Barron wants us to hold MU through earnings Mar 20 Wed, comply or defy?

Wall Street is trying very hard to kick micron down:

• Morgan Stanley thinks Micron (MU +0.7%) will report a “tough” Q2 this week and the print could diminish optimism that DRAM memory chips will see a recovery in H2.

• Analyst Joseph Moore says he’s surprised Micron didn’t preannounce and that it isn’t a question of how bad things are in the short term but rather “how long conditions will continue to deteriorate.”

• Moore doesn’t expect “definitive answers” in the report, but the firm continues to see “discouraging lead indicators.”

• Morgan Stanley maintains an Equal-Weight rating on Micron with a $33 PT.

• Micron will report on March 20. Consensus estimates have revenue at $5.85B with EPS of $1.68.

MS analyst is “surprised” Micron didn’t preannounce bad news. Haha. Never seen that one before.

Barron/WSJ vs Morgan Stanley, who to believe?

Buy ‘Cheap’ Micron (MU) Stock Before Earnings, Despite Chip Price Worries?

Micron Investors Prepare to Learn the Latest

Will Falling Chip Prices Thwart Micron’s (MU) Q2 Earnings?

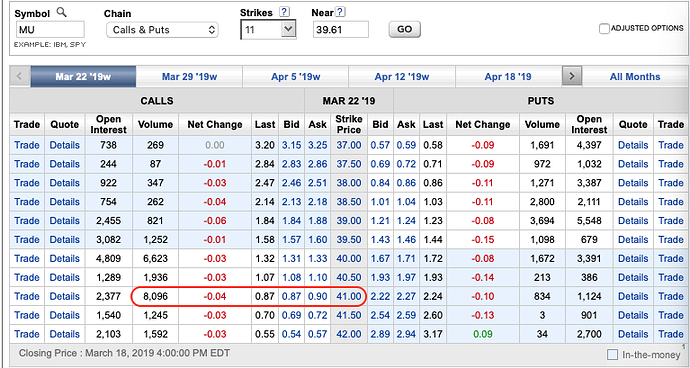

Call(Mar 22 $41) is heavily traded.

MU earnings: Beat WS reduced estimates and slightly below previous estimates. AH hardly changed.

Micron beats second quarter revenue expectations

Micron Shares Rise as Memory Chipmaker Beats Estimates

Micron stock ticks higher as results top lowered Wall Street expectations

40 mins later…

Magic words from Sanjay,

Chief Executive Sanjay Mehrotra said on the call he will idle 5% of DRAM and NAND “wafer starts” while waiting for expected data-center growth to resume in the second half of 2019.

“In response to near-term industry conditions, we are taking decisive action to reduce our supply growth to be consistent with industry demand,” Mehrotra said in the call. “At the same time we continue to invest and execute against our strategic priorities to reduce costs and increase the mix of high-value solutions in our portfolio.”

Micron Technology (MU) Q2 2019 Earnings Conference Call Transcript

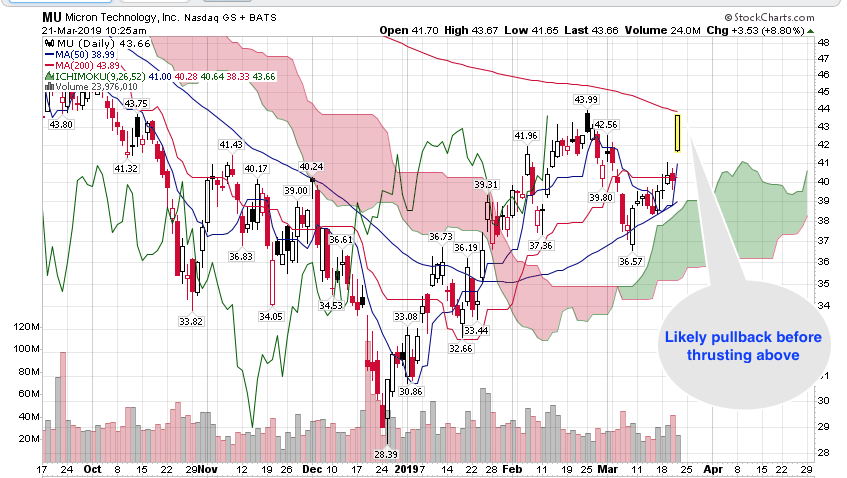

@Jil Another small win ![]() Pure technical play

Pure technical play ![]()

@manch Barron is correct, MS is wrong.

Those guys make 2x, didn’t follow them ![]()

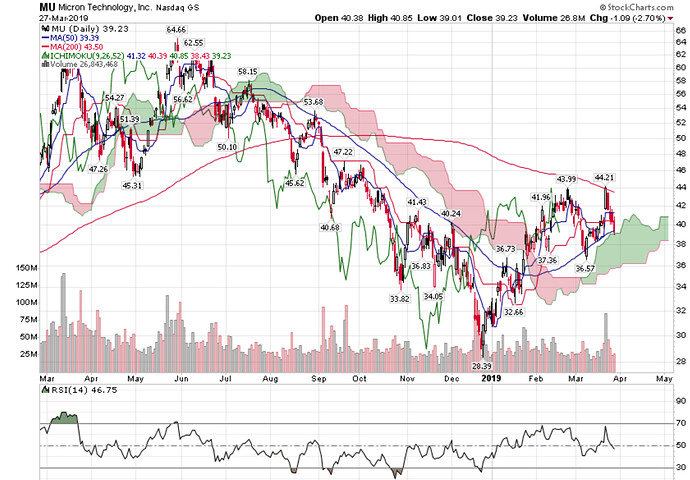

After 4 days (6 calendar days) of pull back, MU is at $39 ![]() Time to BTFD?

Time to BTFD?

Is Micron (MU) Stock a Buy? Deutsche Bank Says Yes

Micron Stock Is Tanking, but Could Soon Bottom Out

Price Declines Are Normal for Micron

Edit:

Where Chip Stock Investors Should Focus Now After the Sector’s Big Rally

… this might be a good time for chip stock investors to pare their exposure to higher-multiple names that have less of a margin for error in the event that a recovery doesn’t go exactly as planned and/or some company-specific pressures emerge. Xilinx, which now trades for 34 times its expected fiscal 2020 (ends in March 2020) EPS consensus, and Cree, which now trades for 33 times its fiscal 2021 (ends in June 2021) EPS consensus, are two examples of firms that now don’t have much of a margin for error.

Sell @manch XLNX. No advice on what to do with MU which is the only chip stock I have ![]()

According to Bret of InvestorPlace,

Micron has been putting in a series of higher lows and bobbing along the 50-day moving average and uptrend support. Short of some unexpected bad news, bulls will likely pounce on this area again should MU stock pullback.

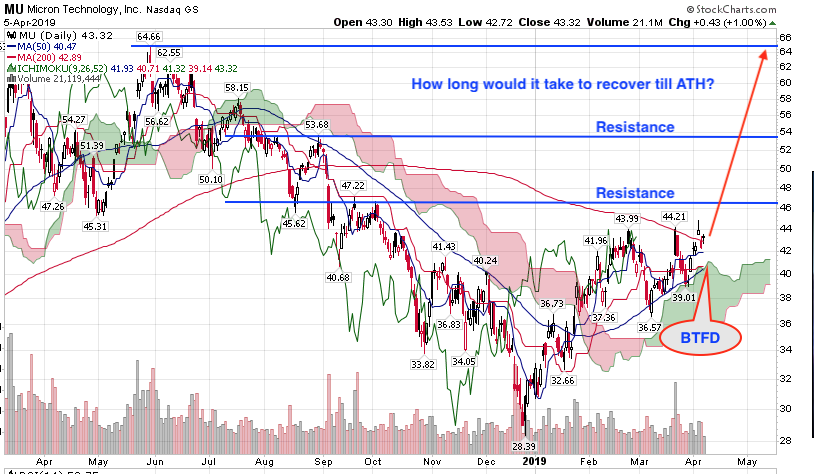

A push over resistance can propel MU up to $46.60, the 50% retracement for the 52-week range. Above that and $50+ is eventually possible. If the 50-day and uptrend support give way, bulls will need to wait for Micron to reset.

4 Large-Cap Semiconductor Stocks to Buy Now

INTC, TXN, NVDA, MU

Micron (NASDAQ: MU ) shares are pushing up and over their 200-day moving average for the first time since last August, setting up a further retracement of a decline from the highs hit last summer that resulted in a 50%+ loss of value. CLSA analyst Sanjeev Rana recently cited falling inventory levels as a reason to expect a strong demand recovery.

Since above 4 are moving in tandem, does it matters which one you buy?

I do not own any chip stocks, MU or NVDA or LRCX, but generally, we are near peak at this stage.

Micron Stock Will Plunge Because the Chip Market Hasn’t Hit Bottom, Morgan Stanley Says

Morgan Stanley timing is right, they just see whole market is upside and trying to downgrade (weak) one.

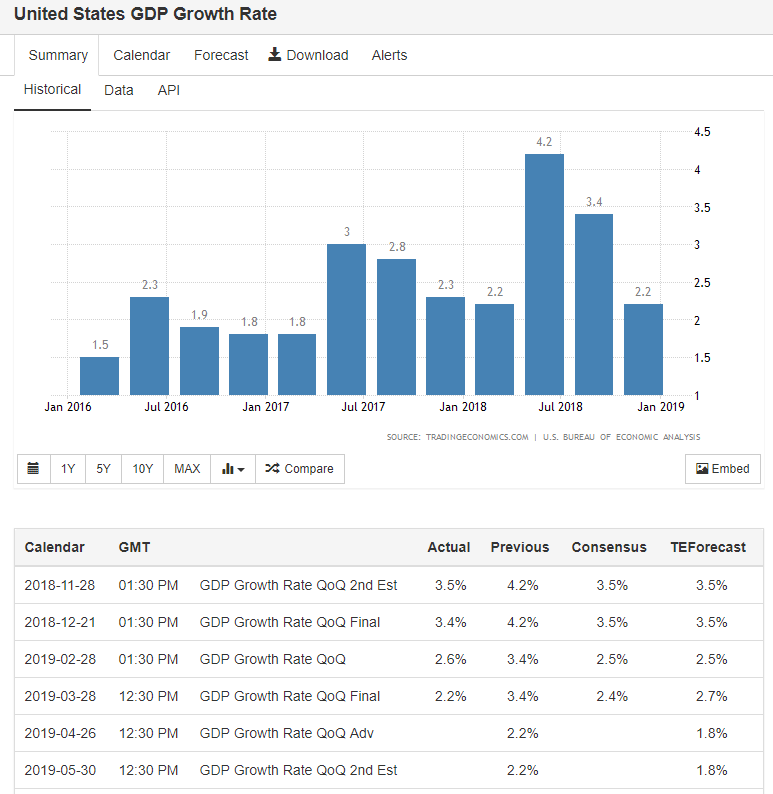

All it needs 40 points in S&P to reach the last year peak. Market is doing reverse against the GDP. It will eventually correct soon. Remember Trump-Pelosi shutdown majority of 35 days shutdown falls last quarter, there is no escape now

You didn’t follow this thread and another thread closely, MS has been bashing MU for nearly a month to no avail. Broken clock is right twice, MS would be right eventually by keeping repeating this bearish posture ad nauseam.

So far Barron/WSJ/Zacks is correct.

Ytd return of XLNX, AMD and NVDA are higher than MU ![]()

MS did not say anything about MU in Jan, Feb, but started telling about Mar end. Since you are so much attached to MU and other chip stocks, you are not accepting any negatives on those. You believe in TA, look at TA of SPY and MU or similar stocks, they are coming at peak level.

They are not broken clock, but they are timing with TA or similar. They sense it is going higher without fundamentals behind it.

No one can predict exact date of fall or raise.

I do not follow MU or other Chip stocks, but generally this nature.

When the fundamentals, say FED or many other well know analysts/economists are predicting less growth in GDP and market booms, there is eventually correction in market.

Who’s that kid? I skimmed thru his garbage and he listed China slowing down as the number 1 key risk. Huh? It’s been bouncing back for a couple weeks now. Did he just watch American TV news and thinks he knows everything about the world?

What kind of peak? Multi-day, multi-week, multi-month, multi-year, multi-decade? It matters.

Is MS or you thinking MU would decline below last Dec low? $36? 50-day SMA? How low it would decline to matters too. Without clearly saying this, MS is talking cock, Mr Market is numbed to their opinion, the first two times cause a big drop, now hardly drop.

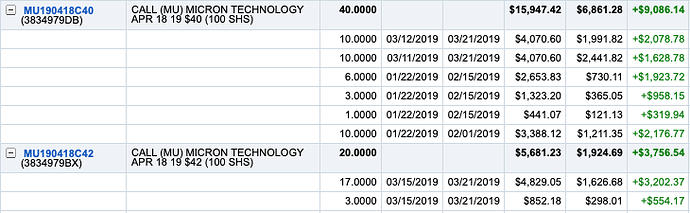

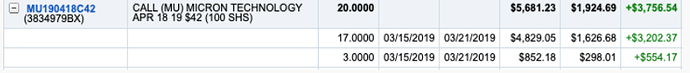

I sense some short-term weakness so I sold 10 calls, left with 20 calls. Short-term weaknesses are not negatives that I am unduly fear. I fear those with multi-year implications. From what I read, they’re possibly talking about short-term negatives, not sure why brokerage firm talks about short-term trading… thought they are supposed to be long term guys, have they join Jim Cramer?

If it is not a possibility that MU would decline to Dec low, I don’t want to know.

I repeat that I do not follow chip stocks. I can not really tell you whether MS & WF are right or wrong Here are some max/mins of MU.

50 Day Min:$36.59

50 Day Max:$43.99

100 Day Min:$29.02

100 Day Max:$43.99

200 Day Min:$29.02

200 Day Max:$59.44

But, here are the words from Manch

“I am surprised by the strength of Micron in the face of relentless badmouthing from MS and WF. Samsung also had a pretty bad print last Friday morning and MU actually rose for the day.”

If you want to really know MS & WF statement is correct or not, just read the entire statement, justification and find the truth behind it.

See here:

-

Last week, German chip maker Infineon lowered its sales-growth guidance for the fiscal 2019 year to 5% from 9%, citing weaker macroeconomic conditions, especially in China.

-

Samsung Electronics Co Ltd said on Friday it was heading for its lowest quarterly profit in more than two years as a glut in memory chips, slowing panel sales and rising competition in smartphones hit margins.

Memory Chips I know 3 big players, Samsung, Micron and hynix (I may be wrong in hynix). If sector (memory chip) is weak, it must affect all the three. It can not be samsung alone, but should affect the sector.

Individual day UPs or DOWNs are not clear indicators.

If a stock is moving against (either UPs or DOWNs) fundamentals, it is bound to correct to normal range.

You can ignore what MS said, keep repeating the same shit issues. Read the link I posted 5 hrs ago.

Where Chip Stock Investors Should Focus Now After the Sector’s Big Rally

Golden nugget,

And when looking at both memory makers and the chip equipment firms that supply them, it’s worth keeping in mind that a memory recovery doesn’t merely depend on improved end-market demand, but on price stabilization and the clearing of customer inventories. While it’s pretty likely that the DRAM and flash memory markets will have better supply/demand balances during the back half of the year, thanks to stronger end-market demand, inventory clearing and the impact of recent capital spending cuts, there are still some wild cards at play.

Judgement calls for wild cards. MS is trying to influence readers/ traders that wild cards are negative with no new info.

In any case, thanks to MS bashing, can do short-term trading…

Sold 10 calls (L20 $35), hopefully can buy back cheaper ![]()

In any case, thanks to MS bashing, can do short-term trading…

Sold 10 calls (L20 $35), hopefully can buy back cheaper

OMG, By posting these Calls, I have become FAN of you ![]()

![]()

You have bought little late (3/15) but sold on peak day (3/21).

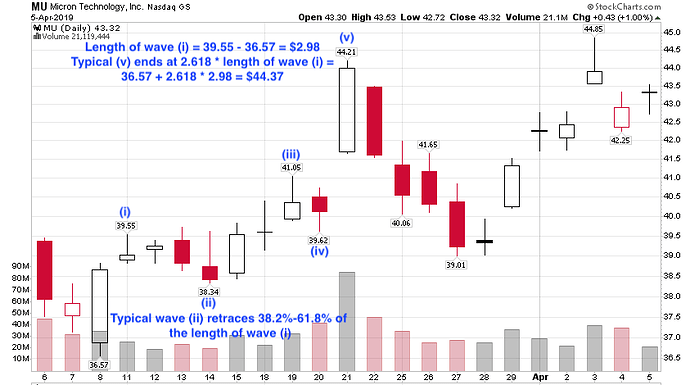

MU example:

-

I will come to know $37.83 (Mar7th) was lowest on March 8th morning say 10 AM, but never know future price and date, but I know it is upside next few days may be 2 to 3 weeks.

-

I will come to know on Mar 22nd appx 10 am peak reached previous day and likely go down.

Tell me if I can clearly identify previous day bottom or peak on next day, how can I make use of it?

Pure EW computations ![]()

Tell me if I can clearly identify previous day bottom or peak on next day, how can I make use of it?

Buy the next day for bottom, and sell next day after peak still make money ![]()

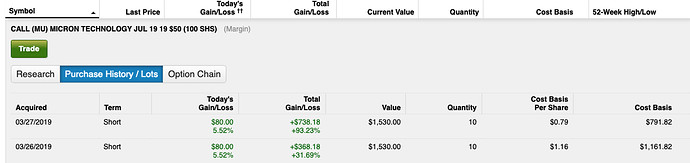

Bought again on Mar 26-27 ![]() more aggressive for once, betting it would charge above $50 before Jul OE.

more aggressive for once, betting it would charge above $50 before Jul OE.

MS has invited MF to help bash MU,

Time to Buy Micron Technology Stock Once Again?

So investors shouldn’t get excited about Micron just yet. It would be better to wait for concrete signs of a turnaround, as there could be more pain on the way if demand doesn’t pick up and the inventory glut continues.

Old logic ![]() many times. Enough to incite selling in PM,

many times. Enough to incite selling in PM,

CFO Dave Zinsner said, “In NAND, we expect a modest sequential decline in our bit shipments in the fiscal third quarter due to timing of shipments and expect growth to resume in the fiscal fourth quarter.”

Not bottom in Q2 as claimed by a reddit blogger.

Investment is ![]() ahead, 3-6 months ahead is normal, you can’t wait

ahead, 3-6 months ahead is normal, you can’t wait ![]() for the bottom to be clear to buy, buy in anticipation.

for the bottom to be clear to buy, buy in anticipation.

Micron stock falls after another downgrade

Cowen & Co. analyst Karl Ackerman downgraded the stock to market perform from outperform. Ackerman said his field work pointed to “the confluence of a sea change in the competitive environment, an erosion in Micron’s NAND cost leadership, and our analysis of the last seven DRAM and four NAND cycles” that suggests Micron’s profitability could fall again in calendar 2020. “We think this is a stark contrast to what is contemplated by most investors,” Ackerman wrote. He said that the trough for both NAND and DRAM may be a few quarters away.

Next earning is Jun 20, so can’t verify till then.

Lyft is threatening litigation against Morgan Stanley, accusing the firm of supporting short-selling

Trust MS at your own risk.

Why semiconductors fell on Apr 9

Samsung lowers first-quarter earnings guidance

Amid the weak memory market, Samsung plans to follow in Micron’s (MU) footsteps and cut spending to reduce memory chip supply. SK Hynix is also considering lowering its output to balance demand and supply. Lower spending will reduce equipment orders for Applied Materials (AMAT) and Lam Research (LRCX) as they earn more than 30% and 80% of their revenue from the memory market.

All the above statistics point to a prolonged memory industry downturn through 2019.

Realist joined WS to bash semiconductors. WS is so determined?

Take no prisoners. All red.

Almost BTFD.

Why are you all fixated on MU. A crap stock that is not much higher than 5 years ago. Better off buying Boise RE. Doubled in 7 years

Who’s that kid? I skimmed thru his garbage and he listed China slowing down as the number 1 key risk. Huh? It’s been bouncing back for a couple weeks now. Did he just watch American TV news and thinks he knows everything about the world?

China’s Economy Is Looking Better and Better

Analysts from banks including HSBC Holdings Plc, Morgan Stanley and Goldman Sachs Group Inc. are increasingly confident that the world’s second-biggest economy is finding its feet after a rocky start to the year. Corporate tax cuts, an upswing in manufacturing and expected progress on a U.S. trade deal are among the factors buoying optimism.

Forward it to Cramer’s clueless kid.