During every recession, this is common news “VC drops”. This means we are going to have a recession.

Year 2000

http://www.cnn.com/2001/TECH/industry/02/09/2000.vc.idg/

Year 2001

https://money.cnn.com/2001/08/13/sbrunning/venture/

Year 2008

Year 2009

VC revives after the recession !

Good, we have one more signal to monitor. From past experience is a leading indicator.

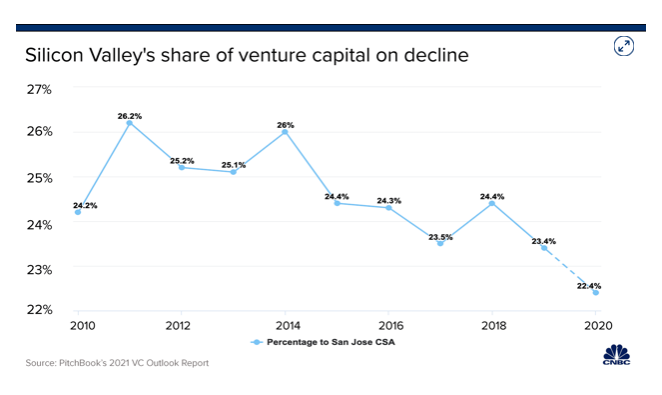

SV share of investments decreasing doesn’t mean the total investment of VC firms is decreasing.

They are, after all, investors like us, also better than us, to find good companies and pump funds to gain big !

It is always common for reduction in VC funding as startups are not going to give VCs multi-millions or billions during recession period.

VC less funding SV means no good start ups or IPO soon, mostly during recession times.

VC firms are investing a record amount of money. They are just shifting where it goes.

2019 was actually a down year.

No need to guess. We have actually H1 2021 data.

The Bay Area is on pace to set a record for venture funding

In the first half of this year, Bay Area startups collectively raised $54.5 billion, according to the report. At that pace, they’ll break the record total for a full-year — $66.4 billion, set in 2018 — in the middle of the current quarter.

Perhaps as impressively, it means that 36% of all venture dollars nationwide are going to San Francisco or Silicon Valley startups. That’s not far off the share the region garnered the last two years, even though the total amount raised by startups across the U.S. in the first half surged to $150 billion — already the second highest amount for a full-year.

Take San Francisco. Its startups attracted $25.2 billion in funding in the first half. That exceeds the totals posted by startups in 49 states. Only its home state of California — thanks largely to the Bay Area — attracted more venture funding.

Menlo Park, Mountain View and Palo Alto each attracted more venture funding than 47 states. Their totals were topped only by California; New York state, whose startups raised $20.9 billion; and Massachusetts, which brought in $17.4 billion.

Some in Texas and Florida have made a lot of noise about Bay Area tech companies and startups moving to their states. But San Francisco and those same three Silicon Valley cities each attracted more funding in the first half of this year than all of Texas, which has garnered about $4.2 billion. All of those Bay Area cities, plus San Jose and San Mateo, each took in more than Florida’s $1.5 billion in the first half.

Bay Area itself has expanded somewhat with hybrid remote work arrangements. I’d love to see data on Sac and maybe even the Reno area.

Are Silicon Valley aka RBA home prices beginning to drop? Suddenly I am noticing more houses being sold close to list price and 200-300k cheaper than expected, based on spring/summer prices.

Seasonality. Nothing to worry about. Next spring we will be off to the races again.

Hope you are right…. But, on second thought, it is not personally advantageous for me to have home prices rocketing up year-on-year.

Why?

Becoz, I am already on the verge of hitting my $500k cap gains exemption for my more recent home, even after fully accounting for all money spent on remodeling, real estate commissions, etc. From this point on, I would lose 35c on every dollar of appreciation if and when I sell. Also, this spring I got a good appraisal and locked in 30 year fixed 2.625% mortgage. More equity in my house does not benefit me since I do not intend to take out any more loan like HELOC etc, just want to pay down existing loan slowly.

So, rapid home price increase don’t help me personally. It may even hurt because it would make local services and food etc more expensive. RBA prices going up at the same rate as inflation - I.e., 4-5% per annum would be perfectly fine.

This is the wrong way to look at things.

Another angle is that you get to keep 65c of every additional dollar of appreciation.

Does not help me if I have to sell and buy elsewhere, because while I get to only keep 65c on each dollar of appreciation, the houses elsewhere would also have appreciated, and I don’t get a discount there.

And it does not help me if I don’t sell my current home eventually - does not matter how much it is worth as long as I am living in it.

Don’t pay down the debt. Leverage it and invest elsewhere for higher returns.

Don’t pay down the debt. Leverage it and invest elsewhere for higher returns.

Already done that. Did a cash out refi this spring. I don’t feel good taking out any more mortgage debt because my PITI amounts to ~ 26% of income. At the same time, not motivated to pay it down super fast either given that I have locked in 2.625% int rate. So, as a compromise, I am just paying the monthly mortgage P+I and no more - this way it will take me 30 full years to pay it off if I stay in the home that long.

At this point, I would rather buy Bitcoin or QQQ with any excess cash saved, rather than pay mortgage more rapidly

Can you quote some examples? What I see is that RBA is continuing to increase / sustain. List prices have creeped up lately though based on prior sales from summer, and it may looks like sold over list is not that crazy.

Here are some recent examples of lower than expected sale prices for RBA SFHs:

All these are 6K lot house, which don’t sell for a premium compared to 10K+ lots. Also Cupertino houses are not in prime school district and one is near freeway. Even in this market, buyers are picky. These houses are in the periphery of RBA.