It’s interesting that headlines now focus on the positive of price increases. They used to focus on the doom of lower transaction volume. No clue how so many people missed that high rates would crush inventory levels, so RE wouldn’t collapse.

Better hope mortgage rate don’t decline too fast. Too fast declining mortgage rate would unleash excessive demand that would drive price acceleration which eventually lead to high inflation again. The preferred scenario is for mortgage rate to decline slowly so as not to unleash too high demand and give time for builders to increase new construction.

The housing portion of the inflation index has a TON of lag. The fed will completely miss it again. It’s why inflation isn’t closer to 2%. Truflation has it at 2.56%, and the biggest delta is they use market rent vs. average of rents being paid.

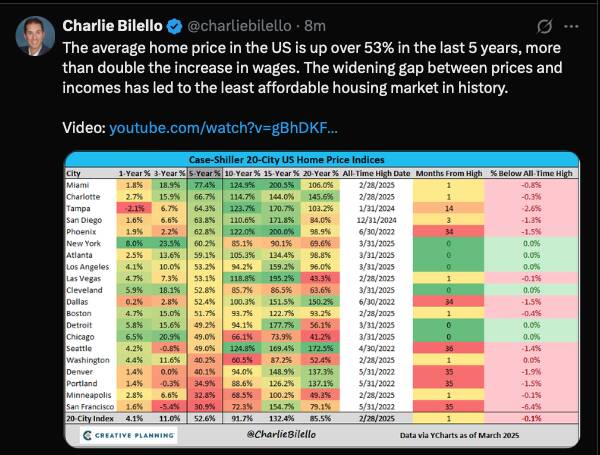

Ultra Luxury market (2 x median) is still in doldrums.

Move up market (0.75-1.25 median) is getting warm. Could explode if mortgage rate drops below 6%.

Entry market (below 0.75 median) remains hot.

For me, RE investment is a diversification from stocks. Still buying on average, one SFH per year.

Rents have softened, renewals at no change in rent.

My target allocation to RE is 20% but because stocks always appreciate faster, so yet to achieve the target.

Housing Price Forecasts for 2024: Illinois and Chicago MSA

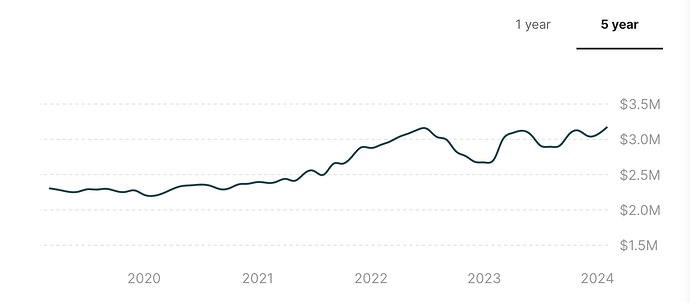

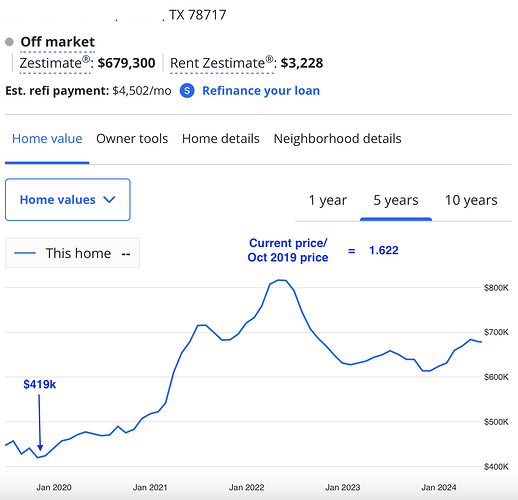

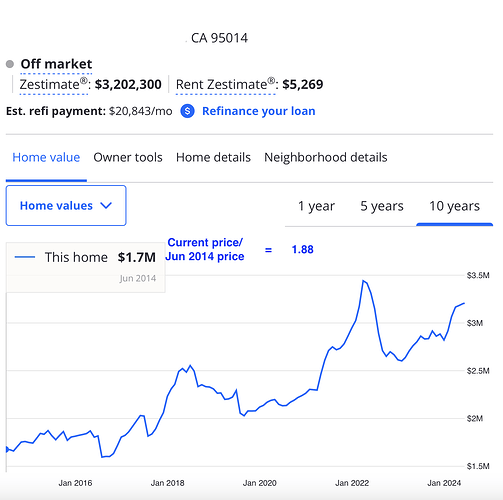

Nothing much to say. Seasonal price appreciation during Spring season. Based on charts, the bull trend in CU has started since Jan 2023. Prices in Austin is sideways from Jan 2023… went up then decline and now up again… net hardly change.

Prices in CU are making new ATHs.

Prices in Austin inch up. About 25% below ATH established in mid 2022.

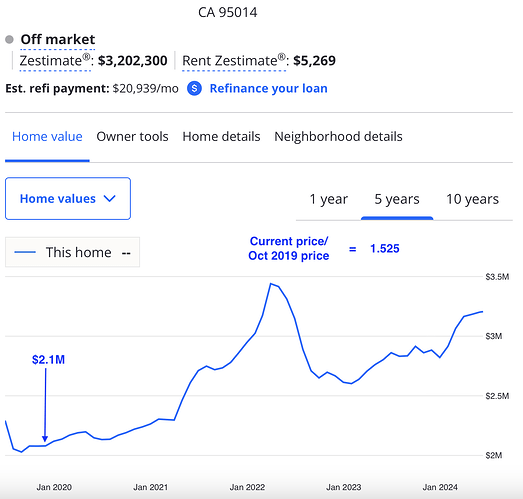

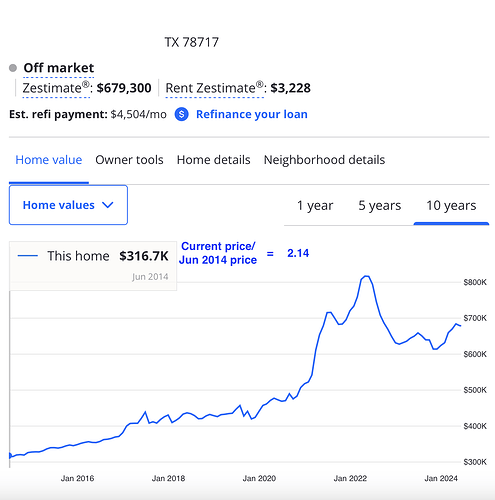

Real estate is in secular uptrend. Covid brought about sharp climb and then plunge but didn’t dent the uptrend. In the long run, you should make money. Ofc, if your timing is so shit that you bought during first half of 2022, blame your bad luck. This is especially true if your RE purchases are in Austin. Anyhoo, your sincerely didn’t buy any houses in Austin in 2022, the trend is obvious ![]() In fact, those who have bought Austin houses in 2022 are Johnny Come Lately.

In fact, those who have bought Austin houses in 2022 are Johnny Come Lately.

.

Without further reductions to borrowing costs, or a big uptick in rents, a 10%-to-15% decline in U.S. home prices would be needed to turn big investors’ heads. That might be a good indicator of how much home buyers are overpaying in today’s market.

Rent has also risen for three straight months after cooling late last year, per Apartment List. And home prices keep ticking up, rising 3.9 percent in February, according to data released last week from the S&P CoreLogic Case-Shiller Index.

Even though rent is rising, affordability for tenants has declined, so I kept rent no change upon renewal. The goal is to prevent turnover. Can always increase rent when economy improves.

This phenomenon is also true in Singapore. IMHO, means buy an owner-occupied Primary asap.