How do you feel about this?

Stocks are never a sure thing.

If he’s so sure about the 8% compounding interest then he should cash out refi and keep the condo. Best of both worlds. End of story.

8% is long term, if he’s talking about cashing out now on the home, maybe he’s not as long term.

Realistically speaking, stock market has a higher chance of going down than up these days.

Also bay area RE appreciates 7% or more on long term average, and with this he has mortgage leverage too!

He has said “I am not sure what to do…” He is right, he does not know. All he has to do is just hold it as long as he can.

The simple fact is “hold the home, bought before 2011, as long as anyone can”. Since he is in PA, his cash flow cap rate is low around 2% or 3% (His calculations are not clear). But still his growth (appreciation) is more. Over time, cash flow will increase, make him FI.

I asked him to visit the forum. He will come here and get benefited.

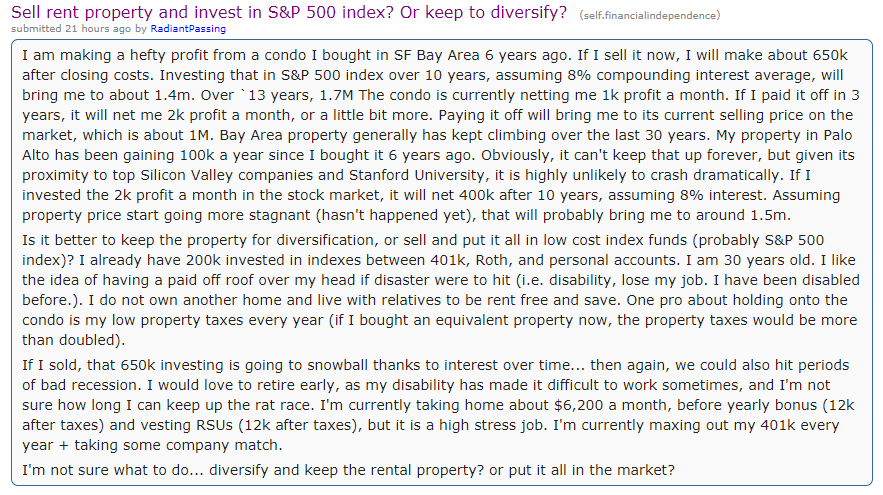

Original reddit poster here. Why is your thread title so insulting? That’s really uncalled for. I am a young person recently begun to be a landlord in the last 6 months and debating my options to best optimize for early retirement and to have a safety net in case I become disabled again. Someone being young and new to investing and asking for advice doesn’t warrant mocking them in a thread title.

Hey, not the person creating the title. Dont’ take it as insulting, he didn’t mean to. Here in the forum we are talking about different investment vehicles. we have both stock bulls, and real estate bulls, sometimes it intersects in one person (@wuqijun), sometimes it does not (@Elt1).

Welcome to forum, and don’t take us too seriously. we are a bunch of folks with different world views.

I think Jil meant “uninformed” or “under-informed”. Jil is a long-timer here on the forum and he is not the insulting type. It’s probably just a language thing.

As for your choices, it’s all about your faith on the bay area real estate market, especially in the silicon valley, as relative to the strength of the US stock market. You already said that it’s unlikely for your condo to lose value dramatically, so for downside protection you already agree that the condo is better than stocks. As for the upside, bay area real estate historic return is very decent compared to stock market returns, and combined with leverage from a 75% mortgage with a nice 30-yr fixed-rate loan at historically low interest rate, it should only do better than the stock market.

To get exposure to the stock market without having to sell, as harriet said, you should take as much equity out as your situation allows and invest the proceeds into the stock market or whatever you believe in. That way you get the best of both worlds. The leverage increases your risk but if you keep the numbers under control that allows you to sleep at night, it seems the best option in your situation. In my opinion a 30-yr fixed-rate loan against a valuable property is the best and safest way to increase leverage. No other type of borrowing can rival that. My personal view is inflation is definitely coming which is the true reason why all prices are so high right now. To play into that increasing leverage with fixed borrowing costs is the way to go.

You will learn more from negative feedback than positive. Play to your strengths, never sell unless you have too. Avoid taxes. Use leverage to boost your returns. Don’t count on a 8% stock return

We have a guy here doing the opposite. @wuqijun took margin loan against his stocks to buy properties in Bay Area.

I did not mean to mock at you ! Sorry, if it hurt you already, removed part of title.

You have come to right forum, people are here to help you.

We have different types of bulls: conservative bulls, aggressive bulls, and then there’s @wuqijun… ![]()

Can’t agree with you more.

I know what you meant to say… you know I don’t like that…

“@wuqijun took margin loan against his stocks to buy properties in Bay Area”

Did you take margin loan to buy properties?

Reason for my ask: Today, my lender’s underwriter was asking me (as a last question before final approval), like letter of explanation, how much margin loan I have with my brokerage?. I was surprised with such kind of questions.

Yes, I had too much stock and not enough RE. So I took out some margin loan to buy real estate.

I strongly agree with what @maluka said. @Jil is one of the serious posters here and is definitely not the insulting type.

Going back to topic, the reason I brought up @wuqijun’s margin loan example is that, one should own both real estate and stocks. Both belong in a healthy portfolio. You can quibble about the ratio but I think one should own both.

How so? I’m not a dictator. People are welcome to freely express their viewpoints without any fear of retribution from me…