Do you avoid investing or flipping properties in an HOA or are you able to work diligently within their construction/remodeling hours and guidelines?

I hate HOAs, they are like another layer of government and costs. Makes remodeling harder and nosy neighbors can be a pain. I have never flipped condos. That is a specialty area. Start with sfhs less headaches

Now that Phoenix is over 100 by the afternoon half of them are piling into Payson, Pine and Strawberry where we aren’t locked down anymore. I’ve never seen the Beeline so packed.

I talked to my boat mechanic in Tahoe. He said it is his busiest season ever…I tried to go to HD Placerville. Huge line

This house came back up from my Redfin fav.

https://www.redfin.com/AZ/Mesa/804-S-Tobin-Cir-85208/home/28210971

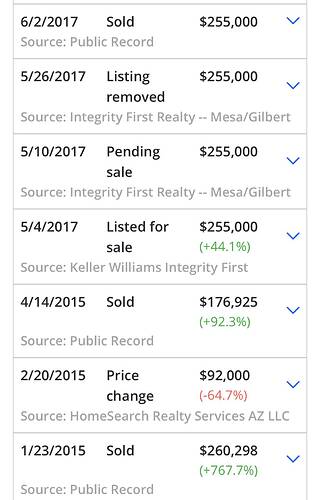

176K (2015) -> 320K (2020)

That’s pretty good appreciation. In contrast, Austin house I bought in 2015 changed from 220K -> 275K today only.

Probably the price of homes in Phoenix dropped much more than price of homes in Austin during 2008 crash. I heard homes in Phoenix Metro were selling for 60 K in the worst times in some areas.

Why was the house sold for $177k shortly after buying for $260k?

Correct comparison is $260k (2015) to $320k (2020) asking.

Austin appreciation is crappy??!!

![]()

Any chance it could be a related party transaction.

Yea not sure about that. But here is one more, not dramatic as that one but still, 184K (2015) → 265K (2020)

https://www.redfin.com/AZ/Mesa/10944-E-Catalina-Ave-85208/home/27773077

Appreciation rates in different zip codes in Austin vary, some are slower (78660) and some are faster (78759) than quoted Phoenix.

Austin appreciates slowly and steadily. If you look at the last 20 years or 15 years, I think Austin might be comparable to Bay Area. should be much better than Phoenix

Austin is cheap because of low appreciation. If it goes too high it will be less attractive. Phoenix has better cap rates. It also is attracting boomer retirees. Good short term play. I only invest in development in Phoenix. I don’t have to worry about long term. California is driving a lot of people into neighboring states. I have invested in Texas short term also. Like most places with low appreciation the big money is on development not long term hold.

Is not what @Mortgage4Rentals meant by…

It meant, the average yearly appreciation of BA is similar to the “slow” yearly rate of Austin for the past 15-20 years. @BAGB had shown some charts that indicate this. Prices in BA are volatile instead of a steady appreciation like Austin. Remember past 15-20 years.

From 2006 to 2020, Bay Area median price up 25%. Austin price probably doubled in the same time frame.

Of course if you bought in 2011, Bay Area would be much better.

Bay Area is a high beta area and timing is important.

Homes in metro Phoenix that dropped the most in price in the 2008 recession were starter homes almost in the exurbs, far from the urban core. I heard the motto back then was “drive until you qualify.” Non-starter homes located in close-in established suburbs should withstand a recession much better.

My Belmont house was bought in 1982 for $145k. Now worth $2m. Austin isn’t even in the same universe. Palo Alto houses that were $20k in 1970 are $3m now.

Appreciation in 90% of other areas have never seen anything like that.

Some find it hard to understand above statements.

Usually, recent trend is more relevant than past trend ![]()

Thinking aloud, how many here started investing in RE earlier than 2005?

I started in 1976. My grandfather in 1935. California is unique. Especially the BA

The reason other areas are cheaper is because they have had less appreciation.

Nobody can predict the future. But California and the BA have unique qualities that can not be replicated in Austin. Weather, and a coastal location primarily

It’s true Austin appreciated better than Bay Area in the last two years. But zoom out a bit it’s not even close.

The two curves met in 1987 and then in 1996. But as the Internet turbo charged the Bay Area economy its home prices just shot to the moon.

You can play with the data here:

Here’s the chart with Phoenix added:

You can see it had a crazy bubble from 2002, peaked at 2006, crashed and gave back all the gain since year 2000. Afterwards its appreciation rate is pretty much the same as Austin.