Hmm. So tax cuts have helped China’s economy grow faster…

Yup. Like cholesterol is vital for a kid’s growth but not good for an old man. It’s economy specific.

More fake news.

https://health.clevelandclinic.org/why-you-should-no-longer-worry-about-cholesterol-in-food/

Last year’s Hot Chips conference proceedings and video:

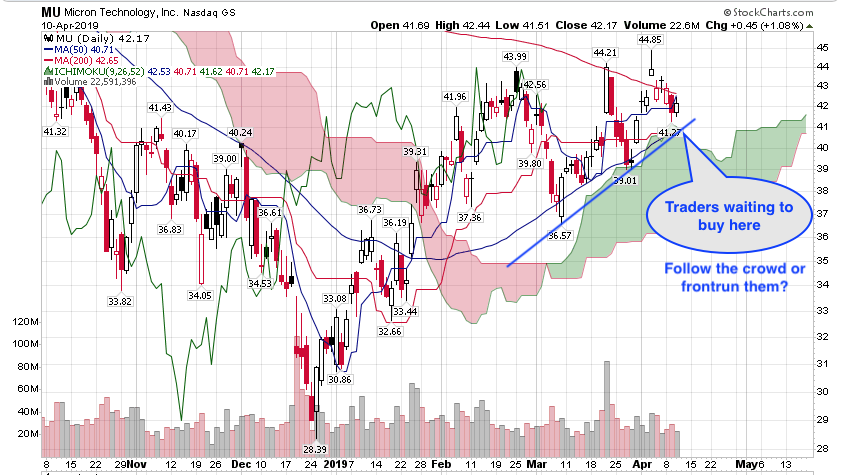

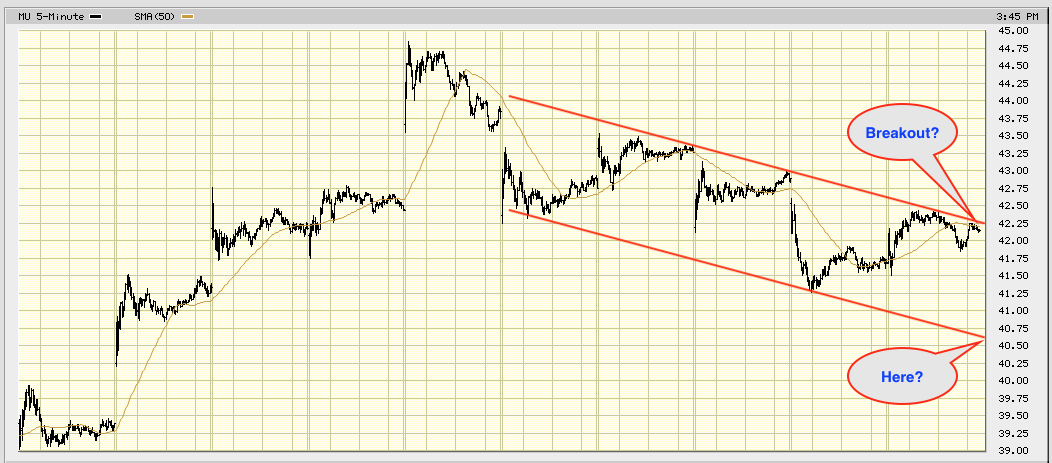

As expected, MU re-bounced from the support, now hovering $43-$44.

5 Semiconductor Stocks to Buy for a Spring Charge

Investors should add MU stock to their portfolios this spring for the simple reason that NAND and DRAM prices appear to be stabilizing. Markets adjusted to the U.S.-China tariffs now and place. A refresh in premium smartphones, ongoing demand for memory and high-speed storage for servers and the firming up of PC sales will benefit Micron in the current period.

Micron Stock Can Keep Surging Because AI Will Require More Chips, Analyst Says

According to Research and Markets, SSD sales will reach nearly $61 billion in 2023, a jump from $26 billion a couple of years ago.

These 5G Stocks Have Soared Over 30% in 2019, and Could Go Even Higher

5G networks will reportedly require 100 times more resources than a 4G network, which also means that they’ll need more storage. As a result, demand for Micron’s memory chips could increase big-time.

Conclusion: Buy any weaknesses, wait for the eventual ![]() Technically, there is an obvious volatility squeeze.

Technically, there is an obvious volatility squeeze.

In a red market, important semis are green.

XLNX crashing.

INTC crashed AH.

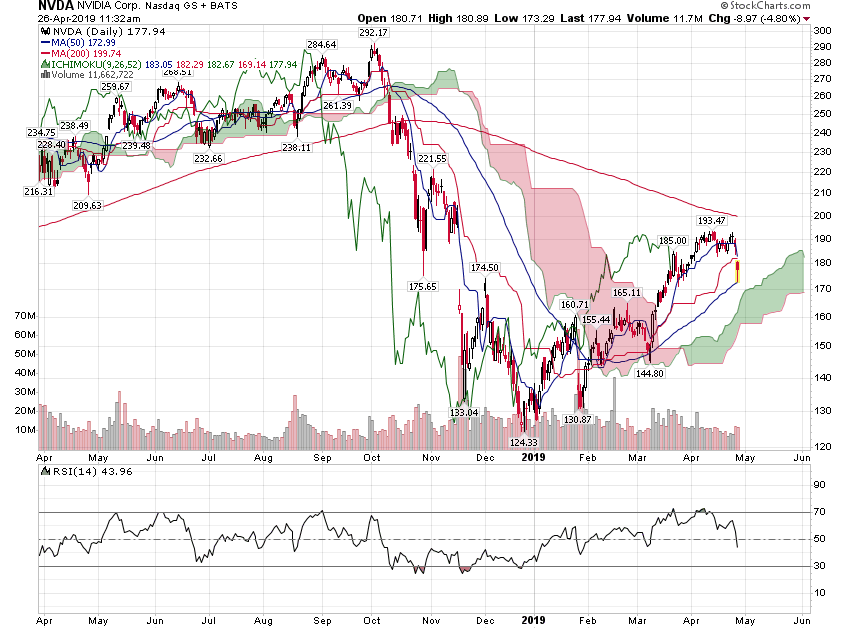

First XLNX, then INTC, killing the semis. WDC and NVDA are collateral damage?

Intel taking down semi stocks and the whole group could be about to crack

NVDA at 50-day SMA, buy or sell?

Chip stocks are at an all-time high, but Nvidia, Micron and AMD are lagging

Semiconductors are firmly in Trump’s crosshairs. They are gonna suck going forward.

• The Philadelphia Semiconductor Index is down 1.6% in early trading after the White House bans U.S. firms from using telecom gear from Huawei citing national security concerns.

• The move means companies like Qualcomm (NASDAQ:QCOM) -3.5% might have to apply for U.S. export licenses to continue supplying to Huawei.

• The prior ban on ZTE sent semi stocks on a wild ride. Micron (NASDAQ:MU) -2.8%, Skyworks (NASDAQ:SWKS) -4.5%, and Qorvo (NASDAQ:QRVO) -6.1%.

• Updated to add some Huawei exposure data from Mizuho. Note that Huawei is broadly a major Micron customer: Skyworks, 10%+ (customer); Qualcomm, 10% (customer); Qorvo, 10% to 15%+ (customer); Broadcom (AVGO -2%), less than 5% (customer); Xilinx, about 10% (exposure); Intel (INTC +0.3%), about 2% (exposure).

@manch Did you cut loss on NVDA or add or do nothing? Technically, short-term oversold, could re-bounce next week, however could decline below $120 over the next few months. Fundamentally is affected by the trade war too.

Stopped out of all semis. Will re-examine next month.

Silicon is back ![]()

Start of the next few months of bull run?

Silicon may have bottomed. Fingers crossed.

How many NVDA, XLNX and AMD shares did you buy?

I didn’t do anything. Riding the down and up ![]()

Silence is golden.

Silence is golden.