I am not a religious person and is not strong in language. So can’t enlighten you ![]()

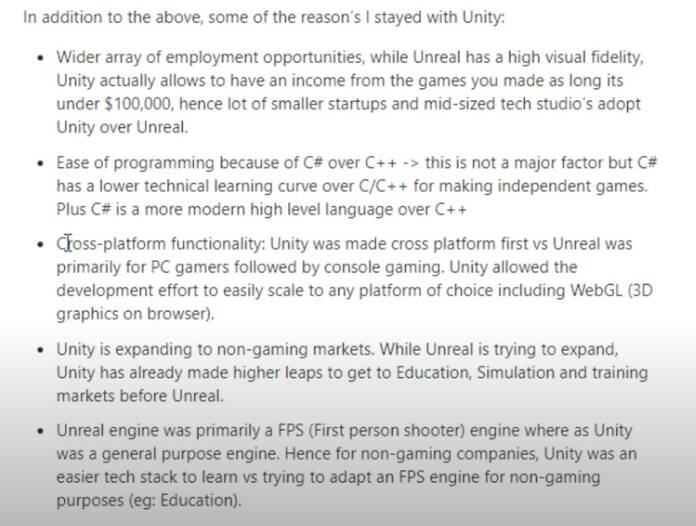

SWOT analysis on U.

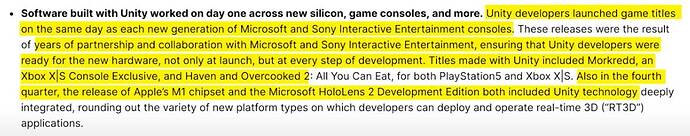

Apple AR/VR apps use U!

Essentially need to hold at least 5-10 years for good gains ![]() Not a swing trader’s stock

Not a swing trader’s stock ![]()

I do not know how many of you looking at good dividend payer now. VIAC is one of them now available at cheap price, after 56% drop in price. The stock was diluted with 3.5B secondary shares which led steep drop with a mutual fund forced liquidation resulted steep drop in price. They are good dividend payer with P/E 11 now.

Do some research for this and get benefit out of it. Even though I like to TQQQ, bought small portion of it.

Someone posted DD, sharing for info (double click image for good resolution)

He is not aware of the profit and loss because he didn’t look at it or Robinhood didn’t show it. Fidelity, eTrade and AmeriTrade show the profit and loss accounting for any wash sales.

One of the things that actually excites me is when I see a large company release a competing product to a smaller company. An example for me was when AWS released DocumentDB to compete with MongoDB. I owned MongoDB stock and my first reaction was “oh shit”.

However, as I digested the news, I realized that in all of the priorities AWS could be doing, they instead chose to devote significant resources to building a Mongo clone. Same thing with Github and the CI/CD companies. If a big company with infinite resources and tons of customer feedback, thinks one of the most impactful resource allocation projects for them is to build a competing product? That’s probably a good sign.

When a competitor, especially a large company, enters into your space….it likely means the market you’re targeting is a whole heckuva lot bigger than you originally thought.

.

Good insight.

Hyping PLTR, AMD and REGN. Why is PLTR so hot nowadays? What happen to AYX and other data analytic stocks?

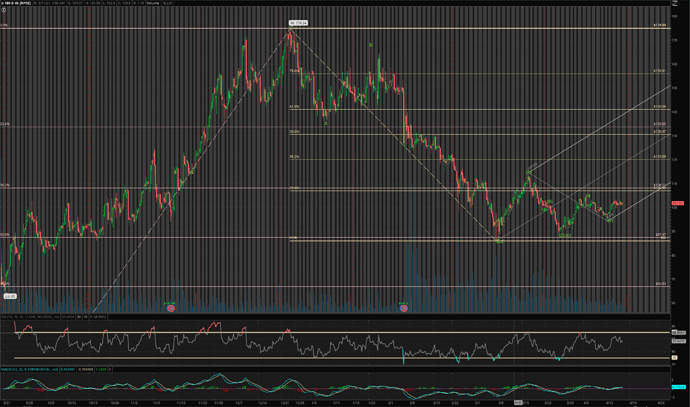

He didn’t notice a potential H&S for AMD?

Been monitoring this for a last few days. Finally bought some today into my long term portfolio.

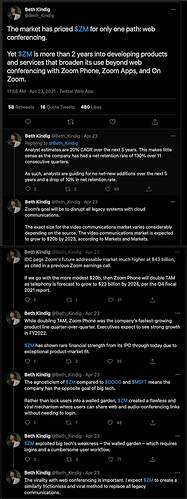

The analyst estimates for Zoom are 29.8% CAGR over the next three years through fiscal 2024. This makes little sense as the company has had a net retention rate of 130% over eleven consecutive quarters. This means analysts are essentially guiding for an increase in churn/downgrades and these projections assume Zoom will not add any new customers.

Beth wants to pump ZM?

What is the urgency to pump? I haven’t built up a sizable position yet. Only 90 shares. I want to up it to 500-1000 shares. Not enough fund so has to hope that it drawdown more.

I believe the market is making a mistake by dropping Zoom from the top 20 for cloud software valuations. Zoom is and lay out the reasons below.

Zoom is more than Web Conferencing

![]()

Zoom phone, zoom rooms, zoom apps, onZoom.

Zoom’s partner program saw significant expansion in 2020. Partner sales bookings increased more than 7x year-over-year.

![]()

Last year, Zoom saw growth of use cases in telemedicine, virtual events, and health and fitness after revamping its partnership program for independent software developers.

![]()

First, there is no other cloud software stock that has made the leap from enterprise to consumer.

True?

For product-market fit, you need the top line to grow rapidly and for the bottom line to strengthen.

![]()

Zoom was also the most efficient in terms of customer acquisition cost, with a median payback period of 9 months compared to the median of 30 months.

![]()

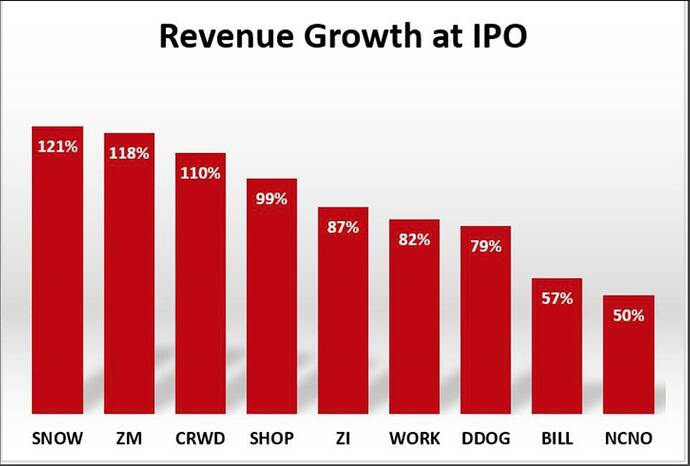

Good chart. I have SNOW ZM CRWD SHOP DDOG BILL ![]() 6 out of 9. Don’t know ZI and NCNO… need to look up on them. I sold WORK after it shot up upon CRM acquisition news. Didn’t follow it after that.

6 out of 9. Don’t know ZI and NCNO… need to look up on them. I sold WORK after it shot up upon CRM acquisition news. Didn’t follow it after that.

Zoom was profitable at the time of IPO while the majority of cloud software companies are not profitable many years after their IPO.

![]()

![]()

![]()

Zoom’s ongoing goal will be to disrupt all legacy systems with cloud-native communications – and this means every possible method of communication that is not currently done on the cloud and/or is currently on the cloud but is too cumbersome of a process due to walled gardens.

Does this mean WORK, TWLO, Skype and RingCentral are in trouble?

Please note, when you see this level of bottom-line growth, it means Zoom is spreading organically and not needing to pay for its growth. This is extremely rare in Silicon Valley and other tech startup hotbeds, as growth marketing is a tactic used to grow the top line at the expense of the bottom line.

![]()

Due to the low valuation and the company having plans to double its TAM quickly, among other reasons, we have closed Bandwidth in favor of a larger position in Zoom.

Beth is driving the price up for me. Slow down baby.

I may need to look at CRWD again. Seems like everybody is loving that name.

.

I like it over the other cloud security stocks for ONE and ONLY ONE reason. It is a holding company and not a development shop. Cybersecurity is quite faddish… technology for doing security changes quite often. A holding company can dump the about to out-of-vogue app and buy a new in vogue app.

https://www.investors.com/news/technology/cybersecurity-stocks/?src=A00220

CrowdStrike stock and Zscaler have dropped off the IBD Leaderboard.

Microsoft is integrating more security tools into its cloud-based Office 365software. Microsoft competes with cybersecurity firms such as Proofpoint (PFPT), Splunk (SPLK), CrowdStrike, Okta, and startup Netskope.

I have 3 out of the 5.

.

![]()

My guess is you don’t have CRWD and ESTC ![]()

ESTC is recommended by @marcus335, I didn’t do any DD ![]()

I like CRWD… it shot up much faster than I expected… was thinking of beefing up to $30k like ZM, TDOC and U. My four horsemen regardless of market conditions.

Cathie has been aggressively adding to U and COIN over the last few trading days. Even dumped SQ and TSLA! U does look very promising, could be in wave (iii) of wave (3) of wave i of wave 3… extremely powerful uptrend! Exploding upwards soon, if true.

@hanera why you didn’t invest in your home country’s tech names? No confidence in Dictator Lee who just got rid of his handpicked successor?

Copy WeChat approach.

This 5 years: Digital wallets and Genomics

Next 5 years: AR/VR

So skip digital wallets and genomics, go for AR/VR stocks ![]()