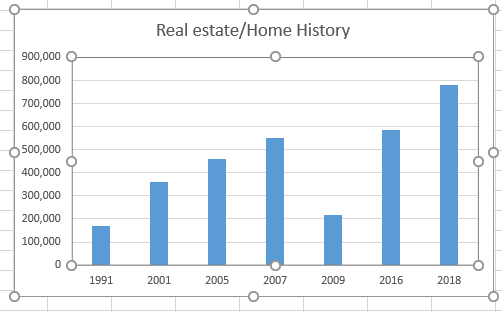

This Santa Clara condo’s price history shows the bubble inflated, popped and reflated perfectly.

https://www.redfin.com/CA/Santa-Clara/1031-Clyde-Ave-95054/unit-1504/home/12171231

This Santa Clara condo’s price history shows the bubble inflated, popped and reflated perfectly.

https://www.redfin.com/CA/Santa-Clara/1031-Clyde-Ave-95054/unit-1504/home/12171231

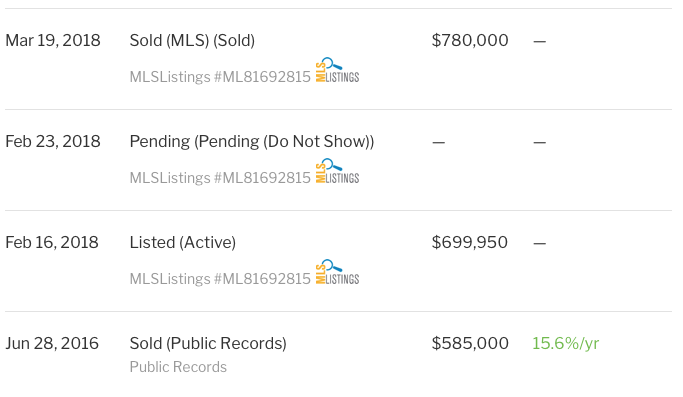

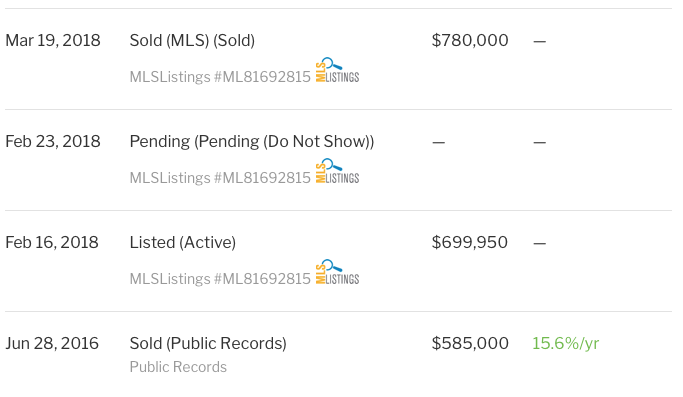

1991: 167,500

2001: 359,000

2005: 460,000

2007: 549,000

2009: 215,500 (!!)

2016: 585,000

2018: 780,000 (!!!)

Prediction:

2023: 1M

2030: 1.5M

This kind of increases are scary as it exactly happened in year 2006-2008

That 2009 period was when my Tracie used her home equity money and bought a few condos in Hayward way cheaply when others couldn’t get loans due to some issues with HOA or something like that. Made out huge…

Don’t worry, this time it’s different.

That is why I am not taking cash out refinance from the fully paid homes using 30 year fixed mortgage.

Yes, is a different group of people ![]() who would have to sell their houses cheap

who would have to sell their houses cheap ![]()

Was he telling seriously? I thought he is joking !!

That is not a great part of Santa Clara. There’s a 7-11right there oh Lafayette. Next to it are a bunch of sketchy looking apartments that aren’t maintained very well.

Correct. And yet that part of Santa Clara is now selling at 600$/sq ft.

yeah, it was sarcasm.

1991: 167,500

2001: 359,000

2005: 460,000

2007: 549,000

2009: 215,500 (!!)

2016: 585,000

2018: 780,000 (!!!)

Just drawn a chart

This home went into pending in 3 days before this weekend open house. Looks like attractive offer was submitted/accepted !! The appreciation is almost like the above.

Everywhere market is crazy. I almost failed more than 4 homes.

S&P 500

Jan 1 1991: 325.49

Jan 1 2018: 2683.73

8.25x

The SC condo only managed 4.66x.

how about considering leverage?

Exercise left to readers. Also I didn’t include dividend in S&P.

S&P 500

Jan 1 1991: 325.49

Jan 1 2018: 2683.738.25x

The SC condo only managed 4.66x.

Real estate is lower, like bonds, than stocks. BA growth rate is appx 5% - 7% YOY (with all Ups and Downs).

Is rental yield higher than sp500 dividend yield?

Is rental yield higher than sp500 dividend yield?

Assume sp500 yield at 1.8% and BA rent yield appx 3%, still stocks are greater than real estate