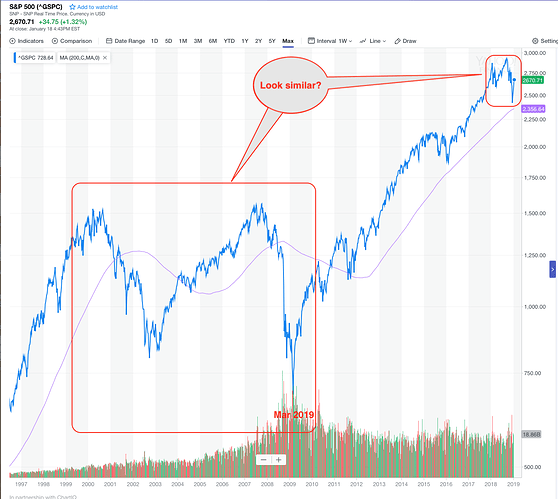

Update … Can VOO scale above the 200-day SMA to give scenario 1 ($268.02 is 5.i) an 80% probability?

Secular bull market is awesome.

Time to BTFD.

Do you foresee secular raise or like once again dipping this year? I just want to prepare myself ready in case it goes down.

Index seems to have one more push up before recession kicks in.

Individual stocks depend. Some doesn’t seem that good e.g. NVDA, doesn’t look that strong.

Larry Fink, chief executive of world’s largest asset management firm, BlackRock Inc., says that the stock market has probably put in a bottom but that for sentiment to take off, the U.S.’s spat with China on trade needs to get resolved.

Who doesn’t know this?

Fink said he believes that in the short run markets have “hit a bottom” but the trade talks and the outcome of the U.K.’s contentious negotiations to exit from the European Union, known as Brexit, will determine how equities perform in the longer run.

Who doesn’t know this?

Anyhoo is good that a big guy says it in public.

Stock insiders love to manipulate market…That is how they get bargains when others panic.

The many technology companies in Davos — Facebook, Google and Amazon among them — may also want to take note of Mr. Klarman’s anxiety that “more and more people are choosing to only seek out information from those who share their views” and his blame that “technology and social media have made it increasingly easy to do so.”

Sell FB, GOOG and AMZN?

Whether a crisis is around the corner or still years away, Mr. Klarman seems relatively convinced that it is coming and that it will manifest itself not just in a market downturn but potentially in more violence as well.

“It is not hard to imagine worsening social unrest among a generation,” he wrote, “that is falling behind economically and feels betrayed by a massive national debt that was incurred without any obvious benefit to them.”

Migrate? Or no escape?

Is it only a political piece instead of investment advice?

“In the 2016 Presidential election he gave the maximum donation of $5,400 to Hillary Clinton’s campaign, stating that “Donald Trump is completely unqualified for the highest office in the land.”[26]

After the installation of U.S. President Donald Trump, he released a highly circulated (but internal) letter to members of his fund that denounced the upcoming investing climate.[30][31][32] The letter states:

Exuberant investors have focused on the potential benefits of stimulative tax cuts, while mostly ignoring the risks from America-first protectionism and the erection of new trade barriers. President Trump may be able to temporarily hold off the sweep of automation and globalization by cajoling companies to keep jobs at home, but bolstering inefficient and uncompetitive enterprises is likely to only temporarily stave off market forces.[33]”

The irony of talking about new trade barriers when trade barriers have been removed in multiple areas with more favorable terms for the US. Now the last piece is a trade deal with China.

Testing 50-day SMA. Holding ![]()

Above 50-day SMA => in short-term uptrend.

Below 200-day SMA => in long-term downtrend.

So, everybody is watching the 200-day SMA.

Greed is making a serious comeback on Wall Street

The Nasdaq is up nearly 10% on the year. The S&P 500 just celebrated its best January in 32 years.

Consolidation (decline < 10%) due? Correction (10% < decline < 20%) due?

How many people plan to move to cash with the run up vs ride the market? I am thinking of selling the rally to move to cash as I think we are probably headed for a recession in 2020/2021…

That would be a self-destructive move, in my opinion.

10x portfolio : Have been selling into rally, now 1/3 cash. 22% ytd is less than target 27% but just want to play it safe. Plenty of time to get 5% … 11 months to go ![]()

Option trading portfolio: Bet earnings & immediately closed post-earnings. Considering selling L20 calls soon.

AAPLs & index: Sleeping on the wheel

I will move to cash - all soon within 3 weeks as I reaching YTD 10% (now 9.2%), more than enough for me. Greediness kills !

Bears and bulls can make money. Pigs are slaughtered at the trough.

Chinese (aka Lunar) New Year is 2mrw. Too early to slaughter ![]()