Blogosphere is full of investors chanting, “NVDA would be worth more than AAPL by 2030”. This type of chanting is keeping NVDA mooning… have to wait a long time for a BTFD moment to add…

Next target over $300 ![]()

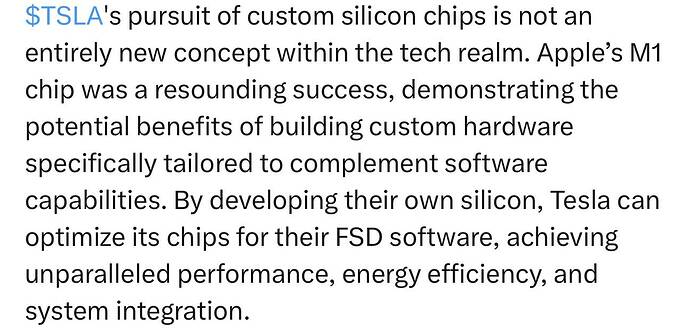

Problem with Nvidia holding the chokehold on everybody is that people are very motivated to develop alternatives. Microsoft just announced last week they are doing in house AI chip development. Amazon already has some for inference. Of course Google has its tensor stuff.

But Nvidia still has a lot of advantage because of the CUDA software stack. It’s not just the silicon. So I am still bullish on Nvidia even though everyone is trying to eat their lunch.

![]()

Very few companies have the resources to make specific purpose chips. Neither do they have the scale that requires such chips.

Who is interested in subscribing?

Today…

Aug 27, 2021, almost 2 years ago…

Market Cap

AAPL $2.71T

NVDA $748B

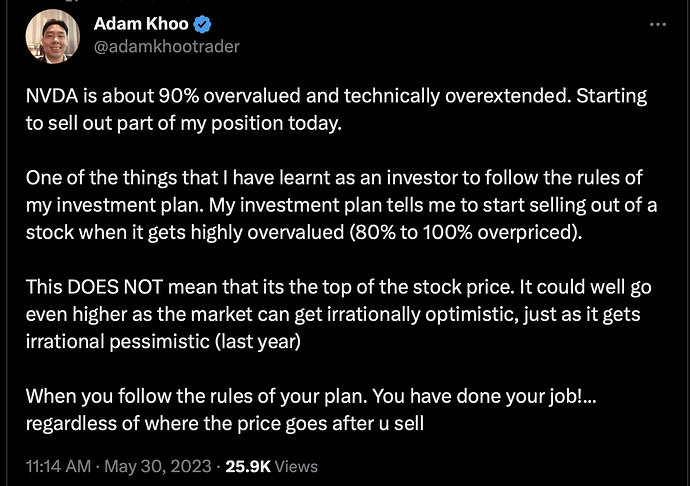

A trader selling NVDA because of valuation ![]()

His track record (correct 3 days ago)… 21%-23% ytd gain… less than QQQ 31% and AAPL 35%.

The Chinese can’t even copy. They just erased the markings on Intel chips and put their own badge on.

![]()

On the Glassdoor profile of Taiwan Semiconductor Manufacturing Company, or TSMC—the world’s biggest manufacturer of semiconductor chips—current and former U.S. employees swap messages about grueling working conditions. “People… slept in the office for a month straight,” an engineer wrote in August. “Twelve-hour days are standard, weekend shifts are common. I cannot stress… how brutal the work-life balance is here.” “TSMC is about obedience [and is] not ready for America,” another engineer wrote in January.

TSMC’s U.S. operations have earned a 27% approval rating on Glassdoor from 91 reviews—meaning that less than a third of its reviewers would encourage others to work there. Intel, one of TSMC’s main rivals, has an 85% approval rating, albeit from tens of thousands more reviews.

Looks like TSMC is having a tough time hiring in America.

Continue to make huge improvements.

Above + Vision Pro + U would enable 3D internet… metaverse/ omniverse would be much later ![]() Wait… can network handle the traffic?

Wait… can network handle the traffic?

Yet she panic sold a large portion of NVDA last year.

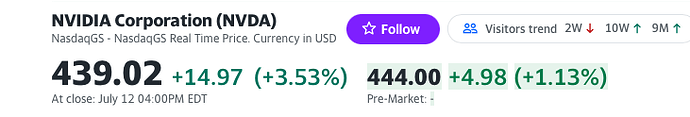

AH ATH. Previous ATH is $439.90.

Thinking aloud, not financial advice:

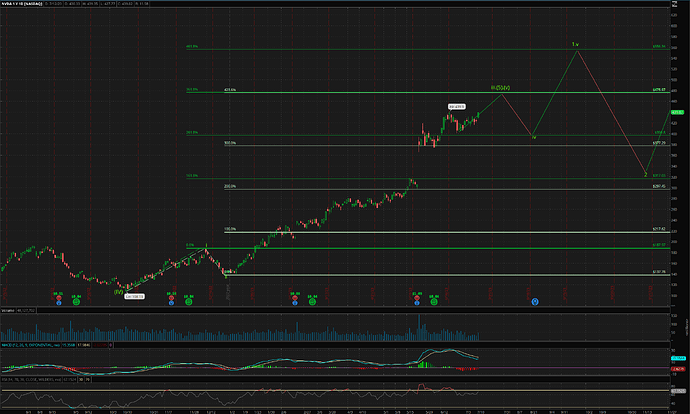

NVDA hits $475, a price that might mark the completion of wave iii follow by a correction to as low as $400… where I will add ![]() If above $475, next target is… outside so can’t check

If above $475, next target is… outside so can’t check ![]() I don’t have calls, otherwise is good to close them, risk reward not good. Should also close shares on margin. Mine are all cash purchases, so just sit and ride any volatility till… I expect for a few years

I don’t have calls, otherwise is good to close them, risk reward not good. Should also close shares on margin. Mine are all cash purchases, so just sit and ride any volatility till… I expect for a few years ![]()

A few years = 10 years ![]() Potential 10 bagger

Potential 10 bagger ![]()

If you didn’t own NVDA, you should read the articles below. No need to read if you own NVDA… you obviously know.

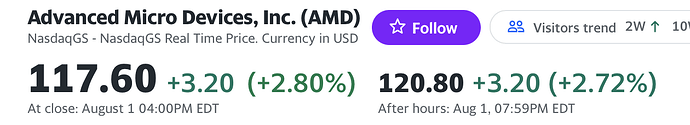

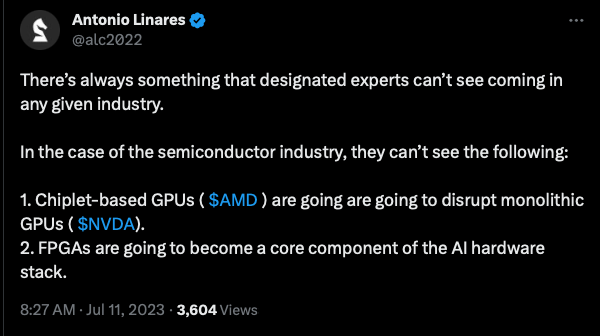

Already chewed on Antonio’s piece on AMD. I still think Nvidia has a massive software moat. But AMD is much cheaper than Nvidia and worth betting on, in addition to Nvidia of course, not replacing it.

So did you hedge your bet? I didn’t.

I have both Nvidia and AMD, but Nvidia position much bigger.