The problem is that with American education you become limited to US corporate system and than it practically hard to join any European/Russian/Chinese firms. they also paying and training well in fields not related to Software.

we need help of Canadian to make GG bridge quieter. I am sure more complex projects more dollar printing and international help will be needed.

Inflation trend is just starting. if you keep buying $3m home. prepare to pay $50k for insruance.

$50K Tesla already approaching $2k insurance and $1K registeration renewal.

Will be interesting to see what happens with fire insurance where I’m at. On the one hand authorities here do a fantastic job of protecting property. On the other hand losses elsewhere might affect our rates.

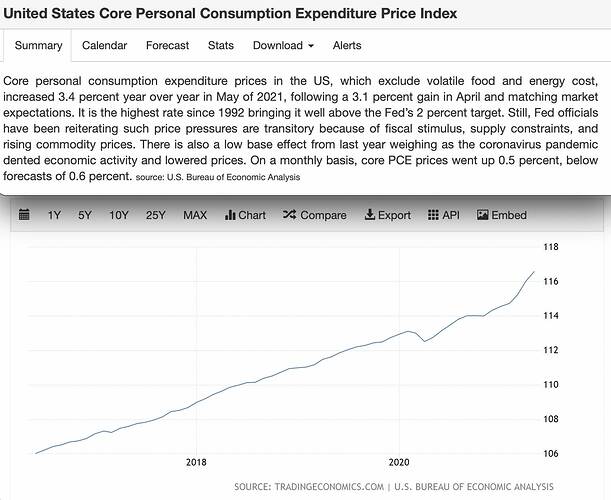

Enjoy 4% transitory inflation.

It is curious case of Audi A8L price for China. It sells for over $100K in SF bay area and most dealers not have it on stock. here for China they pricing it at $58K if my calculation is right. offcourse they will add customs for retail but US prices should not have any customs beyond some nominal fees.

The same is happening with Fab prices. They seems far lower in Europe.

Milking US customers because they can pay for it. Nothing wrong or illegal about it though. Only shows pricing power of Audi.

Chinese customers who buy this type of vehicles are also very wealthy but somehow Audi or Germany is not gouging it.

26 fold increase in profits. while European ones is 4 fold. The inflation will continue as monopolies are created.

Real inflation appears be closer to 7-10 %. Basically, average return from stock market is just keeping pace with inflation.

Lumber crashed thru $1,000 two weeks ago and kept on falling. Now at $774. Was at $1,700 back in mid May.

Interestingly growth stocks like Cathie and Tesla bottomed in mid May when inflation panic was at its peak.

My COIN GBTC ETHE holdings are green  Inflation scare is back?

Inflation scare is back?

Ofc, is Cathie.

Apparently inflation scare is back.

Time to hedge inflation?

TIPS

Gold

Silver

Crypto

RE ofc ![]()

AAPL ofc ![]()

As market participants cheer the evidence that industries like lumber and automobiles are moving past their bout of transitory inflation, we should turn our attention to the slow-moving ship that is the rental market. A rise in rents, which may accelerate in the months to come, could lead to a new, less-transitory kind of inflation for the Fed to deal with in 2022.

Inflation!

Rents were down though, so going back to prior level isn’t inflation. They need to make new highs.

Rents are much higher in Tahoe. But I listed on Facebook market place and got a lot of hate from entitled locals who believe that landlords should subsidize their laid back lifestyle with cheap rent. How about cheap food, utilities and low taxes too?

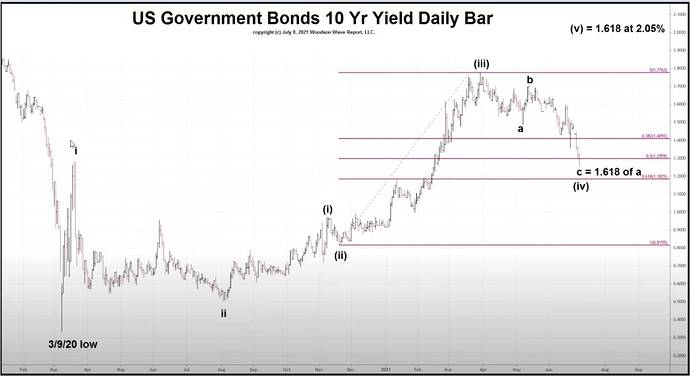

10Y Treasury below 1.3%.