I’m accumulating UBNT. So not sure why still need ANET.

I like SHOP but this volatility is making me cautious, holding 1 call.

I’m positioning for more volatility by call replacements. If price tumbles heavily, I buy the underlying, meanwhile sell stocks buy calls to ride any appreciation with lower exposure.

Reverse hedge?

Hedging. What is reverse hedge?

Call replacement = replace 100 shares with a call.

I do not go for calls/puts, but I always buy stocks (or sell) as OPTIONS have greater volatility (I feel no protection/safety for my amount).

If you see debt of these three, UBNT has debt, both long term and short term, but ANET and SHOP does not have those. Does not mean UBNT is bad, but ANET, SHOP equally good, run on their own money, equity with very low debt.

SHOP I have not seen how much profitable, but UBNT is 15.7% PM, while ANET is 21.7% PM (higher P/E negative too).

When such companies falls suddenly, esp after good results, buying low provides a better margin (of safety) for the investor.

With SHOP, volatility is also there like TSLA, both has extreme P/E.

What is reverse hedge?

That’s the name I saw in the options book. Short 100 shares and long 2 calls.

Short 100 shares and long 2 calls.

I don’t short stocks. Is not appropriate in a bull market. Sound like a good strategy in a bear market to hedge against technical re-bounces and DCBs.

Did a web search, is also called Chinese hedge.

Look like I need to buy the 5th ed.

I like SHOP but this volatility is making me cautious, holding 1 call.

I do not go for calls/puts, but I always buy stocks (or sell) as OPTIONS have greater volatility (I feel no protection/safety for my amount).

Miss my lecture?

100 shares of SHOP @closing price of $137 is worth $13,700.

Say you are worried that the Fed meeting on Mar 20-21* could crash the market.

Possible hedging:

Long put: You could cough out $640 to long a Mar 23 put ($137) to protect any drop below $130.60.

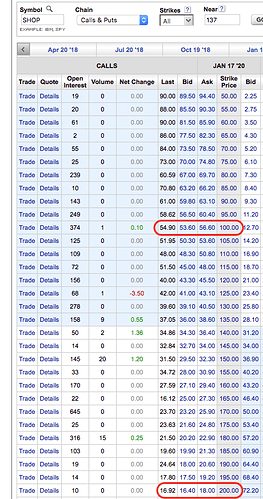

Call replacement: Alternatively, sell the shares at $137 and long a Mar 23 call ($137) for $650. Holding $13k cash.

In both cases, you risk only ~$650. Remember this is a call replacement hedging strategy, not long calls to bet on a bull trend, so $13k won’t be deployed.

Above computation ignore commission, tax issue and slippage.

*Just for illustration, applicable to earning day or any significant macro or company event day

Say you are worried that the Fed meeting on Mar 20-21* could crash the market.

Possible hedging:

Long put: You could cough out $640 to long a Mar 23 put ($137) to protect any drop below $130.60.

Call replacement: Alternatively, sell the shares at $137 and long a Mar 23 call ($137) for $650. Holding $13k cash.

In both cases, you risk only ~$650. Remember this is a call replacement hedging strategy, not long calls to bet on a bull trend, so $13k won’t be deployed.

Above computation ignore commission, tax issue and slippage.

I do not mean to say option is wrong, but it is speculative interest, but not investment idea.

I was worried when stocks dropped 1000+points, wild volatility, to protect big amount. When I sold my stocks, it was 80k+ profit of which 40% YTD gain.

Now, I am not disturbed. Mar 20-21, stocks may go up and down, but not like that 1000+. On any case, my decision was to hold to regain the fall or book profit, and I took the 2nd one.

Now, based on your statement, you are more worried in holding stocks, but playing with options speculative way !

The reason for option falls speculative is predict what way stocks is going to happen in short duration and bet on it, make profit. This is no way identifying right company to buy and hold long ! This needs lot of fundamental ground work, to focus on a company, understand and put your money. It is exactly like you have few millions of cash and where to buy real estate, PA, CU or Austin…etc.

You will bet options with less than $10000 or similar amount, but not with 1M+.

I do not mean to say option is wrong, but it is speculative interest, but not investment idea.

Now, based on your statement, you are more worried in holding stocks, but playing with options speculative way !

Somehow so long option is involved, you view it as speculation even in the case of hedging. Hedging is buying insurance, is not speculation. Well, I don’t think you would change your opinion no matter how I explain to you about option. Option can be extremely conservative to extremely aggressively, long calls can be constructed for buy n hold ![]() With the advent of option, buy n hold doesn’t mean long underlying anymore

With the advent of option, buy n hold doesn’t mean long underlying anymore ![]()

long option is involved

To my knowledge, the max years is 2 and I see premium is not worth.

If you go deep into the money, then the time premium is zero or near zero. I can usually get a 3-5x leverage with call option vs buying the stock. I’m usually 20-40% cash to take advantage of any crazy buying opportunities. That’s the value of options. I can spend far less to get 100% of the gains as owning shares while keeping cash reserves high. I add selling shorter term OOM calls against my calls to generate income and lower risk.

I think where some people use options wrong is in Hanera’s example they use the whole $13k to buy options. That’s not the point of using options as a stock replacement strategy.

I see premium is not worth.

You can long a bullish vertical call spread $100/$200 for $37 if you are unwilling to pay the premium. ![]()

I’m usually 20-40% cash to take advantage of any crazy buying opportunities.

My current cash reserve is nearly 70% ![]() kind of under invested

kind of under invested ![]()

The downside of buying options instead of shares is that you have to liquidate your portfolio periodically and pay cap gain taxes.

The downside of buying options instead of shares is that you have to liquidate your portfolio periodically and pay cap gain taxes.

True, so once the stock has matured such as AAPL, and is paying dividends, you should be rich enough to use long puts (or fancy zero collar) to hedge or sell fairly OTM calls for limited hedge + enhanced return. Is no longer volatile. Current IV of AAPL is about 25-30%, used to be like NTNX, 50+%. Btw, I didn’t bother to hedge AAPL because it is perennially undervalued, and now with WB on board, is around fair valued most of the time.

The issue with all options is time bound, another dimension, and time-decay. Second, we need to look at technical chart than fundamentals. Even with spread, time-decay…etc involved.

I do not know how much each one you use in options, but for me the amount is huge almost one BA home cash price. For example, I bought 5000 TEVA stocks in one account alone, and similar in other stocks. The only confidence that Mr.Buffet would have done due diligence before putting 350 Milllions in TEVA. Same thing I did with AAPL, unfortunately I sold it prematurely. I avoid options as they are too risky esp on time-decay part it. I would prefer to put it in safe companies.

Same thing I did with AAPL, unfortunately I sold it prematurely. I avoid options as they are too risky esp on time-decay part it. I would prefer to put it in safe companies.

Selling a buy n hold position that you hold for less than a year? ![]()

The issue with all options is time bound, another dimension, and time-decay.

You can construct all kinds of position ![]() such as zero delta, zero gamma, zero theta, zero vega …

such as zero delta, zero gamma, zero theta, zero vega …

Zero viagra?

Selling a buy n hold position that you hold for less than a year?

That is the blunder, short sighted step, I made, esp with AAPL, CSCO and BA, all dividend payers.