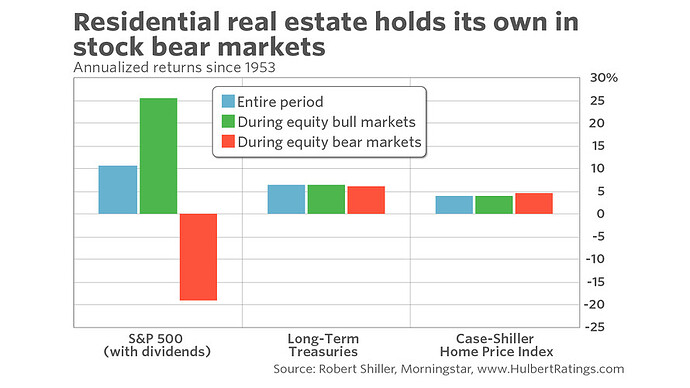

Would you be interested in an asset class that has risen in all but one of the stock bear-markets of the past 70 years — and isn’t bonds? Of course you would. But there’s a catch: The asset class is residential real estate, and it’s difficult to invest in real estate as an asset class.

Consider the performance of the Case-Shiller Home Price Index, which is derived from information on repeat sales of homes across the U.S. Monthly values for this index exist back to 1952, which enabled me to measure the index’s performance during the 20 bear markets that have occurred in the subsequent 65 years. If we overlook one in which the index slipped just 0.4%, there was only one bear market in which residential real estate fell.

Some people are surprised at this chart, since they thought residential real estate had produced much higher average annual returns — instead of rising at a rate even lower than long-term Treasurys. Hasn’t real estate been the greater generator of wealth over the last half-century? But real estate’s wealth generation is due in large part to leverage — buying a house with a mortgage — which magnifies the returns of the asset itself.

Another hurdle is determining how investors can invest in residential real estate as an asset class. This is a big hurdle, since the performance of an individual home will largely be a function of idiosyncratic factors — location, location, location — having relatively little to do with real estate as an asset class.

The next best alternative, as far as I can tell, is one of the ETFs that invest in the residential construction industry. Three that I analyzed for this column are:

• iShares U.S. Home Construction ETF ITB+1.78%

• PowerShares Dynamic Building & Construction Portfolio PKB+1.22%

• SPDR S&P Homebuilders ETF XHB+1.32%

For each, I calculated the correlation coefficient of its 12-month rate of change with that of the Case-Shiller Home Price Index. For all three the coefficients were high and significant. The ETF with the highest correlation since May 2006, the point at which all three of these ETFs existed, is the PowerShares ETF, with a correlation coefficient of 0.70. The iShares ETF had a coefficient of 0.63, and the Homebuilders SPDR had a coefficient of 0.59.

Shillerr index works in Indiana or New Haven…Means nothing in the BA

I need to more leverage in RE. Working on it…

I don’t understand why apartment REITs cant serve as an asset class for residential RE. Does apartment price rise at the same rate as single family houses over the long term?

Why is the REIT price more or less flat? If it holds the residential RE, its price should match RE appreciation.

Anyway, this is consistent with my long term advocate of RE over stocks. Should forget about Bitcoin and KODK and look at houses instead

REits are like bond funds…Whereas individual properties are like individual bonds…different animal…There are Reits that just invest in multi family properties…But many are highly leveraged and can be sensitive to economic downturns…Plus due to diversity you don’t have a choice on locations…

Are REITs allowed to sell property? If they do, do they have to reinvest the proceeds? I’ve never paid much attention to them.

They can buy and sell and take on debt…Pretty much a black box…Never been a fan…

Some REITs own properties. Some do mortgages. There is one that specializes in mortgage servicing rights. Lots of variety.

Firstly, we all agree must own a primary.

Second should be appropriate use of leverage. manch achieves 200% for stocks through the use of portfolio margin (up to 10x leverage). For rental, is hard to get 5x leverage, most probably 3x only. So might not be as lucrative.

REITs are mandated to share 90% profit to owners. Whenever they are selling, it will be shared to owners and that get taxed as ordinary income.