Be careful. Jack Welch got canceled for saying that about unemployment numbers before Obama’s re-election. He was later proven right, but the narrative never changed.

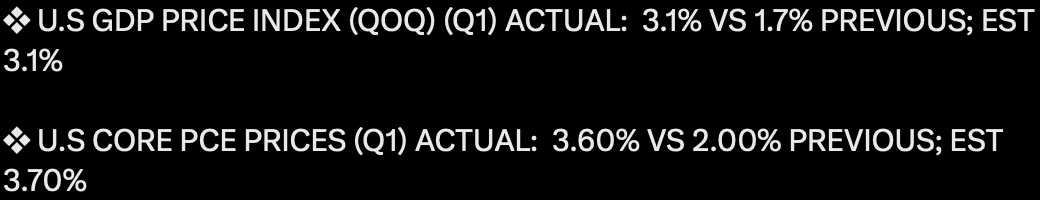

Hotter than expected.

Expected first rate cut would be in Jun or Jul. No more Mar or May.

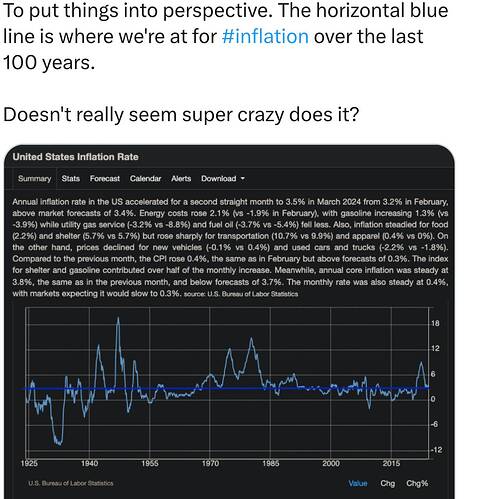

We’ll be below 2% by August or September. That’s how these things work

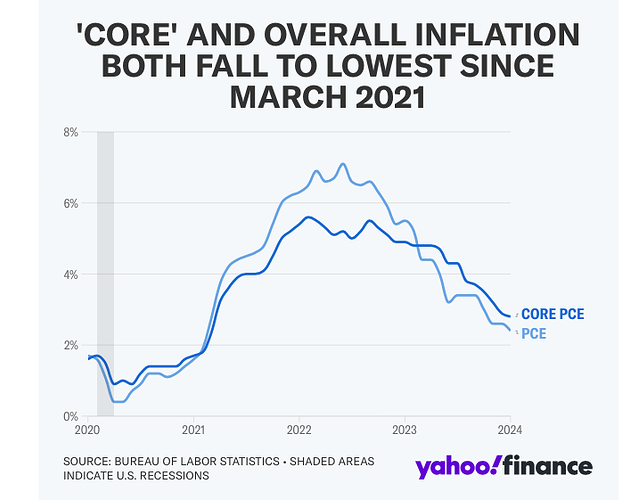

CPI YoY 3.2%, expected 3.1%

CPI MoM: 0.4%, expected 0.4%

CPI core YoY 3.8%, expected 3.7%

CPI core MoM 0.4%, expected 0.3%

https://finance.yahoo.com/news/us-wholesale-prices-picked-february-124217277.html\

The Labor Department said Thursday that its producer price index — which tracks inflation before it reaches consumers — rose 0.6% from January to February, up from a 0.3% rise the previous month. Measured year over year, producer prices rose by 1.6% in February, the most since last September.

Now there’s this.

Economy is already cooling?

Or it was never as hot as it seemed.

If rental renewal (on par or reduced) and crowd (visibly less) in restaurants are indicators, consumers are feeling the impact of inflation.

Deleted; bad link

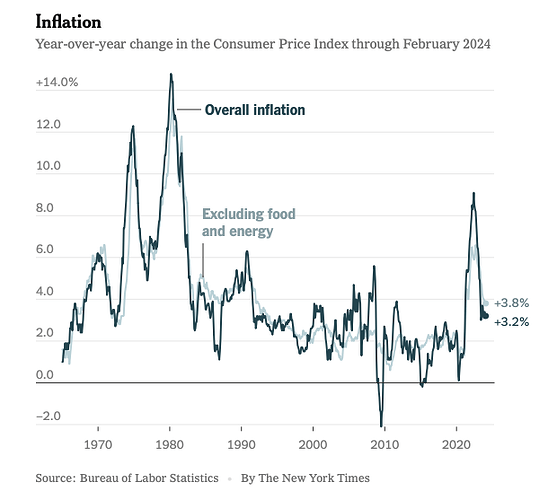

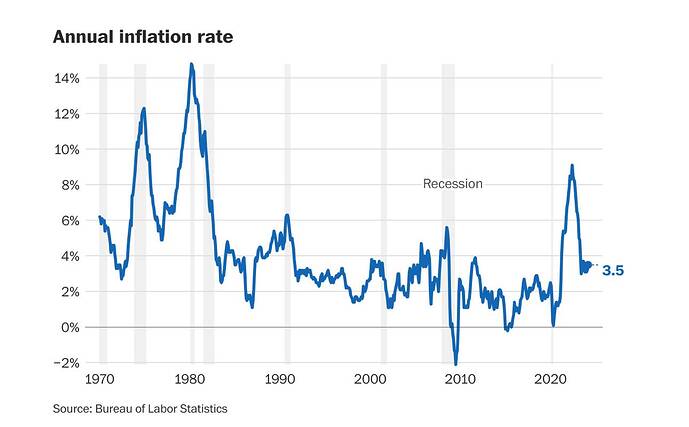

CPI YoY 3.5%, expected 3.4%

CPI MoM: 0.4%, expected 0.3%

CPI core YoY 3.8%, expected 3.7%

CPI core MoM 0.4%, expected 0.3%

PPI (mom) 0.2% vs est 0.3%

PPI (yoy) 2.1% vs est 2.2%

Core PPI (mom) 0.2% vs est 0.2%

Core PPI (yoy) 2.4% vs est 2.3%

Producer Price Index News Release summary

The dollar is soaring today but so are gold and silver.

Weird.

A massive gold rally in the face of rising interest rates is also weird.

…to which I might add oil is also up strongly. The only thing which, at least in the short term, triggers a flight to both the dollar and commodities is a terrorist attack. And there are always people in the know front running it.

Even the rental inflation problem itself isn’t particularly broad-based anymore, geographically: There’s a big difference between the situation in the Northeast and Midwest, where high inflation is lingering, and the West and South, where it’s moderating rapidly.

In the Northeast and Midwest, rental inflation is not even a quarter of the way back down from the peak to pre-pandemic levels. In the South and the West it’s more than half-way and almost four-fifths of the way there, respectively.

The difference seems to be all about supply.

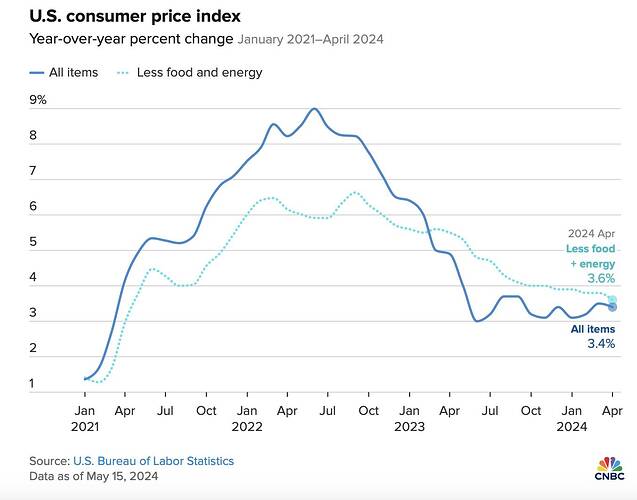

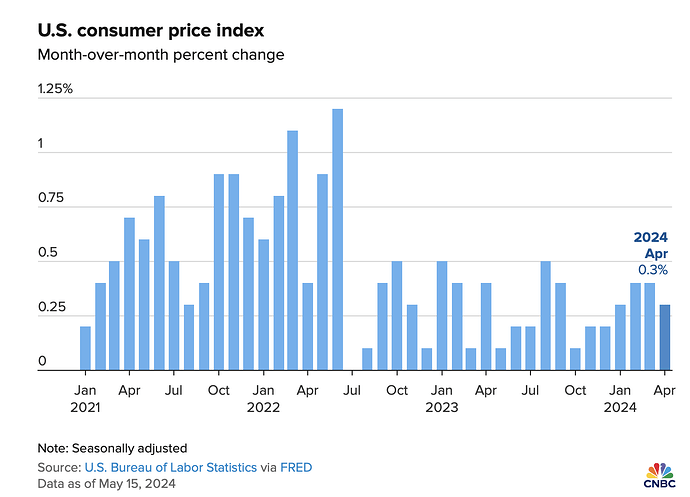

May 15, 2024

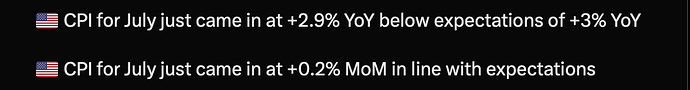

CPI YoY 3.4%, expected 3.4%

CPI MoM: 0.3%, expected 0.4%

CPI core YoY 3.6%, expected 3.6%

CPI core MoM 0.3%, expected 0.3%