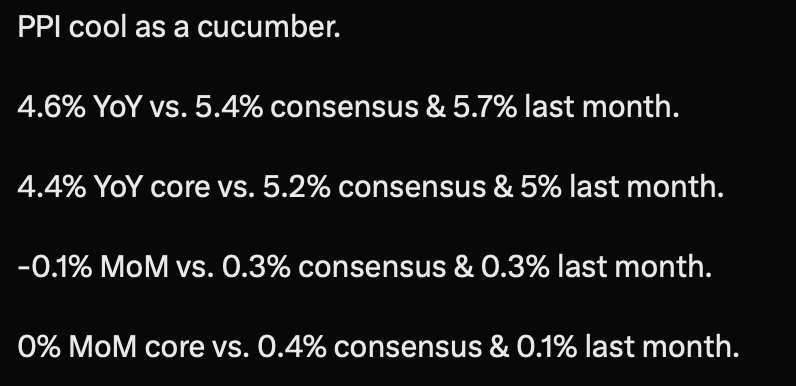

It is truly amazing that Powell is willing to take out the banking industry, the stock market, emerging markets, the RE industry at 4.5% inflation.

Volcker did it at 15% inflation. He is trying to be nastier than Volcker… totally unnecessary.

Meanwhile the people have spoken. Covid has made people want to spend like there is no tomorrow. To hell with hair shirt Powell. People are getting paid $200/hr to shovel snow in Tahoe. They are going to spend it. Lifts and restaurants crowded. The roaring 20s. Let the good times roll.

Being “nastier than Volker”’ would involve raising rates to in excess of 20%. 4-5% is consistent with the long term average - not a restrictive rate at all.

This is much needed in the USA if we want to save US society from crumbling. The cost of living in US has become unsustainable and a huge reset in all asset prices is needed whatever consequences that may have on the asset holders. Anyone denying this fact is delusional. Powell is doing the right thing assuming that he means what he says.

Raising rates from 4% to 20%, like Volker did in the 70s, price of money went 5x.

Powell raised rates from 0.1% to 4.5%. Price of money went 45x.

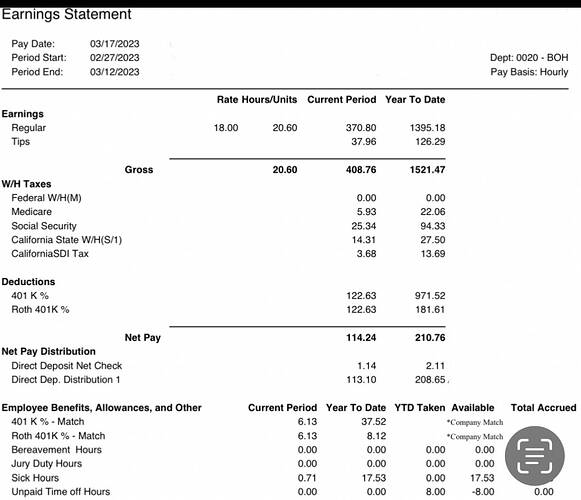

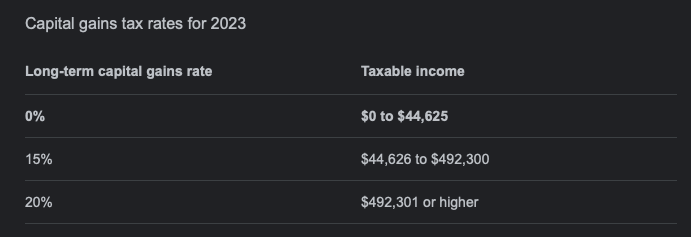

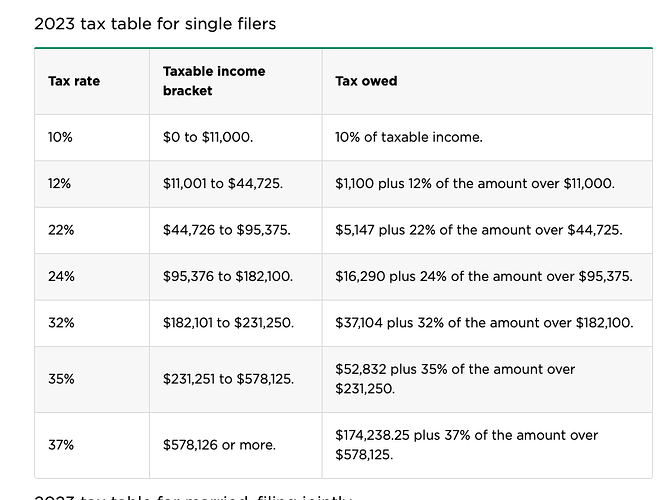

…sigh…I remember being a wage slave. Now that all my income is passive I pay maybe 11% fed and 2.5% to AZ on annual income that exceeds what I made much of my working life. I paid double and sometimes triple those rates on money I actually earned. The system chews.

.

Passive income? Shouldn’t it be either 0, 15% or 20%? Dividends are taxed at LTCG rates.

Active income tax rates…

There’s deductions plus exemptions on the first 40k or so. Reduces that 15% rate to about 11%.

.

My computation shows your net take home is equivalent to those active income earners in the 32% tax bracket. You play the game right ![]()

Thankfully that isn’t yet applying to those blue snakes I breed.

https://www.morphmarket.com/us/c/reptiles/colubrids/more-colubrids/1468891

Wage spiral! Just not for SWEs. Given layoffs by tech companies and rise of ChatGPT, going forward, salary of SWEs would be pressurized… may have peaked.

I have the opposite prediction. We may need fewer number of SWE’s, but the SWE’s that have unique skills will get paid even more. ChatGPT will make a 10x engineer into a 100x engineer. Productivity rise means salary rise.

Remember Instagram only had 13 engineers or something when it was sold to Facebook for 1B? A future Instagram may only need 3 engineers. Fewer number of people to share the bounty means each will get a bigger piece.

.

That is not an opposite prediction. When I utter my statement, I am well aware that you have said your prediction few days (can’t remember exactly) ago. Timeframe context is different. Whenever a new tool is introduced, those who know how to use it effectively will get higher pay… through time, more and more people know how… salary will revert to the “mean”. Anyhoo, you selectively cut off my earlier part of the sentence… what I am saying, ST there will be a good supply of SWEs which should bring down the salary of SWEs… previously, there is a “shortage” of SWEs because of talent hoarding by tech companies. LT… many developments can happen… hard to tell.

Btw, not many companies require 10x SWEs, 100x???, only need 1xSWE. So say with ChatGPT, increase competency by 50% i.e. original 1xSWE becomes 1.5 SWE and 0.67 SWE would become 1 SWE. Since these companies require only 1 SWE, they have an increased pool of 1 SWE to choose from, bringing down the salary of SWE.

Since there are many more 1 SWE than 10x to 100x SWE, the average salary of SWE would be depressed.