My profit is worth more than graduation ! ![]()

Well investors’ idol WB has close to 2B worth of GM stock.

He also bought quite a bit of oracle which I don’t see anyone here following.

I understand WB’s GM hold as they are moving to EV cars and dividend producing company.

Regarding oracle, it must be Larry Ellison as they may want to be inside his kingdom as a board of director. This will give them edge to invest more in Tech companies. I do not really see any major reason.

No.

They’re all truthful numbers so should not be hard for me to repeat with the same response in the future

First is GS, now is MS,

The Worst Is Yet to Come for Stocks: Morgan Stanley

2018 started off with massive tax cuts that inflated earnings but failed to boost stocks. Now that the positive impact of tax cuts on profits is waning, investors are getting what Morgan Stanley calls a “reality check.” That reality is that, as earnings are revised downwards, stocks are sure to fall as well.

Why are investment bankers want to drive down stock prices?

Investment professionals need ways to offer their clients – be they individuals or institutions – the right balance between risk and reward. CME Group helps them manage risk and capitalize on opportunities across major markets worldwide,

That’s it. Santa Claus rally is cancelled.

I hope stocks drop like a rock and flush everyone on this forum out of the market except me

How does it help you when you don’t add?

Do the opposite of what these guys tell you.

I hope stocks drop like a rock and flush everyone on this forum out of the market except me

Not me too ![]() I am with overall 28%, when it reaches 10%-12%, that is it, sale !

I am with overall 28%, when it reaches 10%-12%, that is it, sale !

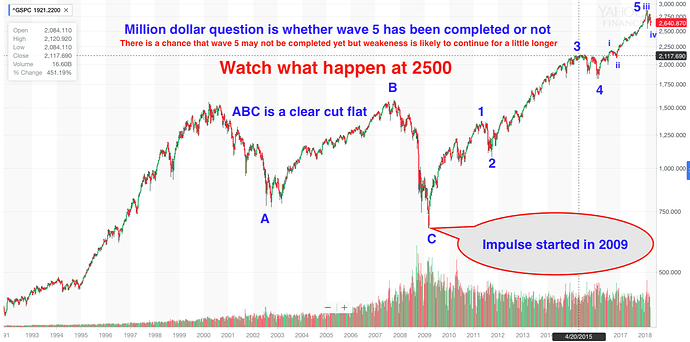

Realize haven’t update for awhile. The answer to the chart below (posted on Mar 30) is it continued to rally till completion of 5. Now the million dollar question is we don’t know how low it will decline because not sure what is the degree of the EW corrective wave. Could be years but for short-term traders and most of us, is irrelevant ![]()

Using VOO instead of SPX or SPY… have been buying VOO as the market sinks ![]()

Explain in simple english please… Are you saying this is a DCB?

.

Explain in simple english please… Are you saying this is a DCB?

Clueless because I am not sufficeintly skillful to conclude but I see a few possibilities, depending on what $268.02 signifies:

-

Completion of 5.i. This is the bottom and 1-2 years of rally.

-

Completion of 5 of Cycle I. Not bottom yet but after bottom many years to a decade of rally.

-

Completion of 5 of Cycle III. Range bound for a few years, follow by many years of rally.

-

Completion of 5 of Cycle V of SuperCycle I or III or V … bigger variations of 2. & 3 … too complex to discuss.

For those who are DCA purchasing of index such as S&P like VOO or VFINX or VFIAX, really doesn’t matter. Just continue.

Btw, scenario 4 is a depression scenario, we’re not expecting that right? Black Swan?

The stock market is likely to remain highly volatile, but the economy is unlikely to fall into a recession and that makes it a good time to “buy the dips” again when stocks fall, said Jim Paulsen, chief investment strategist at Leuthold.

“If there’s no recession, to me it’s a buyable correction. They don’t tend to get super deep and they tend to reverse. The whole key is the recession,” he said in a telephone interview.

I hope stocks drop like a rock and flush everyone on this forum out of the market except me

So, did they get flushed? ![]()

Buy baby! Buy!

Oh! Never mind! You don’t like the beauty of indexing as I told you in another topic. ![]()

Almost  only @manch left with Amzn and @hanera left with Apple. Market didn’t drop steep enough. Another 20% drop will flush out even those two.

only @manch left with Amzn and @hanera left with Apple. Market didn’t drop steep enough. Another 20% drop will flush out even those two.

Any plans?

Selling stocks? Getting out?

Or you will apply the “stay your ground, it will rebound”?

Scenario 1, 2, and 3 are all bullish.

The outlier scenario would require that the current system breaks down and a new system is constructed. The decision makers are invested in keeping things going. They will modify and adjust the rules. Can’t worry too much about a new system because if that were to occur, anyone who has, will have it taken away from them.

Market bull Tony Dwyer sees record upside ahead – after one more painful…

Tony expects scenario 2.

Chart suggest market correction will last at least another six months

Another scenario 2.

IMPORTANT: Make sure you can stay solvent

The BoA guy talked about the secular bull market we are in right now, and the bear markets in 2011 and 2015 that everybody forgot about. Also the importance of 200-wk MA.