Above 50/100/200 day MAs. Stock name comes secondary. I guess I am 90% Technical 10% fundamental investor.

What are the selling signals to use?

Using the MA criteria, would buy FB in early May but the sudden 20% down in late Jul is lower than the purchase price. So we need a good selling signal ![]() Otherwise, profit after holding nearly 3 months evaporated only in 1 day!

Otherwise, profit after holding nearly 3 months evaporated only in 1 day!

Note: I hardly sell my stocks. More into buy n hold rather than trading, so I tend to use long term trends. Trading is mostly opportunistic.

I have another rule - dont hold over earnings . Late July drop is earnings related. Also, another is to trade with stops. I am a control freak and cant see stocks dropping for days and be OK with it. Hence, my trading style suits my personality. To each his/her own!

Real_dreams,

Traders and buy n hold investors are totally opposite behavior.

You and manch would be good trading buddies

When you use “why try to be a hero and fight the trend?” I guess you’re a trader. Now confirmed.

Real_dreams,

Traders and buy n hold investors are totally opposite behavior.

You and manch would be good trading buddies

When you use “why try to be a hero and fight the trend?” I guess you’re a trader. Now confirmed.

Sure, classify as you please ![]() . Just don’t let these classifications make you justify a bad buy !

. Just don’t let these classifications make you justify a bad buy !

Just don’t let these classifications make you justify a bad buy

Long term bad buy is based on fundamentals i.e. if we think FB fundamentals would be deteriorating for years or worse go insolvent. Remember I held AAPL from 1997, which has many 30-90% declines. I haven’t been looking at AAPL charts like… can’t remember… very long long long time ago.

Are there indications that fundamentals of FB are going to be deteriorating for years?

Looking at charts is merely to try to buy as low as I can i.e. as big a margin of safety as I can, don’t know how to compute intrinsic value like WB, so use charts. Also can’t argue with chart much, is very visible. Fundamental analysis can be argued both ways ![]()

My thesis: The low price of FB has largely accounted for the regulatory and macro issues. I don’t know at what price would FB bottom. It doesn’t matter so long it is not in a long term decline. Below $160 is what I feel where the margin of safety is fairly good. I’m not trading with 5x margin like manch, so don’t have to worry about margin calls ![]() or trading with calls like tomato, no expiry date to worry about. So how low it goes is not that worrisome.

or trading with calls like tomato, no expiry date to worry about. So how low it goes is not that worrisome.

I don’t get how a trade war impacts FB, so what macro issue is there? The only threat is regulation. The government isn’t smart enough to do thst effectively enough to limit them. One of the senators asked how Facebook pays its bills if the site is free. Zuckerberg had to tell him they sell ads.

had to tell him they sell ads with a very robotic face.

Rgulations only help big players.

I don’t get how a trade war impacts FB, so what macro issue is there? The only threat is regulation. The government isn’t smart enough to do thst effectively enough to limit them. One of the senators asked how Facebook pays its bills if the site is free. Zuckerberg had to tell him they sell ads.

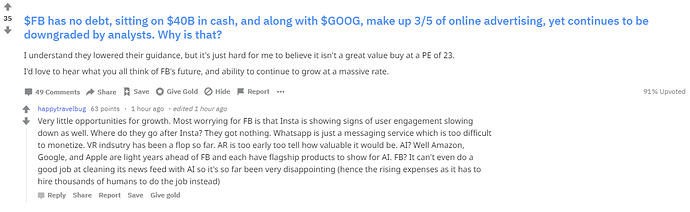

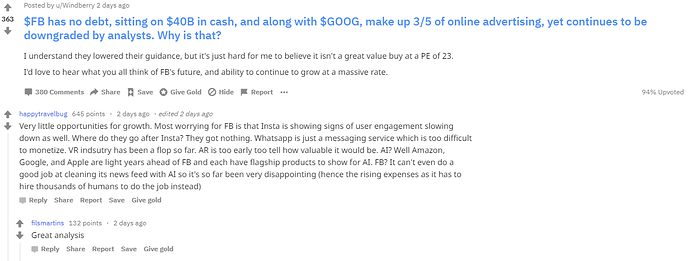

For FB, it is not trade war, but the real issue answer is here.I saw this few days before. This is why FB is not good buy now until we get clarity on their issues.

Exactly. Just look at banking. Now there’s even fewer banks and the remaining banks are even bigger. Small companies don’t have enough customers to spread the cost of compliance across.

I know how many engineers were involved in google’s gdpr. It was a big undertaking, too many different tracks for compliance. Hard to see that cost to be shouldered.

This guy makes nonsense about AR and VR, and talks about AI and how behind fb is of google.

FB’s real value is their user engagement. Sure main app is stagnating, but instagram and whatsapp are full steam. Whatsapp is not even monetized yet…

I’ll bet on Zuckerberg to figure it out. Look how fast they monetized mobile. It wasn’t even a thing, and it quickly became the majority of their revenue. Everyone said mobile would destroy them and now they dominate it.

When you have millions of hours of user time per day, slapping on a stupid banner ad anchored to bottom would make billions a year, right off the bat.

I’ll bet on Zuckerberg to figure it out. Look how fast they monetized mobile. It wasn’t even a thing, and it quickly became the majority of their revenue. Everyone said mobile would destroy them and now they dominate it.

When the road is free (Uncontrolled flow), we can drive at 120+ mph,but we can not do the same at peak-hour traffic (Controlled)

When there is no control on their website (free for all), easy to monetize. When it is controlled by multiple governments (Restriction in place), growth is measured.

People are buying future growth in the current price as premium. When FB’s Future growth is changed (already Mark declared reduced returns i.e., not profit margin 39.3%), the valuation changes that will eventually reflect in the current price.

Without knowing exact Margins, the current price slides and will come to lowest range (well below actual value) by market over reaction. When this happens and someone picks up at that time (which no one really knows), they will maximize the returns.

For example: Last time, when TSLA was below $300, on the day of results, I bought (near lowest at that time), but I did not pick up recent times even though it is less than 300 now.

IMO, blind buy will be good if you buy at any price and hold for 10+ years like WQJ or our bay area real estate.

But, measured or some calculative decision will get us max ROI.

I have limited amount, I always like to maximize my ROI by selectively choosing the stocks and trying to catch the falling knife ! That is my way !!

See the update today shows 94% of the people upvoted (Means high public consensus) that gives better reliability. Some of them are well experienced financial analysts working on their own stocks

The current pe is at 20. fb’s growth is not very limited, cpm growth still has room. the risk is at macro scale with retail etc dying, and amazon eating some of both google and fb’s lunch. Still not convinced, though.

I am curious:

- When fb will monetize whatsapp?

- Whether it’ll buy any video apps coming out lately (Some of which are chinese origin).

- How well is monetization of stories going

- Their off-platform solution, fan. This is where they’ll have a lot of competition with google. Off platform is where the money is at after user engagement stagnates. The downside is off-platform gives more than 2/3 of revenue back to publisher, and context about what user is doing is limited.

- There’s a whole world of games which interestingly FB has not fully unlocked.

WhatsApp monetization should be full steam ahead now that those feet dragging founders are gone. When you have a billion users it’s not hard to make serious money.

There are 7 apps that have a billion users. FB has 4, 10c has 2 and the last one belongs to the hottest Chinese unicorn: byte dance. Yes, FB is weak on short videos which is all the rage in China. Not sure byte dance wants to sell. They are the hottest in town right now.

The IG ecommerce push makes a ton of sense. Many small time merchants sell on wechat so FB can always copy that into WA. Tons of vectors they can pursue.

Technical re-bounce over? decline resume? Bear market started?

If bear market started => RE market leads? Normally is stock market leads RE market. Many smart guys in the know?

Thought you are an investor who doesn’t care about short term market movements?