They own the debt on properties and use leverage to generate the big yield. They aren’t as safe as REITs without leverage that are backed by owning physical property.

For example, NLY is 10B REIT, but completely Mortgage based REIT. Last 8-10 years, they fluctuate between $8 and $17, but consistently paying 10% yield.

Most of the REITs are leveraging low interest like the way we do for real estate. They buy big, less expense on maintenance, get a good yield 10%+ level.

Data center REIT have grown up way ahead as cloud architecture picked up recent times.

There are good growth REIT ETFs such VNQ & FREL. These are safer and YTD returns are 12.35% and 11.70% respectively.

Some of the REITs are AVB (avalon communities) and SPG (I think they own bay area malls including milpitas mall) etc.

However, if we analyze properly we even get more than 25% returns (esp bullish times).

It is up to us to analyze these and then invest with it.

Good observation.

Depending on your view of interest rate trend, REIT is either overvalued (interest rate would trend up) or good valued (negative interest soon).

REIT leveraged are almost like investment property.

The IRS requires REITs to pay out at least 90% of their incomes to unitholders (the equivalent of shareholders).

Read more: The Basics Of REIT Taxation | Investopedia http://www.investopedia.com/articles/pf/08/reit-tax.asp#ixzz4JMMVgQBX

In US, the rates can go up or stay same, but may not go negative rates.

When this rate hike happens, entire economy goes down.

All sectors including REITs will go down.

Over the period, the property values goes up (It depends on various reasons/issues).

Holding debt is completely different than holding a property. If the property is worth $1m and goes up to $2m, you get zero of the gains if you own the debt. They are still only paying you back the $1m principal. The leverage makes it high risk if properties lose value. The borrower can walk away, and you won’t recover the $1m owed. Since they are leveraging to do this, there’s huge risk if real estate prices fall. They are giving you zero appreciation upside, but you get the downside risk. You might as well buy normal stocks and sell calls against it to generate income.

I understand. This is exactly debt holding or MBS buying companies, which I am not so comfortable as the borrower can walk away,

However, companies like AVB are property owners. They may borrow money and buy/build apartments for rent. Similarly, data center REIT, Hotel REITs.

Hotel REIT STWD went down during brexit as they have chains in UK and Euro. Such economic issues will impact entire sector.

Other than this, property owning REITs are good for long run.

Here is the sample how management issue in REIT. Worst side of investing, lesson learning how not to invest in such REITs.

It’s probably been discussed already, but REITs can get hit hard as the trajectory of rates rises, especially if not hedged. You could lose your whole year of dividends in a couple of bad days in the market

Physical Real estate is better, be it rental or primary, when we leverage with low mortgage rates, preferably fixed mortgages.

Physical Real estate is better for flipping as you can make higher returns than stocks in short period of time.

REITs are easier to hold and better, compared to rental homes, to have higher returns when you have 100% money invested. They are risky when leveraged with margin account or some other loan.