Press Releases

As Congress mulls tax reform, REALTORS® highlight importance of homeownership

Wednesday, November 15, 2017

As both the House and Senate sharpen their vision for tax reform (the House is expected to vote on its version this week), REALTORS® remain steadfast in ensuring homeownership is protected throughout the tax reform debate.

“We are watching closely for changes to current law that might leave middle-class homeowners – and homeownership broadly – in a worse place than it is today,” said National Association of REALTORS® president Elizabeth Mendenhall. "A near doubling of the standard deduction, combined with the elimination of other deductions, like the state and local tax deduction, can turn the American Dream into a nightmare for families, as the rug is pulled out from under them. Simply preserving the mortgage interest deduction in name only isn’t enough to protect homeownership."

Here are key differences between the Senate and House bills that would impact homeownership:

State and Local Taxes, Including Property Taxes

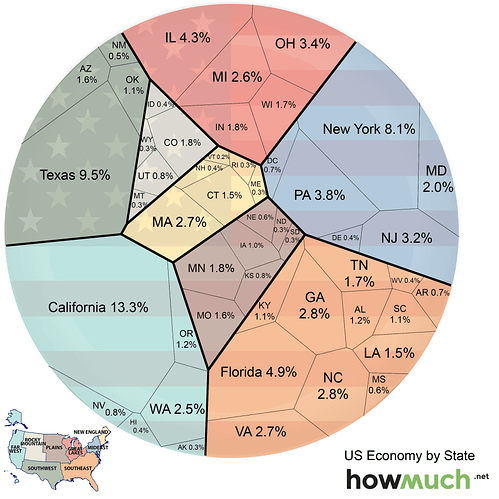

The House bill eliminates state and local tax deductions, but allows deductions of up to $10,000 for property taxes. The Senate bill repeals these deductions entirely, including property tax deductions.

Mortgage Interest Deduction

The House bill limits the mortgage interest deduction to $500,000. The Senate would keep the MID for newly purchased homes up to $1 million.

Capital Gains Exemption on Sale of Primary Residence

The House bill says the seller must own and use residence for at least five of the eight years prior to sale. Income limits apply. The Senate version says seller must own and use residence for at least five of the eight years prior to sale. No income limits apply.

MID on Second Homes

The House version eliminates the MID on second homes. The Senate version retains the MID.

Home Equity Loan Deduction

The House plan eliminates the home equity loan deduction for new loans. The Senate plan eliminates the deduction for new and current loans.

Denise Welsh, president of the Silicon Valley Association of REALTORS®, emphasized it is important to keep homeownership intact for everyone who wishes to purchase a home. "Let’s not let tax reform quash the American dream of homeownership. While the bill reduces taxes on average in every income group, we have grave concerns that with the elimination of the state and local tax deductions, including property tax deductions, millions would still see their taxes go up and home values would drop," said Welsh.

The Silicon Valley Association of REALTORS® (SILVAR) is a professional trade organization representing over 4,000 REALTORS® and Affiliate members engaged in the real estate business on the Peninsula and in the South Bay. SILVAR promotes the highest ethical standards of real estate practice, serves as an advocate for homeownership and homeowners, and represents the interests of property owners in Silicon Valley.

The term “REALTOR®” is a registered collective membership mark which identifies a real estate professional who is a member of the National Association of REALTORS® and who subscribes to its strict Code of Ethics.

For further information, please contact Rose Meily at SILVAR Public Affairs, email rmeily@silvar.org, or phone (408) 200-0109.

and go to the local park for vacation

and go to the local park for vacation

Property tax is only 1% of home value and home values are 30-40% lower than the bay area.

Property tax is only 1% of home value and home values are 30-40% lower than the bay area.