No.

Chief Executive Glenn Kelman reported that Redfin had pulled down its forecast after “an unexpected drop in Redfin’s bookings growth in the past three weeks, slowing traffic growth in a weakening real-estate market.”

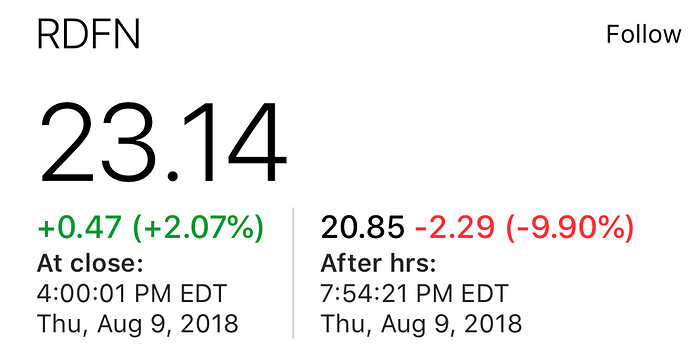

Redfin stock, which fell in extended trading after the forecast was made public, saw that decline accelerate to a loss of almost 10% after Kelman spoke Thursday afternoon, but he did not hold back. He said a decline in U.S. home sales in June was expected to reappear in August and September after a slight relief in July, specifically calling out difficulties in markets on the West Coast that have driven home sales higher in the past few years.

“For the first time in years, we are getting reports from managers of some markets that home buyer demand is waning, especially in some of Redfin’s largest markets,” Kelman said, specifically calling out Seattle, Portland and San Jose as areas where inventory was still tight but did not seem to be pushing prices higher still.

“June sales were down in these markets by double-digits and inventory was up also by double-digits,” he said of the West Coast cities. “The trend is continuing in July and reports are now coming in from Washington, D.C.; Boston; Virginia and parts of Chicago as well that homes there are getting harder to sell.”

![]()

![]()

![]()

It’s a national housing slowdown. What’s the fundamental reasons?

- Mortgage rate increased

- Home price high now

I remember that affordability is still good due to still low mortgage rate.

Economy is booming with good employment.

Tax reform should not affect much.

Seems that home price has peaked for no other reason than high price.

What’s your take?

Hold or sell? Not buying any more because no one else is buying

Is Redfin focusing on coastal high flying market mostly? I think inland markets may be better now. 1031 to Phoenix, Texas or elsewhere?

I called it out here in April and everyone was skeptical…

I think the primary reason is price. In simple demand supply equilibrium it has reached at a point where the demand will go down. I know everyone here will cry low inventory but its simply the supply side of things. No crash but its following the simple laws of demand/supply and price.

What happens next will be interesting to see. My prediction are that since employment is strong the softening of prices will bring some more demand but it wont drastically change the situation.

I heard it’s only 2 offers per house now. Appreciation will be low or even negative

Trump limits on Property tax and State Tax deduction.

He’s talking transaction volume not pricing. There’s still not a lot of aging inventory.

Where does 10k SALT hurt the most? I think California and Northeast.

Portland and Seattle is indifferent to 10k limitation due to Seattle’s zero state tax and Poetland’s extremely low porperty tax.

It feels that forum members have bought many houses in 2018. I’ll send out a poll to compare 2018 purchases with last 5 year average per person

There’s a little impact here. You can deduct state sales tax. Since no one is going to enter all their receipts, there’s a standard number you can claim based on income. It’s worth itemizing that if you buy a new car. I’m sure next year, I’ll hit the $10k cap with property tax and the standard sales tax amount.

The reasons can be many. Law of supply vs demand still holds. I was sent by several lenders to be a tie breaker lately in 95123. These homes are in pending status but past est. closing time. I do not know the reason or know accepted prices. My professional value come out lower than asked price. Sellers seem to think the high price would continue, but the demand side seems to suggest otherwise.

Last 30 days there were more price reduction than before. Sold/Asked was 106.9% while DOM was 15.6 days. Last 60-90 days were 116.3% (Sold/asked) with a terse DOM of 8.6 days. Blossom Valley home prices are lower than other SV neighborhoods. Outer areas like Gilroy home marketing time is back to 30 days but price rose higher. When these areas have higher appreciation rate than inner city neighborhoods that suggests we reached a pleatau.

Lets wait for next interest rate hike due this fall. For every 1% interest increase the affordability rate drops by 10%.

It is nice to have an insider insight. Thanks sam.

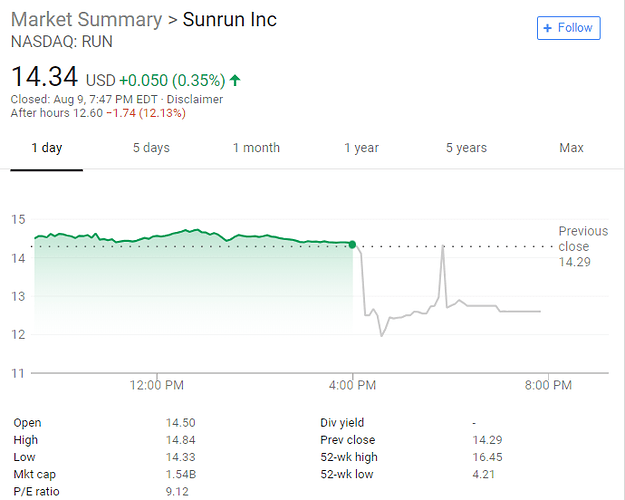

Not only RDFN, but sunrun (RUN) too 12%-14%.

Almost bay area stocks like FB, NFLX, TWTR, RDFN, RUN…etc hit by trade war + interest rate issues

We’re now forecasting slower revenue growth for the third quarter based on an unexpected drop in Redfin’s bookings growth in the past three weeks, slowing traffic growth in a weakening real estate market," Chief Executive Glenn Kelman said at a post-results conference call.

Canary in the coal mine.

Blame on Turkey.

Or will Turkey save housing market by reducing mortgage rate?

how so?

Turkey crisis will cause stocks to fall, mortgage rate to fall and save the housing market. Even Trump is giving them a final punch

Will Greece, Italy and Spain have some kind of crisis soon?