Yup. There must be no evidence of Bill Clinton doing anything wrong. He also got acquitted by the Senate.

The power of the sanctions on Russia is based on the dominance of the US dollar, which is the most widely-used currency in trade, financial transactions and central bank reserves. Yet by explicitly weaponising the dollar in this way, the US and its allies risk provoking a backlash that could undermine the US currency and sunder the global financial system into rival blocks that could leave everyone worse off. “Wars also upend the dominance of currencies and serve as a doula to the birth of new monetary systems,” says Zoltan Pozsar, at Credit Suisse.

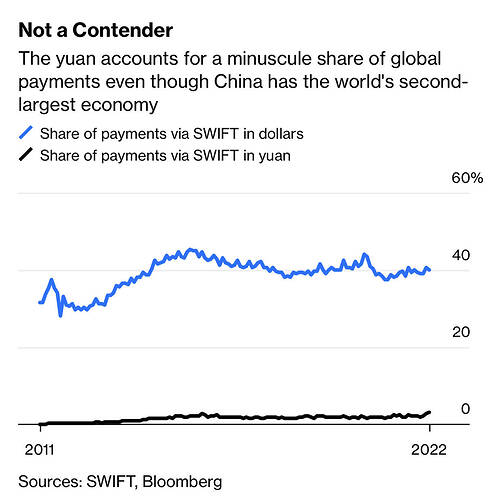

China, in particular, has long-term plans for its currency to play a much bigger role in the international financial system. Beijing views the dollar’s dominant position as one of the bulwarks of American power that it wants to chip away at, the flipside of the US Navy’s control of the oceans. The Ukrainian conflict will solidify this view. Zhang Yanling, former executive vice-president of Bank of China, said in a speech last week the sanctions would “cause the US to lose its credibility and undermine the dollar’s hegemony in the long run”. She suggested China should help the world “get rid of the dollar hegemony sooner rather than later”.

But if there is a steady shift away from the dollar in the coming years, the sanctions on Russia’s central bank might come to be seen not as a bold, new way of exerting pressure on an opponent but the moment when the dollar’s dominance began to decline — a financial Suez Canal. Analysts point out that previous examples of financial warfare have mostly related to blocking money for terrorism or deployed in specific cases such as Iran’s nuclear programme. Targeting a country of Russia’s size and power is unprecedented, and for better or worse it could become a blueprint for the future, argues Mitu Gulati, a financial law professor at the University of Virginia. “If you change the rules for Russia, you’re changing the rules for the whole world,” he says. “Once these rules change, they change international finance forever.”

Larry Fink, the chief executive of BlackRock, the world’s largest investment group with $10tn of assets under management, argued in his annual letter to shareholders that “the Russian invasion of Ukraine has put an end to the globalisation we have experienced over the last three decades”.

Even the IMF believes the dollar’s dominance could be diluted due to the “fragmentation” of the system, although it will likely remain the primary global currency. “We are already seeing that with some countries renegotiating the currency in which they get paid for trade,” says Gita Gopinath, the IMF’s first deputy managing director.

Clinton lied to a Grand Jury about a sexual relationship with an intern. The legislative branch decided that it did not rise to the level of “high crimes and misdemeanors.”

How exactly? I’d love to see their concrete plan.

China is an export oriented economy. That means it accumulates foreign currency, If they don’t hold their surplus in USD what else can they hold it in? No other country has as deep a liquidity pool as ours.

If China wants to play a bigger role in international finance they need to open their banking system and get rid of their capital control. They may do something at the margin but nowhere nearly enough. They have been bitching about American dominance since 08. Nothing’s changed.

Something’s changing. Twenty years ago 70% of global transactions were settled dollars. It’s now down to 60%.

Reserves can be held in gold and in a basket of currencies. What’s been missing is urgency. Now we have that.

I’m skeptical that the reserve currency is going to change much in the near term. If we had a Trump second-term, things may have accelerated. Trump moved us to to a very dangerous tipping point by pushing Europe into China’s arms. Thankfully Putin’s Ukraine miscalculation has brought us back from the edge.

Pretty amazing to think how Trump executed Putin’s playbook:

1.) Disrupt US trade with China (I agree we needed to get tougher on China)

2.) Weaken US alliances with Europe

3.) Undermine US democracy by increasing polarization

It is going to be fascinating to see what happens in China. Mismanaged coronavirus reaction with severe lockdowns. Economy slowing down fast. Xi pursuing unprecedented third-term. Internal whispers that the country is not on the right path. Deteriorating relationships with US, Europe, India, Australia.

US is playing an interesting game in Ukraine. By taking a strong stand and pushing back hard against Russia with our partners, we may be going for the moonshot of replacing both Xi and Putin.

Bloomberg article is ![]() Is the reason why many nations want to change that.

Is the reason why many nations want to change that.

Any country whose thinking does not ally with US, will be wary going forward. China govt will try to do it. Concrete plan my guess will emerge with time from the Chinese experts in it’s finance ministry.

Problem with China achieving it’s goals with it’s currency is, if US is using dollar as a weapon against a major country after 70 years of $ being a reserve currency, Chinese govt will start using its currency as a weapon from day 1(very soon), hence trust in Chinese currency is much less.

Having one’s currency as the dominant reserve currency needs to satisfy certain conditions. It needs to:

A) let foreigners have massive amount of claims on that country’s assets, and

B) foreigners willing to park money in that country’s financial system.

To do that China needs to open its banking system widely and get rid of capital control. It therefore means foreigners have a much bigger influence on China’s banking system, and we know CCP is a control freak. It’s easy to talk a good game. It’s far harder to follow through with real actions.

In fact having USD as global reserve currency incurs massive costs to our economy, in exchange for geopolitical dominance. China’s economy is far weaker and can’t easily absorb those costs.

didn’t understand this part.

Demand for USD implies a stronger currency, all things equal. Stronger currency hurts exports, and that in turn hurts job creation.

After China’s wishy-washy take on Ukraine, their “no limits” partnership with Russia, and their crackdown on business leaders/big tech, people will be hesitant to park big assets in China. Their own citizens park assets outside the country for a reason.

That’s definitely true, i.e. there are some negatives of it.

US also benefits out of it. Again, this is a complex topic(currency-financial/strategic/reserve/trade) with many many factors interacting, and I don’t know enough in detail to comment. Net Net, my “guess” would be, US benefits more than it loses. Otherwise US wouldn’t be holding on to reserve currency status for so long and that’s the reason other countries aspire to be in US shoes.

.

![]()

Lose low pay manufacturing jobs,

Gain high pay high tech jobs.

The job loss isn’t because we manufacture less stuff. It’s because of automation, so we need less people to manufacture. 2000-2010 was the era of automation.

.

You just destroy the often cited reason of job loss due to outsourcing.