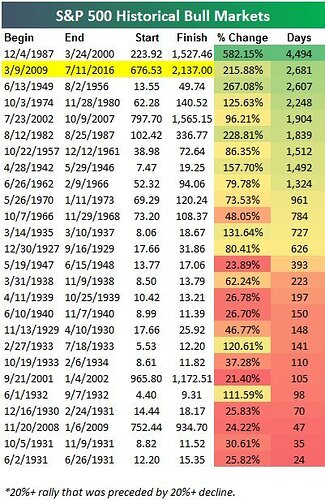

I think this bull market will become the longest of all, beating the 1st Clinton bull market.

Demographics is on our side. Working population starts growing again. Millennials overtaking the boomers, so more people making money and more people will spend.

I say this bull market will last for two more terms of Hillary. 8 more years to go!

Bull market continues.

Make tons with VINIX by doing absolutely nothing.

Haven’t bought anything for the last month or so, and gradually tightening my stops. Now that Trump is the top dog I see more risks. But I will just ride it as long as I could. My working assumption is always that I can easily be wrong. I can easily be wrong to be optimistic, and I can easily be wrong to be pessimistic.

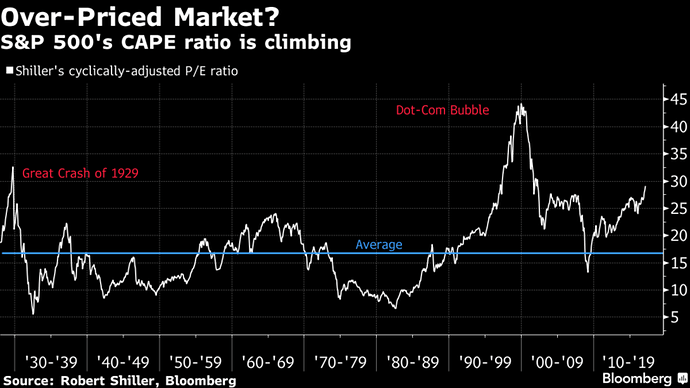

Shiller’s take:

Even if he’s right, that chart says the market can go a lot higher before the pop. We all know there will be another recession and 20%+ market downturn. The magic question is when. If we knew exactly when, then it’d be easy to get rich off of it.

At least one of my partners having an indexed life insurance is getting upwards of 17% returns on his policy of $50K a month. Good for everybody once they know where to cut and run. Any deferred program out there, be this 401K, IRA, etc are enjoying good returns, and so their brokers with their 24+ charges.

Otherwise, get ready! It takes you double of what you lost plus something more to get even in any recovery.

By the way, the cookies followed me to this video with “Treehouse”.

hard stops or soft stops? The market is likely to end with a thump so stops won’t save you from losing a lot when it happened. of course, it may still be higher than selling now.

Agree with marcus, unless you can get the time almost right, is BSing.

Shiller has been questioning the rally for years. Not saying he’s wrong, just that his position hasn’t changed lately.

I’m always surprised at how much attention is given to trying to time the market and pick the hot stocks on this board. Both are sure-fire ways to lose money in a market that’s been going up for over a century.

To have success in real estate you generally need to use leverage and try to cherry pick. That kills lots of stock investors. And investing based on who the president is and what he said today or yesterday is a one way ticket to financial oblivion.

I agree. But, remember, somebody has to sell something. That cough medicine of the past centuries is still sold in the market, under different names but still used, be this real estate, stocks, insurance, etc.