Someone in user comments suggested ADBE or CRWD will be better investment.

Isn’t one of the benefits of REITs that they amortize the cost of bad tenants over a lot of properties? Unless someone owns 100 buildings in multiple places, it seems unlikely for any of us to be able to get that benefit by owning rental properties.

.

Choose tier 1 and screen strictly. One bad tenant kills your return drastically so better to be vacant than to rent to potential bad tenants.

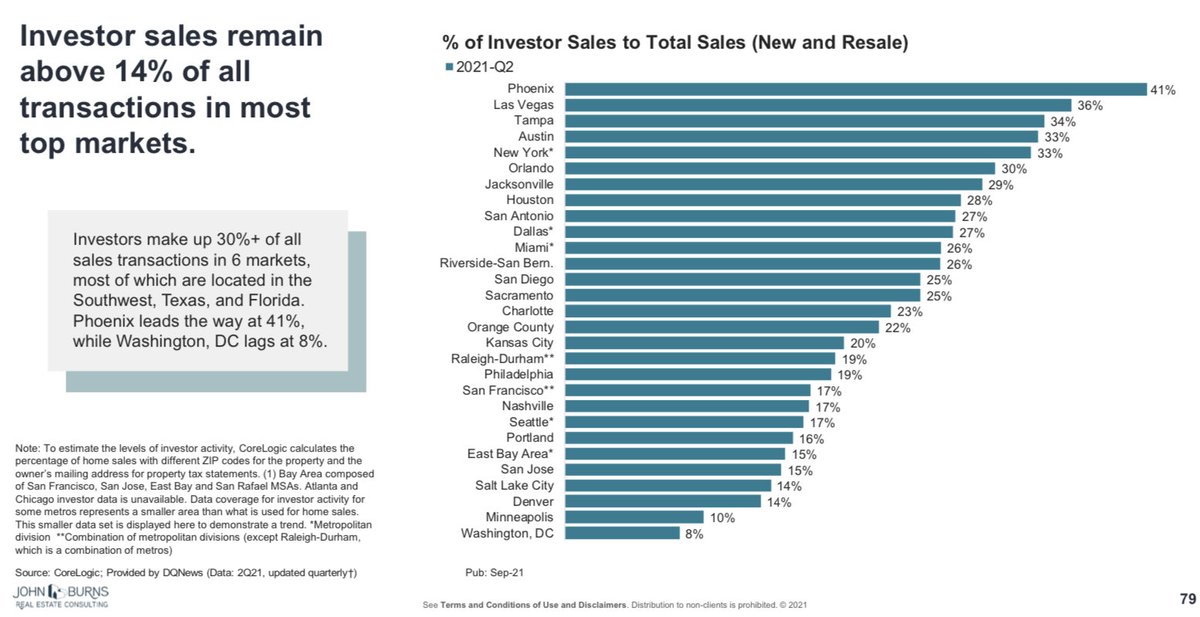

31% of Austin sales are to investors. In Bay Area investors account for only 15% of sales.

These Phoenix and LA investors are institutions, right?

Didn’t read your article, I think author is referring to downtown + nearby zip codes. Those have many investors.

Austin = Bubble?

What is explanation for so little of investors interest in bay area real-estate?

Investors chase cash flow. The BA has low cash flow due to high prices meaning high demand. Contrary to your assumptions. Meaning investing in the BA is for long term investing only. Buy and hold.

Curious how come DC has such a low sales to investors. Salt Lake City too. Thought it’s a boomtown. Maybe prices have already stretched too high compared to local fundamentals?

What can stop someone from holding property for long term where cash flows are high? You just get more from rents and less from appreciation.

Most investors never sell or 1031 to better deals . Capital gains taxes are brutal. Low cap rentals are like high growth stocks. Where as high caps are like value or dividend stocks. Personal preference. Other ways to get cash flow… refinance for instance which is tax sheltered.

Rent control? For DC

SLC - Heavily Mormon I thought. Maybe there’s a high value placed on buying a home for your family?

Huge tax advantages for owning rental properties – depreciation can quite substantial. Potential taxes on capital gains (over last 3 years - wow!) can be deferred with 1031 exchanges. Your payments from the REIT are generally regarded as ordinary income or capital gains = pay the tax man.

REIT is good for investors that don’t have large capital to invest or no time to search for rental properties.

Agree. REIT can be a valuable part of a portfolio. I love the simplicity of an REIT. And some pay quite well. Less hassle for sure! Just important to know the difference between putting money into an REIT (pros and cons) and actual investing in real estate (pros and cons). There is a reason millions of “average” working men and women have been able to raise themselves up financially through investing in real estate. For many, not having “large capital” and “no time” was not a significant barrier. But that’s another topic.

REITs are required to pay out at least 90% of their taxable income to qualifying shareholders, resulting in regular dividends. Investors can benefit from a reliable monthly income stream, which can provide financial security during retirement. Additionally, REITs offer added diversity and liquidity, as they can be easily converted to cash and typically yield higher returns than real property, making them a lucrative investment option.

Reits are like bonds. They are highly sensitive to interest rates

.

![]()

Don’t like bonds. SVB incident show that.

Prefer the real thing.

Btw, to mitigate fluctuations of bonds, investors use bond laddering and mixtures of different maturity.