It is rare to find such disruptive companies, may be one company in 2 months or 4 months.

I read wsj, barrons, reddit, focus filter finviz, stocktwits, ceobuys, sec 13F-HR…like many sites.

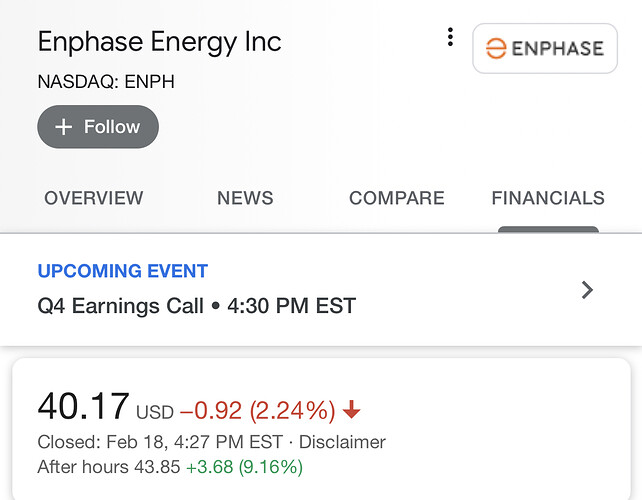

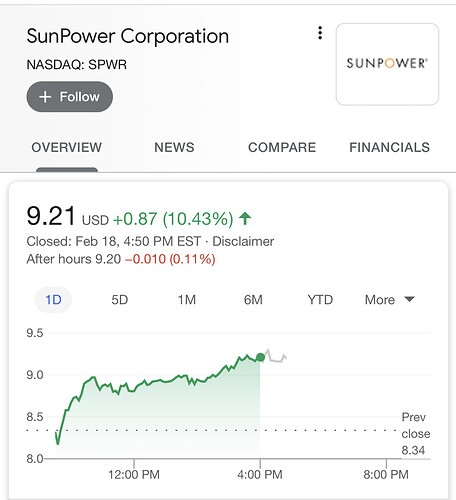

I recently found ENPH from ceobuys where the CEO repeatedly bought lot of shares. Then found a competitor SEDG out of it. Now, ENPH is up 20%.

My friend (ex-sun run) informed me to buy RUN when it was dipping below $14, bought around $13.5-13.7 and it is up 21.5 now.

Learnt TEVA, STNE from warren buffet holdings.

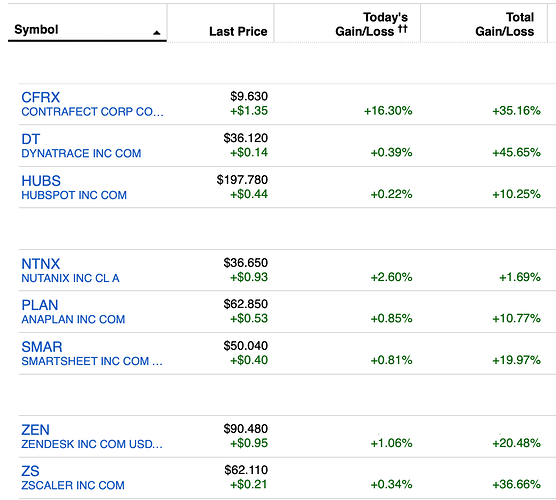

Learnt CRFX from barrons. When PFE bought 6.7% of CFRX, they published it. I read and bought some.

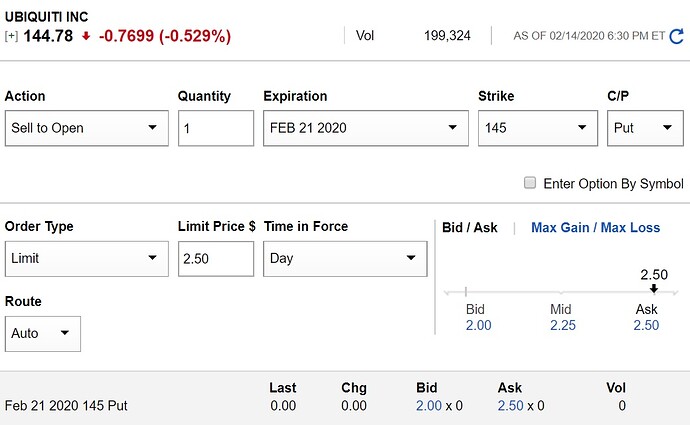

Create a filter in finviz screener and try to look periodically momentum stocks. But that person who got 6503 shares knew about the TNDM instrument and its innovative. He was telling that the stock will have good future and bought bulk, held longer period.

The more you know, better you are. I sold those stocks long back,may be 12-18 months before, but I still remember the history. Go deep into fundamentals and get to know the companies.

Limit only 10 to 20 stocks what you feel better for you.

Now, most of the sites, I am scraping using python, automatically updates my database from there I am getting text message using textbelt (site). Once alert comes, I may read the details, deep dive.

Even today, I am writing/modifying some python program to scrap edger SEC site. This is the reason, I do not have time to write debates here.