I am curious, what macro phenomena do you think would have to happen for housing supply to increase?

buy!

No NYT, it is not different this time. As mortgage rates rise, home prices will come down. It’s just basic math

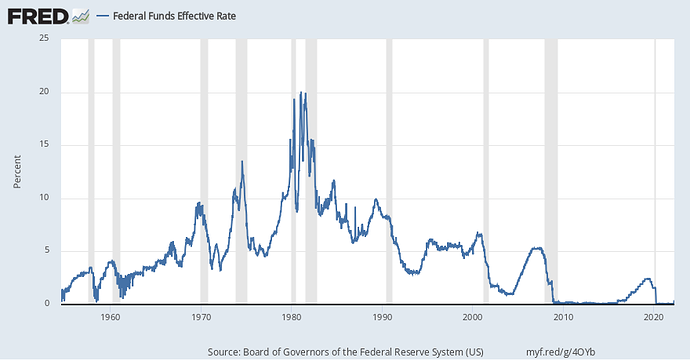

Go ahead and find the prior time when rates increased and home prices declined. Everyone repeats that, but it’s literally never happened. Home prices actually decline when rates are declining.

Just look at the late 90’s when home prices were going up. Rates were going up too. That or look at what was going up leading up to 2008 when home prices peaked. Rates were increasing yet home prices kept increasing. When the bubble popped, rates and prices were both declining.

I think you’re mostly right. The Fed tends to be late to crash the party and raises rates as high as they can until negative consequences start to appear in the economy. In the 2000’s the Case Shiller home price index peaked in June 2006, which coincided exactly with when the Fed stopped raising rates.

Similarly, the San Jose Case Shiller peaked in Q3 2018, one quarter before the Fed stopped their 2016–2018 series of increases.

With those correlations out of the way, I still think this is a case of cause and effect, with rate increase not being particularly good for home prices over the medium term. If the fed had continued increasing rates through the remainder of 2006/2007/2008 would home prices not have come down? During the increases the economy is usually so hot that the higher interest rates are not enough to slow things down. When the rate increases stop, it’s because the cracks are starting to show and the Fed is forced to take a pause to do damage control and subsequently bring rates back down.

The fed only rises rates when inflation is high. High inflation means home prices are going up.

I don’t disagree with you. Home price increases tend to build up a lot of momentum behind them and be hard to suddenly turn around (in fact you wouldn’t want to because it would create instability). Interest rates are like the 2nd derivative i.e. acceleration/deceleration. If the car is going 100 mph (on a freeway with a 65 mph speed limit) and you start to gradually tap the brakes it doesn’t suddenly go in reverse. We’re going to continue to make a fair amount of forward progress here and if they get it right settle right at 65.

Is that a TSLA? ICE cars don’t go reverse when tapping brake.

Inflation solidify home price stay at top level.

Yes, when FED knows (many ignorant people believe FED does not know anything about economy !) cracks are going to hit economy, they stop raising rate so that they can take control at worst period !

Seemingly right, but it does not work like this way. You will see year 2022 home prices shoots up sky high with increase in interest rate.

Marcus is right here, inflation increases home prices. Inflation solidify asset prices, holding same level or up raise level as inflation continues to grow (Money value decreases).

This is very common for all MV,SV,CU and RBA shacks. People are buying dilapidated shack homes with high cash down payment. Reason: No lender will give any loan more than replacement insurance values of shack homes.

This means 4M shack homes loan must be less than $750k (150% of insurance replacement value of home), and rest must be stock RSU/ESPP/Options…etc. In short, loan leverage is very low and defaults are very rare at MV,SV,CU and RBA areas. There is no reckless (or very less such) loans after 2008-issue.

This is silicon valley, any one holding espp/rsu would have original value $500k, but current value may be multi-millions by growth of AAPL, GOOGL, FB, TSLA…etc so many money makers. Silicon Valley (most USA) is stock economy. Real estate follows stock with bond value (hardness) with it.

Even if there is stock market dip next week, market keep going further bullish new ATH until the last rate hike of FED. Until then no homes in bay area coming down, but keep going up and up, never stops its growth. Entire stock market will come to an end 3 months after the last rate hike, then real estate shows max range 5%-10% as lot of the owners are high cash down payment homes.

Okay, as usual, I do not plan to reply any questions endless way. I saw really valuable/constructive discussion in this real estate forum after a long time, tried to add value to it.

Whether anyone believe it or not, it does not matter !

Good Luck again, going to sleep mode now.

.

We’ll so rich that we ![]() both RTO and WFH, watch TV and blog incessantly.

both RTO and WFH, watch TV and blog incessantly.

Since last Sep, prices of ![]() in SV and Austin are racing at about the same rate.

in SV and Austin are racing at about the same rate.

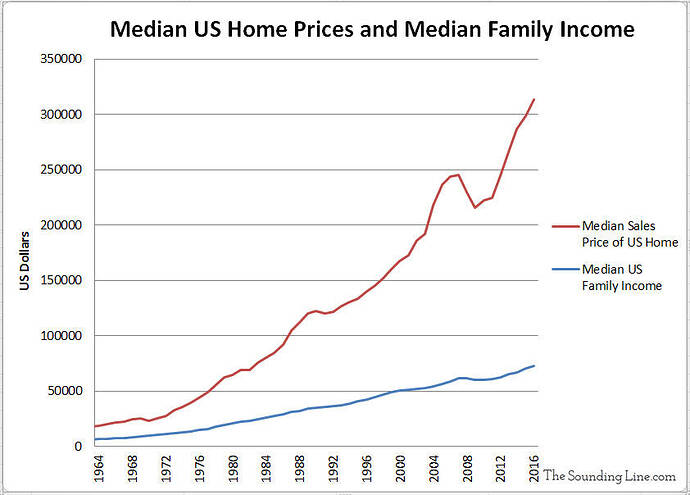

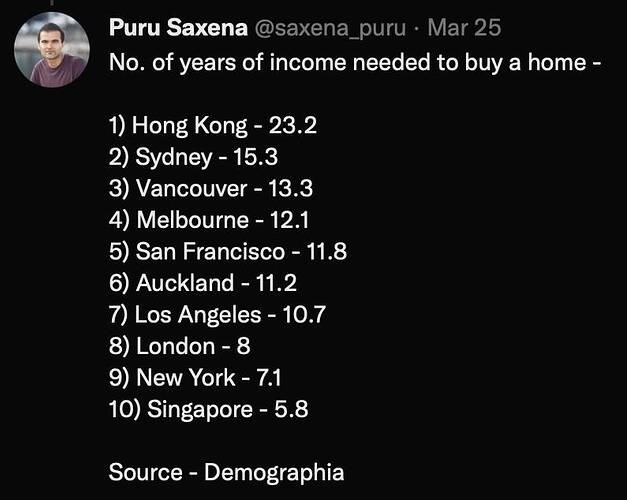

It show Singapore House price/ income as 5.8. Thought is wrong. After some checking, I think the reference house is a subsidized HDB 4-room (S$260k-$380k)… similar built-in EC or private condo $1.5-$2M.