Another San Francisco tech firm FTW!

But in Opendoor’s case, they are making their money via the narrowest of profits on the flipping of homes. The company makes a gross profit of about seven or eight percent on every home it sells, consisting of the spread between what it buys for and then sells for. But then the company also has to pay an agent to help it sell that house. And it has to in some cases pay to fix up the house. After those additional expenses, and after the cost to Opendoor of interest, what’s left over is what’s called a “contribution profit ,” the money they make before all the operating costs of maintaining an office and a sales staff, etc. Opendoor’s contribution profit margin was less than one percent last year.

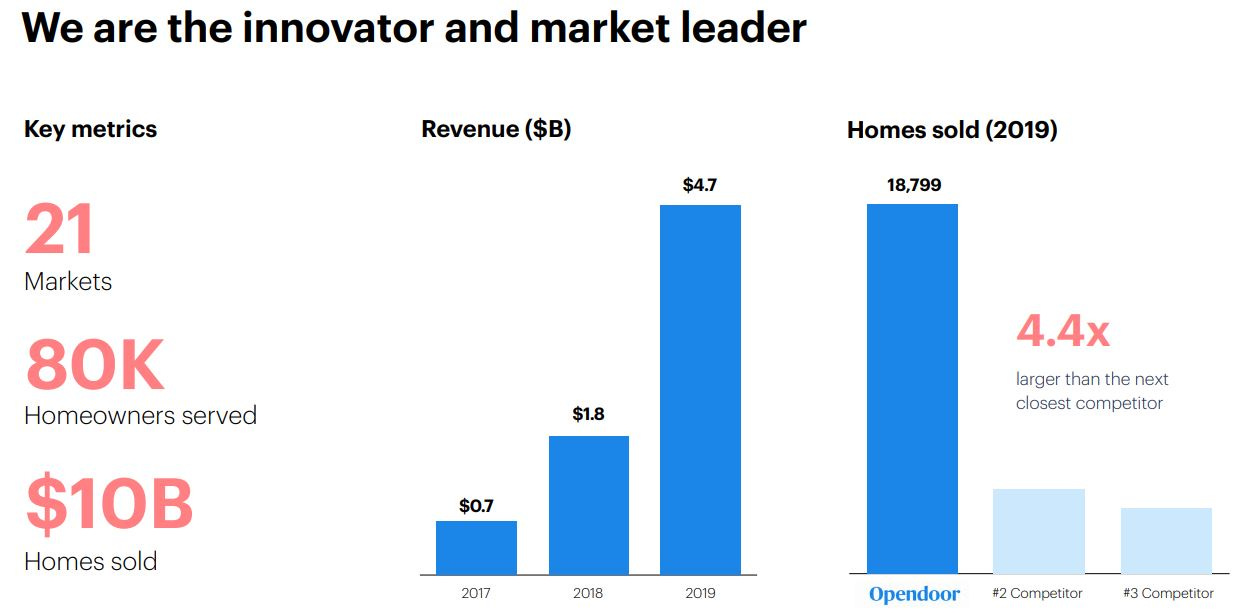

They need a lot of volume to have any hope of being profitable:

Arounian expects it will be profitable come 2023, when he forecasts a profit of $9 million on sales of $10 billion