I don’t know anything about DDOG or DT. Will need to look into it.

Interview dated Apr 2019.

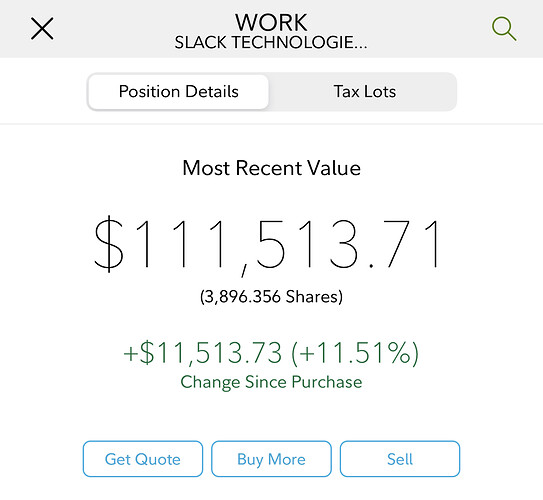

He thinks highly of WORK and ZM but only put $ in WORK. WORK is down from first day of IPO while ZM zoomed more than 10x.

He said shouldn’t invest in enterprise software (refer to cloud startup) except WORK and ZM. He opined their software sucks. He said better to stick with AMZN, GOOG, FB and MSFT for cloud computing.

AMZN merely go sideways if not for the Covid pandemic.

This guy doesn’t understand hardware. He didn’t mention AAPL during the interview, since then AAPL shot up 3x while the four he mentioned gained only 50-100%.

I agree. My opinion of his opinions on investments is pretty low!

Cybersecurity Stocks To Buy As Covid-19 And Remote Work Speed Shift To Cloud

Sound like an updated article on cybersecurity.

Good, has already raised cash waiting

Have sold NET and COUP, not sure want to sell BIGC and SNOW. Don’t have the other on the list.

WTF? Didn’t Cramer say load up on Zoom yesterday?

Still yes to load up under the latest Magnificent Seven, stocks that go up regardless of fundamentals and macro-economic conditions, millennials love them, “ …earnings don’t seem to matter at all. “ buy at any price

NFLX, ROKU, PYPL, SQ, TSLA, PTON and ZM

High $70s now. JC is good. Recalled, he said buy TSLA around Nov 2019, very efficient, biggest bang for the bark (ofc Mar 2020 is better, if you know there is a black swan), far better than holding for 5 years. His sense of when is pretty good.

What happened to your $80 put?

Anyhoo, I have BTC those $80 put and now STO $70 put ![]() lowering the assigned price.

lowering the assigned price.

Well known cloud stocks

Touch 50-day SMA

PLAN

WORK

ADBE

CRWD

COUP

DOCU

SHOP

Below 50-day SMA

FSLY

This will be exercised and result into $72.5 equal value. It is okay to hold such FSLY as this is already low. I have also sold TSLA $375 short term puts (nov 6th).

Not interested in those cloud stocks that touch 50-day SMA?

Wow PTON spanked on Goldman downgrade. Down to 120 after hours.

I am tempted.

For me, Need to wait for market stability (after elections).

And now the FUD has arrived:

Is this the last October surprise? Only 13 more days to go.

Bye bye WORK?

Morgan Stanley was bearish on Apple last year.

I would recommend to invest in WORK. Some big announcement will come up on either some sort of partnership with salesforce or salesforce buying slack. I don’t know the exact specifics but some news is in the offing.

Thanks. Quite often brokerage houses who get wind of such news would instruct their analysts to put up a bearish rating to depress the stock price so their clients would get them cheap. If what you say is true, then this is likely be the case. I didn’t add nor sell my WORK holdings.

True and I see many say WS hates stocks listed directly where slack is one of them. I know about salesforce from fireside chat of Steve with RBC capital analyst 1 week back. The analyst asked why salesforce is not a customer yet and also said you can skip it if you want with a laugh. Steve said I don’t know whether I can talk about this now and skipped to next question. Check this if you haven’t, it starts at 46.22