Std deduction might double to 24K for couples.

Reduces motivation for high earning households to buy a house?

looks like coasts get hit hard. elimination of itemized deduction other then mortgage interest. so no more state tax and property tax write offs. ouch.

Yeah, House ownership might not be that financially rewarding going forward.

Thanks for voting for that lunatic.

basically be a renter or own multiple properties through a S corp and rent to yourself… hmm wonder who that applies to

People who pay mortgage interest substantially higher than 24K/year will benefit from itemization.

yep. which is most of us on the coasts. take a typical dual income tech household. they are probably pulling back $300k to $400k a year. let’s say a $1M mortgage at 4%. you are probably paying about $25K in state tax, $18k in property tax, $40k in mortgage interest. looks like mortgage interest deduction will be kept. but you lose the $43K in other itemized deductions. this would raise your federal tax by about $15k. now it is going to come down a bit from the top rate, but the lower and middle parts of your income will actually be taxed a little bit more from the tax bracket compression. so save about 5% on income over $250k, but pay a couple of points more on income less then that.

net effect of this new tax policy is that for W2 wage earners working in STEM fields on the coast are going to get screwed

With Trump changes in Corp tax at 15%, C-Corp are better than S-Corp when Individual tax bracket is more than corp tax rate.

This means, anyone with 25% tax bracket paying higher than C-Corp of the same earning. If we make s-Corp, the earnings are attached to individual through for K and taxed at 25%.

Experts may please chime in if I am wrong.

:1,$s/S-/C-/g

yeah. meant C corp

We rent from each other?

i really dislike this tax policy. it entrenches and pushes income inequality. especially with the elimination of the inheritance tax, the favorable treatment of individuals who incorporate themselves and the punitive treatment of being a salaried employee relative a non-salaried person at the same income levels.

it is just bad policy. and shows the shallowness and selfishness of this administration. it encourages rent seeking and punishes work. and it basically creates moat around the very rich. if you earn more then $1M, you are fine under this policy. if you earn less then $100k you are probably not impacted (until the deficit blows up and the bills needs to be paid), but the professional class that is trying to cross the chasm to be financially independent while working a regular job just got thrown another hurdle to pass

yep ![]()

You the experts, keep giving us more information, I really love to see you all excited and happy about it.

hah. my back of the envelope calculations were pretty close. 25+ million households get screwed. this is a giveaway to the rich masked as a tax cut for everyone (devil is in the details).

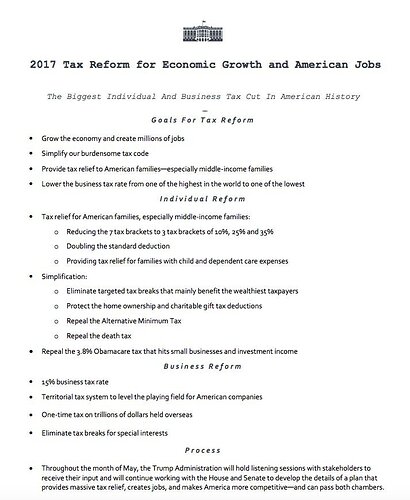

It’s not a plan. It’s a plan to have a plan:

I agree with you 100%, even though I will benefit a lot from this so-called plan. My pass-thru income from LLC will be taxed at 15% flat. Businesses benefit at the expense of workers. Income inequality will accelerate even more.

Maybe instead of working a W2 job, people should all set up their own LLC and “consult” for their companies instead? Health care plans on CA exchange are not crazy expensive.

Could be a plan to encourage mom and pop businesses  From gig to LLC

From gig to LLC

Hmmm, people say my wifey’s cooking is good enough to open that Malaysian take-out place…Millions, I tell ya!!!

What is that?

Well, here’s to hoping Congress does the right thing…