SVB is a victim of woke politics. A silly way to run a company. I don’t like bonds either. Not a fan of REITS either. But I would only consider low leverage multi family… like Essex or Avalon Bay… never buy mortgage reits or office building reits. Why not just buy Public Storage similar to a reit but recession proof. 4% dividend. Way off its highs

Why Not buy REIT?

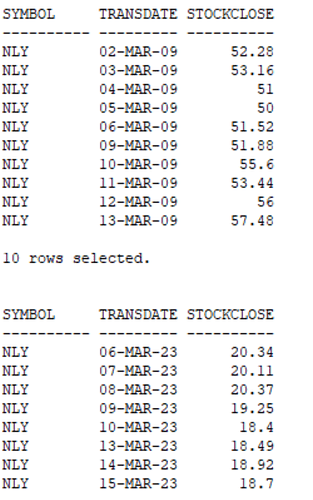

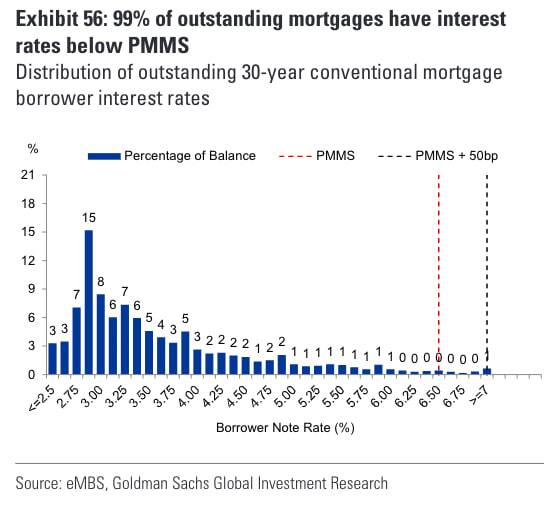

I have this NLY (leveraged Mortgage) REIT, seen this many years, but degraded the value with prolonged low mortgage rates.

In 2020, it came down to $14.50 and recovered up to $38.5 (peak), but is giving 18% dividend with 70% payout ratio. I am still waiting for $15 to $14 which will come in next 7-10 days to get more.

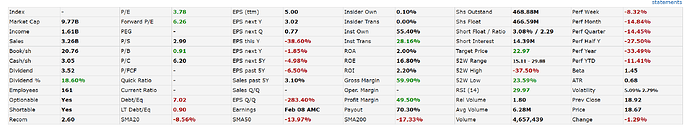

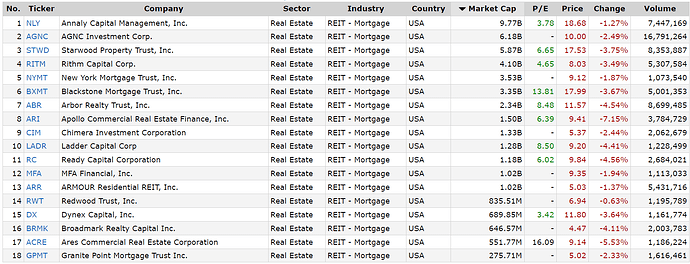

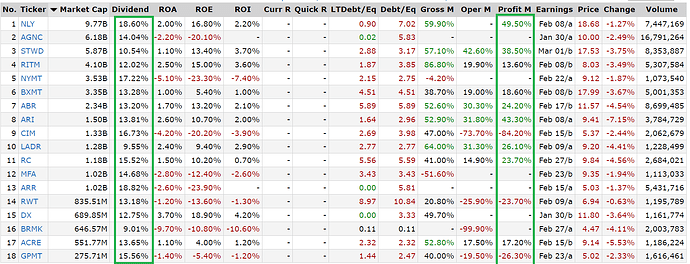

This is the largest Mortgage REIT (9.77B) with P/E 3.78. With growing rate hike and Mortgage Returns are high, potential chance returns will be attractive. Still need to do more quantitative research, but I am slowly accumulating instead of Rental home (no more real estate)

As long as company survives, this may be a better potential than Rental Home and have better liquidity, no hassle buy/sell.

I may be right or wrong!

It all depends on Dr. Doom… aka Powell. I remember the mortgage reits that crashed in 2008

The current correction is higher than 2008, but I do not know the reason for NLY (still need to research).

REIT will crash when Real estate crashes heavily mainly as both are related.

Whatever they earn, 90% profit they need to pay back to share holders, payout appx 70% they share as dividend. I have seen this REIT was 10B market cap for the last 10-15 years and this is one of the largest REITs.

You like risk. High dividends mean high risk. These are going to blow up.

RITM has been a dog for me. I am rotating out of some of the REITs into financials.

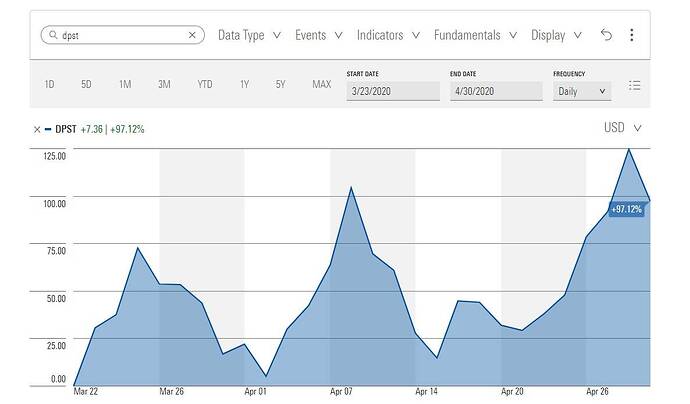

I am also doing it from SOXL and TQQQ to KRE and DPST (3x). However, do not know how DPST works going forward (very high risk).

Last time, I noticed Chip Sector crashed Oct 2022, but that made SOXL jump 97% within short time.

This DPST recently jumped from $7 to $11 with in a week 57%, and now it is back to $8.

During 2020, it is was going up and down heavily within short duration

Today was an amazing day.

The put premiums on FRC for a month out were ridiculous. Apr 21 2023 22.5 700$. Juicy!

Do not hold more than any day. Trade when you see profit, that is what I do nowadays as market may swing one day up and next day reverse (or similar).

Still high volatility, you can expect daily swings up or down, but market will be coming to an end by FED meeting or next day or some time before too.

Not really! Market is coming to an end for volatility when VIX reaches appx 34 in next 3-7 days, spx May be 125 points below current level,and then turn bullish towards 4300 to 4400 in next 3-5 months.

Nothing guaranteed, but I believe market coming to an end.

With this, I am madly getting into all dropped bank stocks, etfs… etc

Good comparison if you’re weighing passive income from REITs vs. hands-on property ownership.