![]()

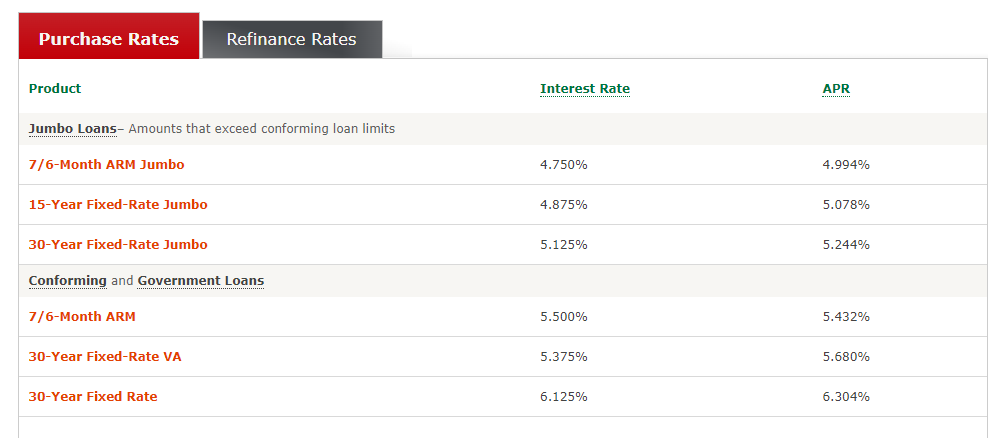

Probably what some folks are doing is what we would have done: go with a 5-7 years ARM and hope for the best (meaning can refi later hopefully at a lower rate). Life does not stop, so if you want a house, well, this is one way to do it…

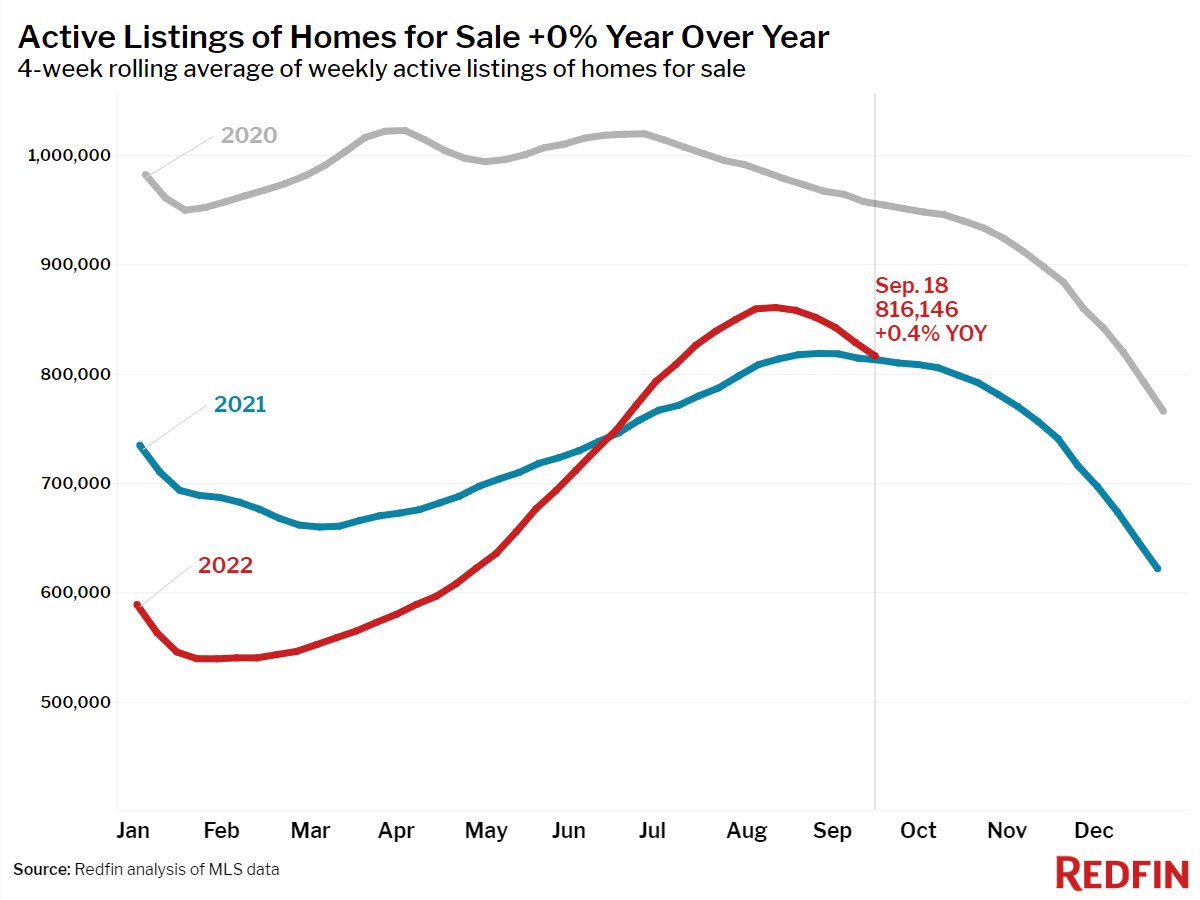

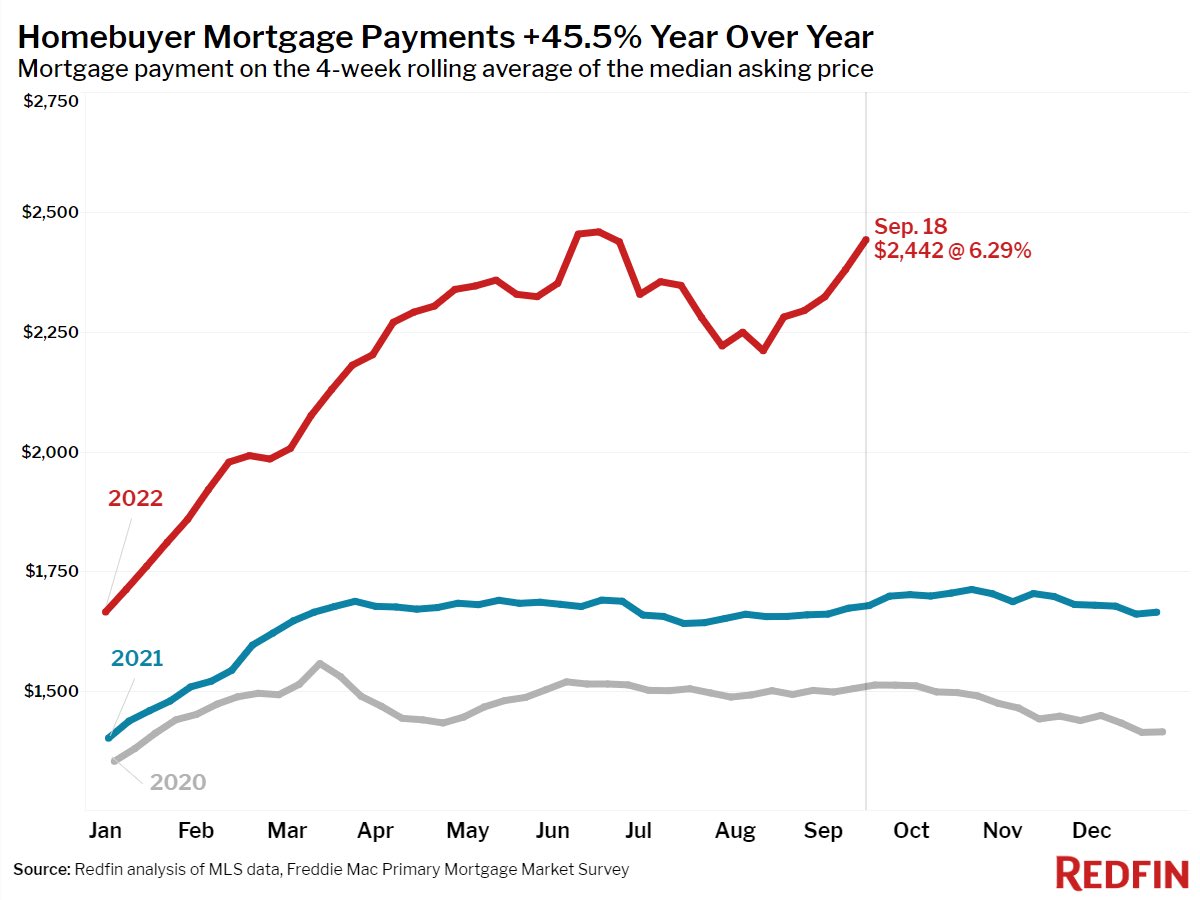

Mortgage demand rose for the first time in six weeks despite interest rates moving sharply higher.

Profile of buyers, ‘buy before rate goes up even more’.

They are also called bag holders.

Powell wants to Volkerize the economy. Even that SOB couldn’t tank RE market the way Greenspan did with his nothing down loans.

In fact the stock market recovery started then and took off big time.

Everyone remembers the great RE crash of the mid 80’s, right? Oh wait…

After 2008 sub-prime loan issue, all banks/lenders changed the loan guidelines as given below:

As a general guideline, 43% is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Ideally, lenders prefer a debt-to-income ratio lower than 36%, with no more than 28% of that debt going towards servicing a mortgage or rent payment.

Rarely 43% is given. Considering 36% normal eligibility, the 24.5% is still affordable level with additional 10% on property tax, insurance…etc.

Thumb rule is 1/3rd mortgage, 1/3rd living expenses and 1/3rd taxes, that is all any joint/single family income person(s) eligible.

Yup, which means most bay area buyers need to put over 20% down to meet DTI requirements. It’d take a lot for them to be upside down.

I am very curious to know if you have saved enough down payment and you can afford monthly payments at the current rate (with 43% DTI) with a relatively stable tech job at bay, would you buy a house right now?

All depends on the time horizon. the deal and the location.

I think for people who have or are staring a family and want to raise it there, then go for it. You’ll live there so long that timing the market doesn’t matter. You can refinance alter when rates drop.

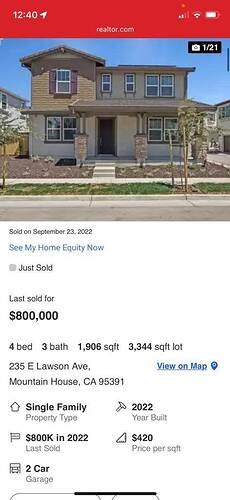

My friend bought similar to this home in Manteca for $675k (2600 sqft) with lot of 6500 sqft just last month. He locked the home 11 months before and 6 months when I told him about economy issue, he said “This is the house I am affordable and the lender is ready to give at 10% down payment. If I buy, I can forget my rent $3200 (Santa Clara) and pay down PITI $3600 (Manteca). If I do not buy, I may not buy in future, better to buy now. Then, I told him to lock the rate 6 months ahead, lender gave him 4.125% fixed for 30 years”. He just moved last month.

Same way, one of relative, newly married, bought the home at LA for 510k two bed room condo, of course down payment help from parents.

There are people buy for various reasons when sellers are there for every season !

Realestate gurus, a quick question for you. I am considering putting an offer on couple of old houses that would have to be rebuilt. Wanted to get your estimates of the demolition and building cost.

Menlo Park/Palo Alto/Mt View area. Flat lot, residential area. Existing house would be around 2000 sq ft. New house - 2 storied, 3000 sq ft, 2 car garage. Maximize backyard area subject to city laws. Nothing fancy… no Italian marbles but also something that would justice to spending $2M on the lot! LOL!

What would you suggest for my budget?

Quick answer – if you don’t already know what it costs to build it’s likely to cost you more than you think. I’d suggest 1.5-2M.

You can check out what Thomas James Homes charges Northern California Home Plans, Rebuild with TJH. You can also take a look at what New Avenue charges Costs — New Avenue Homes

Where are you going to find these 2M lots? TJH and other developers will take them before they hit the market if they can. It’s possible in neighborhoods very close to the freeway, but you shouldn’t spend that kind (4M) of money that close to the freeway. Even in Mountain View where are you going to find these lots? If you find one, I’m willing to go halfsies ![]()