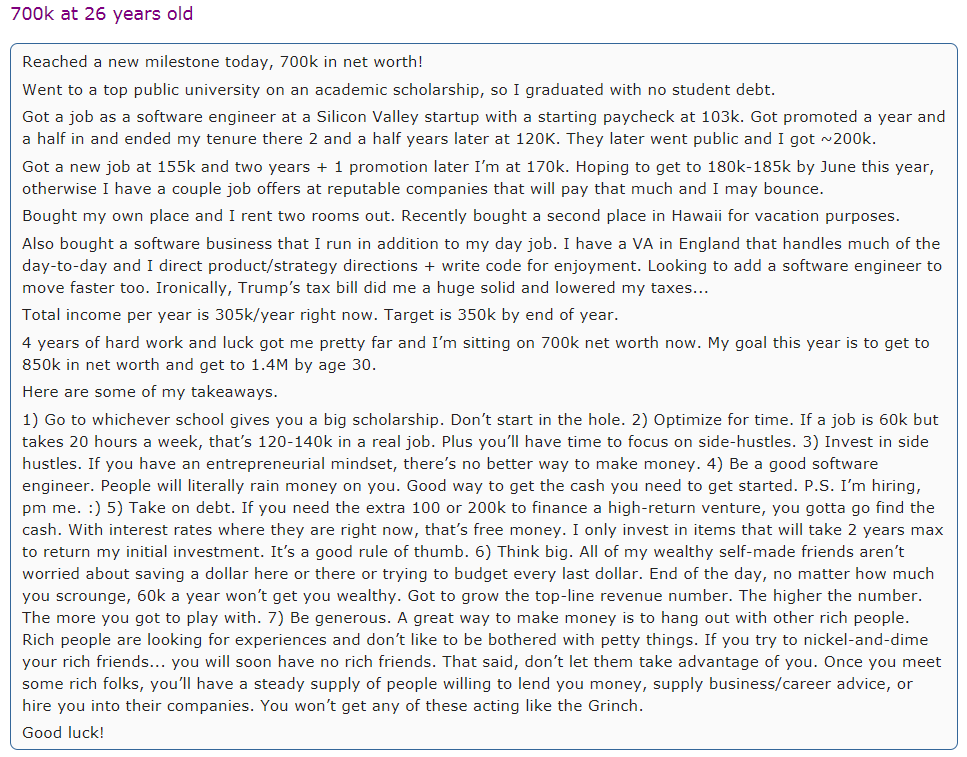

Copied from reddit, before it is getting deleted (normally original poster delete it after few days)

One of his big idea is to hang out with rich people. As a hard working software engineer who has a side software business, how can he find and hang out with rich people?

Also he emphasized borrowing. Did he borrow a lot of money for his software business? Other than his mortgage, I can’t think of a reason he needs much borrowing.

But his story seems to be real.

Automate. He doesn’t have to code much, does he?

Also getting to 700K/year income as a SWE in one of the FANG is not hard, very doable in 5-6 years total.

His wage income is 170k. His networth is 700k.

It’s much harder to have a 700k annual income than 700k networth. I know quite a few SWE, not a single one makes 700k a year. I think it’s very hard to make 700k a year from salary and RSU.

Correct, my mistake.

I think the thing that he does nicely is - he’s starting a business, and after some point, this will become a “passive” income, or more-or-less-passive income. That’s the more important part to me.

I make a good amount, but i work for it. His way is more sustainable, and less stressful

Yes, his side business makes more than his job. You can buy 10 rentals in Vegas and 10 rentals in Sacramento and enjoy some good passive income as well

I should get into this. I have too much in stock market…

REIT also works to get good passive income, much more passive than rentals. I think capital gains can be even better passive income if you are good at stocks.

I am OK with stocks, but never been in a bear market yet, so by definition, everybody is good with stocks these days.

But I tend to not hold long term, so for me capital gains are taxed at active income rates.

The problem with reit is you cannot get leverage, no?

REIT usually gets mortgage so it’s leveraged, usually at 50%. You pay for the overhead, but I assume the overhead is small with big REITs

Most of the reits i looked at don’t show anything near the returns of a leveraged US property. Can you point me to an example?

You can leverage on REIT by going into margin. My margin interests is 1.6% so if your REIT is returning 8% a year you are still making 6.4%.

Time to reveal my real intention for making this site. I want to meet rich people. Any of you guys rich?

First give your definition of the rich.

This article says the optimal leverage for REIT is 25-40%

http://www.investmentnews.com/article/20090809/REG/308099972/how-much-leverage-is-too-much-for-reits

Rich means networth of at least $5M x Number of people in your household.

I am poor by this definition, nice to have met you, kthxby.

Can you post an anonymous poll on how many are rich here? Better to get a distribution of networth range. I did a poll on overall LTV a while ago

Nah, nobody wants to reveal how much money they have. I am not rich either. Nice to meet you guys.