Still didn’t decline much. Is this a ROKU or a BB? Will it, like FIT, be acquired by a mega cap?

Meanwhile, TDOC makes a new low, now is RED for me… consolation is had reduced stake by 50%.

…

Recently, you and JC are in the same page.

“There’s been a lot of damage done, but given how much the stocks had run going into this sell-off, many of them could still experience a lot more downside before they start looking enticing,” the “Mad Money” host said.

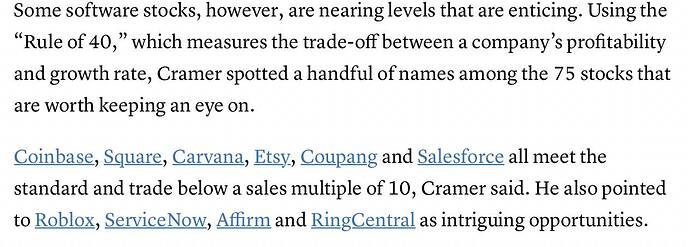

In a list of 75 tech stocks, Cramer noted that on average they are down 37% from the highs. Despite the decline, their valuations remain elevated when compared to corporate outlooks.

“Without a major decline in interest rates, I think the cloud cohort will continue to struggle, and there’s no hurry to do any buying until we get to lower levels for most, if not all, of these stocks,” Cramer said.

COIN SQ RBLX ![]()