Saw this on another forum. Thoughts?

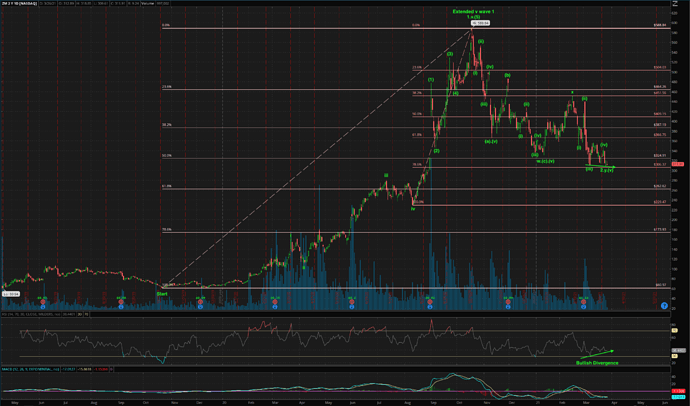

Outdoor Billboards are turning digital and CCO (Clear Channel Outdoors) is a leader. They have so many prime sites and also do lot of advertising on displays at Airports. As we are coming out of pandemic this company has a huge potential. They have burden of 7+ billons debt and issues with management but still stock price is at right levels to enter. I have been following it for quite sometime and recently seen lot of new businesses advertising on their displays. Looks like McDonalds also entered into a deal to advertise on them. At current price levels of $2 it is a good buy. There might be chances of big company acquiring also as they don’t have the burden of IHeart Radio arm also. Ad money might flow into these hoardings steadily. Enter long term for good returns.

I’m just amazed at the valuation. They do have a lot of users though.

If Telegram IPO succeeds. This could become a Tax hub. in the middle of Europe and Asia backed by big sovereign wealth funds. low tax and high standard of living. They prefer Android based systems.

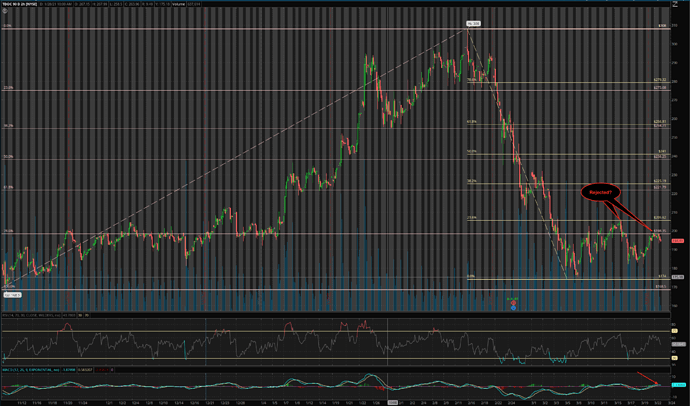

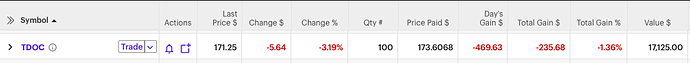

Thought Cathie is a bit earlier scaling back to TDOC around $220. It dropped to $174 and re-bounced, got some ~$185. Thinking of increasing the stake but… why is TDOC got rejected at those critical price zones? Forget about technicals and blindly follow Cathie to buy in bulk? I did that for U… should I do that for TDOC? U is pretty red now ![]() Obviously TDOC is green

Obviously TDOC is green ![]()

A deep dive on TDOC:

- Healthcare is a $9T market globally, with $3.6T in the US. It is estimated that $250B of healthcare spending could be virtualised in the US alone, with the market expected to grow 22.4% per year until at least 2028. Teladoc’s revenue is currently less than 0.5% of the projected US market

- At the end of 2020, Livongo had 600,000 chronic care enrolments, which is a fraction of the 31M people in the US with diabetes, and the 147M living with one or more chronic conditions. They started with diabetes and have expanded their capabilities to include hypertension, prediabetes, weight management and behavioural health

Any one using Apple Watch or iPhone to monitor health is using Livongo

Over 10x in one year and I bet we all missed it. Wow.

I follow Portney and he always talks about PENN. Never took that guy serious since he just gambles in market and doesn’t have knowledge, so skipped this stock.

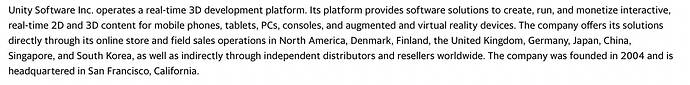

Unity is a fantastic business with a large market opportunity and a clear path to sales growth for years to come. But with the stock trading at 40 times sales, a lot of future growth is already priced in.

Closing price on Feb 23 = $110.61. Today closing $92.71. -16% since the article.

40 P/S is not very high for growth stocks. In fact, you want high P/S, between 30-50 ![]() . Below 30

. Below 30 ![]() Above 50

Above 50 ![]()

https://finance.yahoo.com/news/unity-collaborate-real-time-3d-130000594.html

Portnoy spends all his time sampling pizzas. What a clown

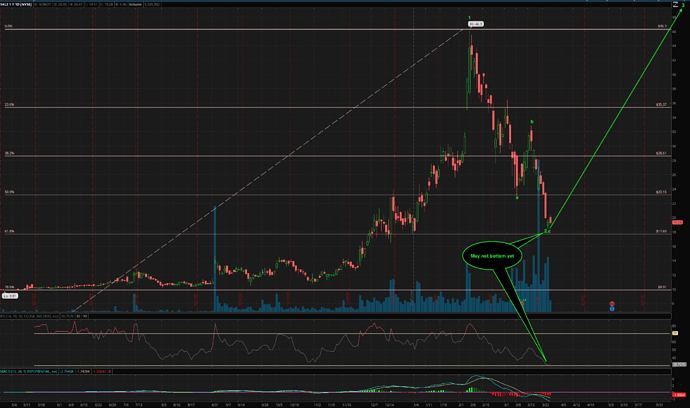

High probability that ZM has completed wave 2. May be is wave 4 ![]() not enough history to tell… just guessing.

not enough history to tell… just guessing.

Short interests stats got updated today. IPOE (SoFi) jumps more than 10 points to 29.6% short. LMND jumps 3 points to 17.5% short. FSLY is still the same or didn’t get updated, at 21.3% short.

I got done with my LMND puts quite nicely in the last few weeks. Still waiting to see where DASH will go - I have puts in the 90-95 range.

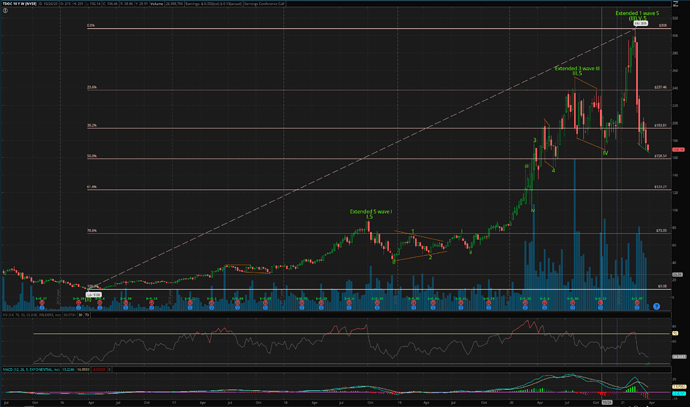

First thing first, labeling could be wrong… could be one degree too high. Relative labels should be correct ![]()

TDOC broke below wave IV… boost my holding to 100 shares (finally), avg price ~$173. Initial plan is to boost to $50k worth or may be 1000 shares??? This is a buy n hold (hopefully forever) investment. Current market cap is ~$26B, 10x should be possible right? 100x? 2-5 decades later?

TDOC is in SuperCycle wave (IV) ![]() a multi-decade trend less corrective wave. Possibly completed wave A or wave A.a or wave W.a or … frankly, I don’t know

a multi-decade trend less corrective wave. Possibly completed wave A or wave A.a or wave W.a or … frankly, I don’t know ![]() just buying in to ride SuperCycle wave (V), a multi-decade up trend which I don’t know when it will start… may be months, years or decades later

just buying in to ride SuperCycle wave (V), a multi-decade up trend which I don’t know when it will start… may be months, years or decades later ![]()

The issue is TDOC is near low, max it can touch $160, but how fast it can grow and how much it can grow… Any way, I understand you plan for a long time.

What if your super century drop comes, as predicted my Master WU, which you also feel confident? This is common to TDOC or TSLA, esp buy & hold, but okay to swing trade !

Do some research on AMRS, this has grown up from $13 to $18 and may likely reach peak. IMO, they are very small 4B company, growing slowly. They expect/forecast double revenue growth this year. It is up to you to decide whether this good or bad…

Just watched the blah blah blah by Bosworth. Is he hyping AAPL? AirPods ![]() Apple Watch

Apple Watch ![]() “Re-invented iPhone”

“Re-invented iPhone” ![]() Home Pods

Home Pods ![]() 2mrw, selling all my other stocks and buy buy buy AAPL.

2mrw, selling all my other stocks and buy buy buy AAPL.

![]() Definitely buy AAPL

Definitely buy AAPL ![]()

The solutions are expected to enhance the job market by creating nearly 7 million opportunities in China, 2.3 million in the USA, about 400 million in Germany and the UK, lastly, in Japan with over 500 000 jobs.

New tech is expected to create new jobs ![]() 400 million? Most probably typo, intend to mean 400,000

400 million? Most probably typo, intend to mean 400,000 ![]()