I know people with large down payments (not 100% cash) who are looking to buy now. They want to strike while there’s less competition. They can get more home for the price, since there aren’t bidding wars. They are less sensitive to interest rates and figure they can always refinance later when rates drop. They are buying homes to raise a family, so they plan on staying 15+ years. They will get to refi at some point.

I have checked other RE data too and they are all suggesting that Bay Area RE has not dropped since August. Most cities have flatlined and tier 1 cities are actually rising again. Check Altos, Zillow or Redfin data and all say the same story. Even October closing prices are higher or equal to August. Recent listing prices and closing prices (which is not yet in those data) also suggest the same.

True but I still wonder why they are buying when practically everyone including some honest RE agents are saying that prices will drop another 10-20%. They can rent for a year. On the other hand, if there are too many such buyers hiding then perhaps prices will never fall. Fingers crossed. Weird market.

If you look at the last graph on ZeroDown, SFH median sale price had an uptick in Sept but then declined in October, at around same level as Dec 2021.

Awesome website. Based on this price per sqft in Bay Area is already down by almost 25% from peak. By Jan, Feb next year prices should easily drop by another 10%. Holy moly.

Recent listings I’m tracking suggests that there are still many deniers.

.

Are you pulling the trigger once you got another 10% decline or will buy from Mar onwards.

My thinking remains the same, will buy in Q1 unless Fed gave a surprise and hike rate to 0.75% in Dec (this might happen as CPI is likely to be higher than last month).

My plan is the same. Will pull trigger starting from Q1 2023. Today I saw some properties come in market at lower than what I expected so looks like high rate is slowly but steadily pushing the weaker players over the edge. Have quite a bit of dry powder and 4% yield on cash and cash flow from rental real estate is adding to it slowly.

.

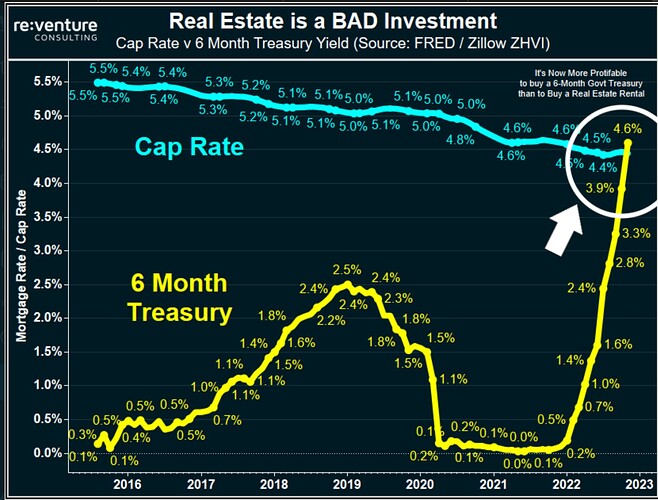

Every RE website talks about this. I don’t evaluate using this metric at all. I don’t use what are taught in RE websites and books. I use my own metrics. How to evaluate the significance of this cash on cash?

In an ideal world if your goal it to expand your portfolio the fastest, the right formula is probably to avoid generating too much positive cash. If a RE is generating positive cash flow it means you have left growth opportunity on the table. But how do you make sure your properties are not cash flowing especially if you buy fixer uppers and fix them up to raise rent - the answer is obvious, cash out refi or 1031 (less preferred). That has been my formula too. However this formula works well in stable or falling interest rate environment. Over last year, we saw an unprecedented rise in rates so cash out refi does not look like an option and I am not yet buying not so 1031 is not an option. That’s why I am now stuck with massively cash flowing properties (post improvements) and accumulating even more dry powder. Plus I have a way more equity stuck in these properties (post improvements).

The bright side is when interest rates fall again, I will have a ton of ammunition. But it will be at least a couple years before interest rates fall back to earth.

.

Didn’t realize that. Guess because I was more on diversification, less on building a RE portfolio per se. What I do is try to have zero or negative profit (exploiting depreciation to achieve the outcome).

![]()

Thought this is the way to buy new rentals. Guess have to change tactics to use cash-out re-fi ![]()

Those who had a high equity and good cash flow in RE but did not do cash out refi at 2% in 2020/21 literally left free money on the table.

Few years later, shortage of houses would ![]() prices again.

prices again.

![]()

Didn’t realize that CAR has such nice data on their website. California median price is down 11% from the peak and roughly even with last year.

- St. Louis Fed President James Bullard noted that “the policy rate is not yet in a zone that may be considered sufficiently restrictive.”

- Using the so-called Taylor Rule for monetary policy, Bullard suggested the proper zone for the fed funds rate could be in the 5%-7% range, higher than current market pricing and unofficial Fed forecasts indicate.

Academics like to talk complicated.

Sufficiently Restrictive = Fed rate higher than inflation rate

Above should be there in Feb/Mar, nothing new! Is why market expects…

Dec 0.5%

Jan 0.25%

Feb 0.25%

Why keep repeating the same thing again and again… no new info.

This is the way news/media works. When markets are going down, they pick posts/video/statistics about downtrend and publish.

Naive retail investors, working on daily routine, will scan news because market is down. They get convincing answer and believe them correct.

When market goes up, they publish bullish posts/videos (even pre-recorded ones) etc.

I was in that crowd (Naive investors) previously, nowadays laughing at such news!

If you have listened FED conference, QT reduction is accounted for some rate increase %. The FED chairman quoted once but did not tell how much % for that. He cut that topic and did not want to go further about QT.

If we account rate increase and the QT reduction percentage, it may be 5%-7% they consider.

.

![]()