Banks are screwed. I took my money out months ago . Money at fidelity at 4,5% for money funds. Just like in 1981… why keep money in banks. I told Wells to give me better interest. They are brain dead.

I understand this risk and this is applicable for XLF or KRE, but not DPST.

Remember DPST is high risk 3X and short term holding/trading, I will sell that as soon it comes to 80%-90% range. Even last 10 days, I bought appx 1000 shares DPST at $7.50 and sold around $10.5 as a Trial. This timing is based on my algorithm to find out peak and bottom. I will be buying back again. This is completely short term play. Now, I increased DPST higher level.

KRE or XLF are long term holding, may be 45-90 days. I will be selling these when market (SPX) comes to peak. Until SPX goes bullish, these KRE and XLF will likely follow. Since they are corrected to deep low, they jump faster than SPX.

I will not be holding any of these (KRE or XLF) when SPX is going to drop. Without SPX dropping heavily, bank assets won’t come down to 1/4X.

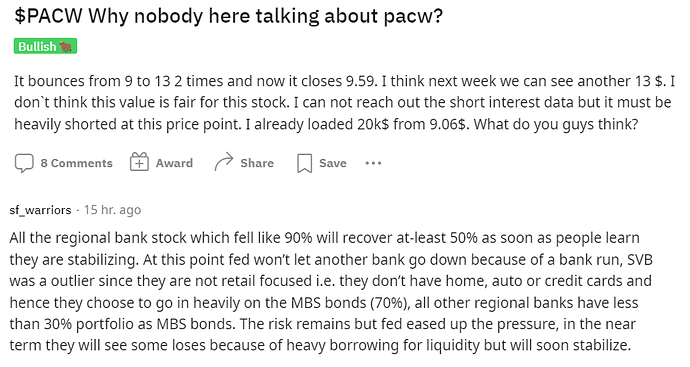

For NYCB, PACW kind of small risky stocks, planning to take some kind of hedge (like SQQQ) when I feel SPX dropping. In fact, I studied enough about NYCB and bought some bulk qty when it was $6-$6.50. Meanwhile, I will also educate myself about these stocks in next one or two quarters. If they are doing great, I may continue to hold. I need to evaluate quarter by quarter without which I can not confidently say or forecast the future. Fundamental study is essential.

I have some SCHW,take it easy stock,but this is small qty and I can hold it without any concern for many years. If it beocmes 1/4X or below its purchase price $53, I will keep adding it. I just purchased today after doing research recently about it. I do not have any concern about this company going bankrupt or insolvant in near future.

Current KRE/DPST/OTHER BANK STOCKS/CASH are in 60:20:15:5 ratio.

For me, identifying SPX move is easier than any individual stocks.

We will revisit in 45 days…Let us see how it works…When everyone is scared to touch banks, smart money takes them high…!

If banks don’t offer higher interest they are are kaput

They always live with net interest margin, difference between what they get rate and what they pay to depositors!

Good interview. Shit ton of CRE needs refinancing this year. If all these regional banks can’t or won’t make loans, things will get ugly fast. The Fed always sets 2% as inflation goal. Why 2? Why not 4?

2% is a ridiculous target. Since WWII, it’s been above 2% far more often than it’s been below it.

…so if we target 4 we’ll have to live with 6.

It crushes the poor who have few assets and most of their savings in cash.

I honestly don’t remember ever hearing 2% as a target until more recently. We accidentally achieved it due to a boom in worker productivity. Unless we have a similar boom in productivity, 2% isn’t realistic. I don’t understand how the fed thinks inflation can be 2% after a long period of near zero rates and a massive increase in the money supply. If defies all logic and models to think we’ll have 2% inflation after that.

It wasn’t even a publicly stated goal until 2012. It was an unofficial goal in 1995.

Like acre replied, we may have to live with 6% then.

Inflation is deadly for all people, esp earnings are diminished, retirement is hard. Most of the retirees, and people living with pay check to pay check.

Rule of 72, inflation is 2% leads 36 years to double any item price. If it is 4%, it doubles in 16 years.

Simply, all CD savers, high safety bonds, retirees, low wage earners, pay check to pay check living people, esp low income people - very common people struggle.

Wealthy & intellgent investors people survive nicely and even grow while income - equality and wealthy - poor disparity will be increased, economy may lead to state of unrest. See Sri Lanka unrest, we see chaos, Pakistan, Afganistan…etc.

Never mind about media, as they do not have any accountability, and they are short sighted with daily news.

This is main reason FED was created in the first place in 1913 - to independently control the inflation while balancing employement.

On my second topic: Banks are financial foundation/pillers of economy.

If banks are not there, none of us would have got a home here as we need all cash offers.

If banks are not lending, no start ups will come in picture, no IPOs will be floating.

The liquidity crisis (main unrealized loss on treasuries, mbs) is short lived phenomena when FED rates are high, but that is being reduced by FED finding at par value (it is FED took that pressure indirectly).

During this process, all banks or regional banks, dropped heavily. Yesterday, KRE distributed nicely dividend 3.43% which is almost 10 year bond return. Holding long will reap better benefits of growing better.

I see this is not a threat, but an opportunity for me.

FED started support at arrow places!

BTW: My comments may be biased, as I hold KRE shares, Do not trust, Do your own analysis

This is managed by FED liquitidy crisis reversal giving Regional Banks(RB) lending at PAR values. Whatever HTM they hold (Treasuries, mbs), RBs can get at par value (maturity value) from FED for current interest and lend the same to all loans. Now, RBs will pay say 4.5% to FED and they lend 7% to car loans, earn net interest margin. When FED reducing rates in future (2024 or after), RBs can pay down FED loan (Treasuries, mbs valued higher than today as a result of FED rate cuts) and keep it with them until maturity so that theu do not need to pay 4.5% rate they pay to FED now.

Simply state, FED indirectly insured all RBs against liquity issues, and RBs unrealized losses will be reduced when FED reduces rate.

When FED enters, they support such institutions to grow so that economy is stable and getting finances for growth. Financing is backbone of our business economy.

This isn’t a liquidity issue. How are CRE borrowers going to afford higher interest rates when vacancy rates are this high? If CRE borrowers default, then the RBs foreclose on the RE assets which by that point will be plummeting in value. If they can’t sell the foreclosed RE to cover the loan balance, then they are going to take losses.

Got it. It is the domino impact of FED Rate hike, cost of borrowing increased for all companies. Yes,CREs are term loans unlike Residential fixed mortgage. It will affect everyone across the country. This will be an issue when FED keeps the rate at same level for next 6-12 months. Defaults will close the companies/businesses…etc increase the mass lay off, results higher unemployments…reduces demand. Cloud companies will get affect, ranging from small sector to big sectors…entire economy.

Now, market won’t price until this is coming out soon. However, IMO,this is the issue when SPX drops from next peak, until then this is hidden.

When this likely going to happen/breaks, then FED will start reducing rates. This is exactly what FED wants to do…Then congress, FED, Treasury…everyone will step in …appx Dec 2024 recession ends.

Exactly ![]() So no systemic risk? Only those swimming naked fail

So no systemic risk? Only those swimming naked fail ![]()

Putting new regulations mean nothing if lax enforcement. US has tons of regulations, quite often is the lax enforcement that result in outcome like SVB and FTX.

Under Trump a new regulation was put in place requiring hospitals to be transparent about their charges and post fees for their more common procedures. Only reason it’s had so little effect is that there’s almost no enforcement.

Any remotely competent CFO or CEO should understand their risk of rising interest rates. I think even analysts level people should be aware of that. People talk about the lack of hedging, but I’m not sure how practical that would be. Hedging gets very expensive when it’s for longer duration. It’s the same as options or futures contracts.