Pathing the way for other tech hubs gaining more startups. No longer need SVB. Less one critical incentive to be in SV.

With this evolving GFC, smart money is moving into China and Singapore banks, ofc in Yuan and SGD ![]() While Central Banks of China and Singapore no longer rollover expiring T instead plough into Gold.

While Central Banks of China and Singapore no longer rollover expiring T instead plough into Gold.

This is mainly by Ukraine war, they need to get oil from Russia as USA blocked all assets/access using USD!

Heh, I’m still using them too. Great customer service. A few months ago I decided to start switching my auto-pays - all 9 of them (utilities on two houses, insurance, cell, internet, etc) to a local bank that pays 1.3% on checking accounts while FR still pays essentially nothing. Figured there was no reason to leave even a bit of money on the table and I might need a few thousand in cash on short notice if I needed to pay a small local contractor for something. Good thing I did that. If FR gets taken over or sold having to do all that switching on short notice would be a royal pain.

People can’t withdraw their deposits from an insurance company. They’ll just have lower income than they should. A big part of insurance company income is the profits from investing the reserves. I guess if there were multiple massive hurricanes or similar events that required higher payouts then there’d be risk if the bonds are worth less.

.

Insurance bought Re-Insurance for these types of exception. Knox is almost like spreading FUDs, is why I didn’t want to post his tweet when I read it. Some1 did mindlessly.

Insurance companies have capital requirements. If their assets are impaired they need to raise fresh capital.

Did people forget AIG is an insurance company?

That’s nice and all. But still why not move accounts with more than 250k over to SVB? Why even risk it?

Make no mistake here - it’s the people who have $$$ at First Republic + SVB who are systemically important. You? Not so much.

I have down business with First Republic for 20 years. I am withdrawing most of my money. Sticking with Wells and Fidelity. Had been doing business with them forever.

Banks are banks ! When FED is giving at par value for treasuries, they take advantage of it to keep the liquidity during troubled period until uncertainty is over, mainly after quarterly reports due in just 30 days.

I’ve had nothing but bad service from Wells. And I don’t like the whole “woke investing” thing going on with the large money center banks. Bad for my community. I’ll stick with my smaller regional banks and keep most of what cash I need in MM funds invested primarily in short term treasuries.

Not interested in RE?

Not really. Don’t want to landlord. Don’t want to maintain a big house. Don’t want to live in the popular areas. I have a very small amount in REITS but even there I prefer qualified dividends for income. I have two small houses, one on 50 acres with it’s own well.

ST treasuries are right as I have got 5.3% interest rates recently. Treasuries are so called safest instruments to park emergency cash. Best for retailers to park until uncertainty is over ( until FED started reducing rate).

Everything else likely potential to go down meanwhile.

It is a kind of asset allocation strategy for those who does want to take risky bets.

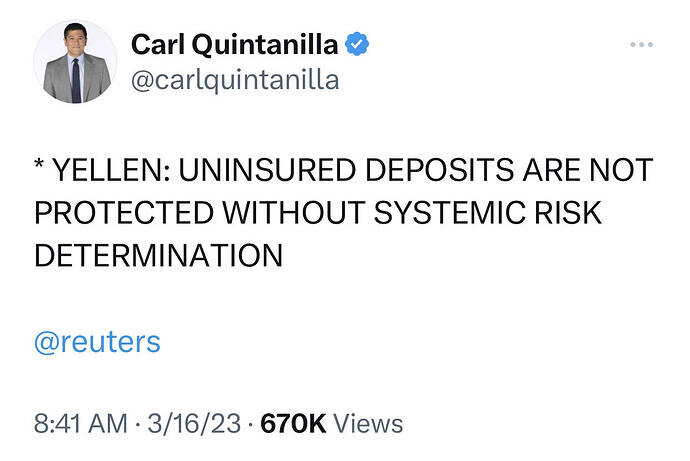

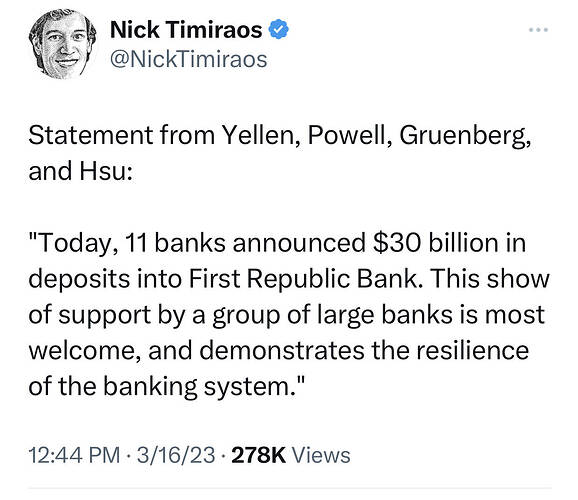

has apparently pushed the SIBs to recycle some of the deposits they received from

back into FRB for 120 days. The result is that FRB default risk is now being spread to our largest banks.